Riding the wave of big bargain buy-ups

Updated: 2013-10-14 06:31

By Cecily Liu and Zhang Chunyan in London (China Daily)

|

||||||||

Chinese companies make their mark in Europe with flurry of M&A deals

Weetabix cereal, MG3 hatchbacks, London black cabs, the Lloyds of London building, red wine from Bordeaux and Danish audio equipment maker Bang & Olufsen: They do have some things in common. All were cash-strapped and are now enjoying a fresh lease of life, thanks to Chinese companies.

Many of these brands are iconic names that have been around for ages. Although some are now controlled by Chinese companies there has been hardly any difference in the quality, look, feel and availability of the products, experts say. More importantly, the timely Chinese investment has helped local communities by preserving and creating more jobs in an otherwise bleak environment.

Across Europe, be it Germany, Italy, Belgium, the UK or France, investment by Chinese companies has been rising steadily and moved on to broader sectors, such as innovation and luxury.

According to Thomson Reuters, M&A deals involving Chinese companies rose 12.5 percent year-on-year to $172.7 billion during the first three quarters of this year. During the same period the value of cross-border Chinese M&As grew 10.5 percent year on year to $67.5 billion.

Yingni Lu, director of the London-based consultancy firm EcoLeap, says Chinese companies are now changing tack in Europe and looking at deals that will give them access to the key technologies and technical know-how of their European targets.

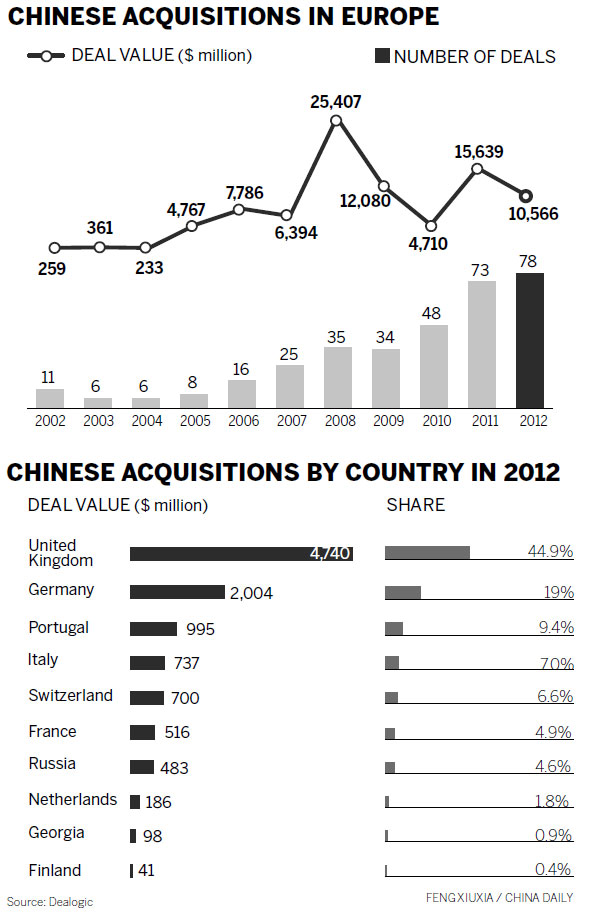

To some extent, that also explains the increased interest in European M&A deals among Chinese companies, experts say. According to data provided by stock market research firm Dealogic, the value of Chinese acquisitions in Europe reached $10.5 billion last year, compared with $259 million in 2002. The number of Chinese deals in Europe reached 78 last year, compared with just 11 in 2002, according to Dealogic.

Germany is still one of the top choices for M&A deals by Chinese companies because of its wealth of engineering talent and premium technology. Last year, Chinese companies snapped up German forklift maker Kion Group and cement-machinery maker Putzmeister. Other destinations such as the UK, Italy, Switzerland and France are also seeing more interest from Chinese companies.

China Investment Corp, the country's sovereign wealth fund, acquired minority stakes in infrastructure including the UK's Heathrow Airport Holdings and Thames Water Utilities Ltd. Another state-owned company, China Three Gorges Corp, bought 21 percent of Portuguese power company EDP-Energias de Portugal SA.

Private push

China's privately-owned companies are following in the footsteps of State-owned and sovereign wealth funds in making acquisitions in Europe, says a report published by global consultancy firm PricewaterhouseCoopers LLP in March.

The report says a growing number of Chinese private equity firms are now shifting their focus to overseas mergers and acquisitions, as opportunities to invest in China's capital market diminish.

"Although it is still early days, this shift has a big influence on deal-making between Chinese and European companies in the years ahead," the report says. "It may make the M&A arena even more competitive and also bring more investment opportunities to those watching out for them," the report says.

