Are foreign investors behind real estate price spikes?

Updated: 2015-08-28 04:42

By Louisa You(China Daily Canada)

|

||||||||

A new research paper out of the China Institute at the University of Alberta (CUIA) calls for more data on foreign investment in Canadian real estate.

The paper, titled Foreign Investment in Real Estate in Canada, was published on Aug 6 and examines issues and challenges surrounding the controversy of foreign real estate investment in Canada, especially from China.

The author, Kerry Sun, is a research associate at the China Institute, an Edmonton-based think-tank established in 2005 to enhance and support teaching and research activities between China and Canada.

“While foreign investment in urban real estate is a sensitive subject, the China Institute believes that bringing facts to bear in public discussion of this issue offers the prospect of adding light rather than heat to the public policy debate,” CUIA director Gordon Houlden said.

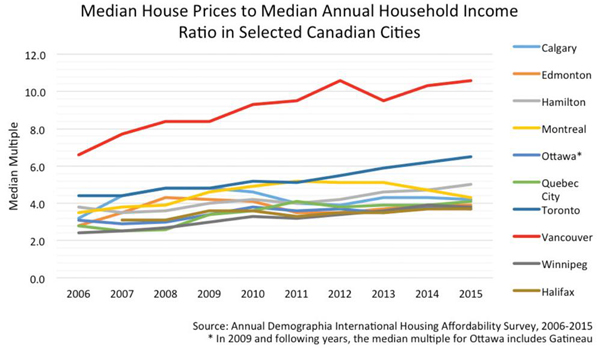

“Although Toronto and Montreal have drawn significant interest from investors, Vancouver has become the epicentre of the controversy concerning foreign investment in real estate,” Sun wrote.

Median house prices in Vancouver have risen from approximately eight times the median household income in 2008 to 10.6 times in 2014, and since 2008, global Chinese outward investment in real estate has increased more than 200 fold to approximately US $33.7 billion in mid-2014.

In a June 2015 poll, 64 percent of Vancouver residents said they believe that foreign investors were “a main cause of high housing prices.” However, the British Columbia Real Estate Association pinned it more on Vancouver’s constrained geography and limited supply of detached homes.

Canada Mortgage and Housing Corp, the country’s leading mortgage insurer, found that only 2.3 percent of condo owners are offshore investors who reside permanently in other countries. The percentage is higher in some neighbourhoods, such as 5.8 in the Burrard Peninsula, and only 2.4 percent of homeowners in Toronto are foreign investors.

Montreal has the highest percentage in Canada, with 6.9 percent of owners residing permanently out of the country.

However, the data collected only reflect condo ownership, and are not pertinent to other real estate, such as detached homes. The report says that in Canada, “no formal mechanism exists to track the level of foreign investment in real estate, leading to much uncertainty on related matters.”

“Historically, Canadian real estate markets have provided high returns to investors, and in recent times observers have also suggested that the depreciating Canadian dollar is favourable for further investment and asset purchases from abroad,“ Sun wrote.

On a recent election campaign stop in Vancouver, Prime Minister Stephen Harper said that if re-elected, the Conservative government would commit $500,000 to collecting data on foreign buyers.

“There are real concerns that foreign, non-resident real estate speculation is the reason some Canadian families find house prices beyond their budgets. If such foreign, non-resident buyers are artificially driving up the cost of real estate, and Canadian families are shut out of the market that is a matter we can, and should, do something about,” Harper expressed.

Harper also recognized that “[in] most developed countries, governments track this kind of information, but governments in Canada, historically, have not. And, as a start, this needs to change.”

The research paper agrees that “existing sources of data provide an incomplete account of foreign acquisitions and residential properties, contributing to the contentious treatment of this subject in public and media discussions.”

Sun also stated that “investments originating from China are a particularly prominent subject of interest, due partly to perceptions that Chinese investors are involved in a substantial portion of transactions in Canadian real estate markets.”

Alex Liu, of Sutton Group-Seafair Realty in Vancouver, said that, “Every time we do business, we have to fill in where the buyer or seller is from, and in fact, 90 to 95 percent are locals, either Canadian citizens or residents. So actually foreigners, that is, foreign investors, including Chinese investors, buy little real estate in Canada.”

“That’s only the surface, however,” said Liu, “for my clients, the majority of the money they use to buy real estate may come from China, including money from family or foreign business.”

“For example, we have recently opened sales on a new building, and nearly 100 percent of the buyers are ethnically Chinese. There are other [non-Chinese] buyers as well, but they are mostly investing to re-sell their properties.”

He also believes that as far as the renminbi recently de-valuing, it will more or less affect the housing prices a little; but he sees the interest rates as a more important factor which would have a larger impact on housing prices.

“So the main force of the Canadian real estate [in Vancouver] is the Chinese people that live here, or want to live here that have Canadian resident status,” Liu said. “But they cannot be considered foreigners; they are Canadians emigrated from foreign lands.”

Although the scant data collected affirms that foreign investment is not contributing to the real estate prices as some may have thought, Sun points out that “the challenges associated with data collection, housing affordability, the origins of foreign capital, and the social implications of real estate attest to the complex nature of the controversy over foreign investment.”

Sun said that “at present, perceptions have become as influential as the reality of real estate investment,” and with new data hopefully on the way, Canadians can sleep a little easier knowing that most of the buyers in real estate market are Canadians as well.

- Hungary scrambles to confront migrant influx

- Turkey to hold snap parliamentary election

- Caroline Kennedy used personal email for official business

- Czech appeals for closing Schengen external border

- DPRK says inter-Korean contact gives lesson to South Korea

- Trial starts for Chinese scholar expelled from Norway

Hairdos steal the limelight at the Beijing World Championships

Hairdos steal the limelight at the Beijing World Championships

Chorus of the PLA gears up for Sept 3 parade

Chorus of the PLA gears up for Sept 3 parade

Iconic Jewish cafe 'White Horse Coffee' reopens for business

Iconic Jewish cafe 'White Horse Coffee' reopens for business

Beijing int'l book fair opens new page

Beijing int'l book fair opens new page

Top 10 Asia's richest tech billionaires in 2015

Top 10 Asia's richest tech billionaires in 2015

Female honor guards train for military parade debut

Female honor guards train for military parade debut

Floral replica of the Great Wall appears on Tian'anmen Square

Floral replica of the Great Wall appears on Tian'anmen Square

Chinese long jumpers leap to history

Chinese long jumpers leap to history

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China not the only reason global stock markets are in a tailspin

Market woes expected to delay Fed hike

Gunman had history of workplace issues

11 under probe and 12 detained over Tianjin blasts

War anniversary: Britons born in captivity, raised in freedom

Too hard to say goodbye to Tibet: China's Jane Goodall

Two US TV journalists fatally shot on air

Smaller cub died at National Zoo

US Weekly

|

|