On top of deals already completed, the true level of acquisition interests is perhaps better reflected in the number of potential deals being speculated on in recent months.

Examples include the Chinese lender ICBC's interest in acquiring Standard Bank's commodity trading arm in London, and Qingdao D&D Investment Group's interest in machine tools manufacturer 600 Group, to name just two.

Lu of EcoLeap says typical opportunities for this type of acquisition lie within the "mid-market" sector, where the size of investment ranges between 10 million pounds ($15 million) and 100 million pounds.

"Compared with investments in larger target companies, these mid-market opportunities would bring Chinese companies controlling stakes without much capital injection. This means they can incorporate niche technology gained into their existing production facilities, then gain market entry into Europe for their own products."

According to the biennial Euro-China Investment Report published by the Antwerp Management School in Belgium, investment from Chinese companies helped create or preserve about 100,000 jobs in Europe during 2011 and 2012, when the continent's economy was hit by a downturn.

As of January this year, there were 7,148 companies in Europe with Chinese investment that employed 123,780 people. A year earlier, there were only 4,525 such companies with 27,381 employees, the report said.

"We found that China's investment in Europe surged by almost any measure in 2011 and 12," says Zhang Haiyan, head of the research team and academic director of the university's Euro-China Research Center. "China's story of investment in Europe is still unfolding."

Marcus Shadbolt, a partner at the China-focused financial advisory firm Vermilion, says: "The growing number of Chinese acquisitions in the UK is a natural evolution.

"After the financial crisis, China became very large in terms of its share of global GDP growth. At the same time, certain European markets have a shortage of capital for investments. These markets provide good conditions for transactions, where Chinese companies can provide capital to European businesses and also help them access growth in the Chinese market.

"It's definitely a win-win situation, because fundamentally you're marrying market access and capital with brands and technology. This is what Western companies have been doing over the last few years. Chinese groups are now deploying the same rationale," he says.

Good fit

Experts feel that Chinese companies have been able to manage integration relatively smoothly. As an example they cite the successful acquisition of British automaker MG Motor UK by SAIC Motor Corp.

Martin Uhlarik, design director of MG Motor UK, says the renewed production of cars after the SAIC acquisition is like a rebirth, as fresh capital infusion has allowed the company to flourish internationally. "MG is kind of enjoying a renaissance. It's not every day that a designer gets a chance to be part of that. Not many brands are being reborn with such a big investment."

In 2005, SAIC bought MG after the 89-year-old company went into liquidation. Three years later, MG began a small-scale assembly of limited edition MGs from Chinese-made kits at Longbridge, near Birmingham.

MG introduced its first car, the MG6 Magnette sedan, in the UK in April 2011, which was also the first all-new MG in 16 years. With the MG team's help, SAIC has also started producing MG cars in China, for the local market. SAIC employs about 400 people in the UK and sells several hundred cars a year in the country, but sales in China reached 200,000 last year because of surging demand for cars there.

Last month SAIC launched its first hatchback car model MG3 in the UK, sold across the country through its network of about 32 dealers, which is expected to increase to 40 by the end of this year.

Uhlarik says working as part of the SAIC team opened his eyes to the quick growth of China's automotive market - and made his job exciting and challenging at the same time.

"The Chinese market is changing so quickly, and the SAIC team's knowledge and expertise are growing so quickly. If you look at where SAIC was five years ago and look at them now, the learning curve of know-how has really exceeded my expectations."

SAIC's ability to support MG's remarkable growth is representative of the new trend of Chinese acquisitions in Europe.

Chinese manufacturer Shandong Yongtai Chemical Group Co acquired majority ownership of British car parts maker Covpress in July in a deal valued at 30 million pounds. Chinese carmaker Geely Automobile Holdings Ltd paid 11 million pounds for 80 percent of Manganese Bronze Holdings Plc, parent of the London Taxi Co, in February, after buying 20 percent of the company in 2006.

Seven months after the Manganese Bronze acquisition, Geely restarted full production of London black cabs at London Taxi Co's old factory in Coventry, in the English Midlands. Following the investment by Geely, London Taxi Co has created an additional 66 engineering and technical jobs in Coventry and expanded its London operations with the recruitment of new sales personnel.

Daniel Li, chairman of the London Taxi Co and chief financial officer of Geely Group, says: "We stick to our plan and we deliver what we promise."

Geely Group Chairman Li Shufu says: "We are pleased to have created dozens of new jobs, and have already begun work on the planning and design of the next generation of this iconic vehicle. Geely's priority will be to re-establish the manufacture, sale and servicing of new and current vehicles on broadly the same basis as existed before the business went into administration."

Since Geely acquired the company from the administrators in February, the company has cleared the inventory of vehicles that remained following the closure of the production facilities last year.

Once fully up and running, the production line will complete about 10 taxis a day, five days a week. They will be the most sophisticated produced by London Taxi Co.

In 2011 the company made 1,100 vehicles. Last year it turned out 900 before the administration forced production to cease. It plans to be back up to full production of about 2,000 vehicles a year in the next 12 months and expects to return to profit this year. About half of these will be for the overseas market after London Taxi Company won export contracts in Saudi Arabia and the United Arab Emirates.

"After a period of worry and uncertainty for the workforce, Geely Group's investment has secured the future of the iconic black cabs company, protecting highly skilled jobs in the Midlands and ensuring that London cabs continue to be made in the UK," British Business Secretary Vince Cable says.

Peter Johansen, vice-president of Geely's black cab operation, says Geely intends to further invest to expand production in Coventry in the near future and his team is looking for a suitable site to set up a new factory.

Charged up

Another example of a European business enjoying great growth after receiving fresh injection of capital from its new Chinese owners is Dynex Electronics, a semiconductor manufacturer based in Lincoln, England.

In 2008, Zhuzhou CSR Times Electric acquired a 75 percent stake in Dynex and has since helped the British company build a 12 million pound ($19 million) new R&D center to focus on developing insulated-gate bipolar transistor technology.

Dynex's R&D team also increased from 12 to about 40, including those from the Zhuzhou company on secondment.

Dynex has also helped Zhuzhou CSR to build a new factory in China, which specializes in producing low-voltage IGBT semiconductors, while production of high voltage IGBT semiconductors remains with Dynex in Lincoln.

"The strategy Zhuzhou CSR Times Electric discussed with us is to retain our operations here in Lincoln," says Paul Taylor, who has been CEO of Dynex since 2004.

"They wanted us to grow. Particularly, they want to invest in technologies and facilities we have here, so we would be able to become a leader in technology."

Dynex's team in Lincoln has grown from fewer than 250 before the acquisition to about 330 now. The company's sales in China have also grown as Zhuzhou CSR became a distributor for Dynex's products for the Chinese market since the acquisition, Taylor says.

The European food and beverage industry has also proved attractive to Chinese companies.

In June last year, Chinese food group Bright Food Co Ltd bought a 70 percent stake in Bordeaux wine exporter Diva to gain a foothold in the French wine-making region. While Chinese businesses and individuals have shown interest in buying wine-growing properties, it was the first time a Chinese firm had made a move into French wine trading.

"This will give Diva a better knowledge of the Chinese market and will boost the firm's means to sell its products," a spokeswoman for the French merchant said when the deal was announced, adding Diva sold a wide range of wine qualities, including grand crus, the designation for classified vintage wines of the finest quality. Of the 11,000 chateaus along the Garonne River in Bordeaux, 15 to 20 have been sold to Chinese investors since 2008 and another 30 could soon change hands.

Analysts say the trend will intensify, even though China is among the world's 10 largest domestic wine producers.

Bright Food also completed its purchase of a majority stake in British Weetabix Food Co last year, marking the largest overseas acquisition that a Chinese company has made in the food industry.

As part of the deal, Bright Food paid nearly 700 million pounds ($1.12 billion) to acquire a 60 percent stake in Weetabix and also agreed to cover 500 million pounds of Weetabix's debt. The remaining 40 percent of Weetabix's shares continue to be held by the private equity group Lion Capital Management Group.

"We are delighted about our partnership with Bright Food," says Giles Turrell, chief executive of Weetabix. "We are confident that, with Bright Food's support, we will be able to significantly strengthen our market position and expand our business internationally."

Shadbolt at Vermilion says examples of Chinese companies successfully growing their acquired targets' local production and employment numbers will serve to reduce the negative sentiment in the minds of some European businesses and the general public.

Experts expect that the M&A trend will continue, as Chinese companies, finding growth slowing at home, will continue to look abroad for know-how and strong brands.

"At the end of the last century, China was all about cost reduction for Western companies. Chinese companies adopted the same rationale when buying overseas, sometimes leading to redundancies," Shadbolt says.

"Now China is all about growth and cross-border M&A is seldom predicated on redundancy programs. Therefore we expect this sort of fear will gradually subside as more successful growth-driven deals are completed."

Wang Mengzhen contributed to this story.

Contact the writers at cecily.liu@chinadaily.com.cn and zhangchunyan@chinadaily.com.cn.

|

The assembly line at London Taxi Co's factory in Coventry, England. Geely Automobile Holdings Ltd restarted full production of the iconic London black cabs on Sept 11. Provided to China Daily |

(China Daily 10/14/2013 page13)

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing

Riding the wave of big bargain buy-ups

Riding the wave of big bargain buy-ups

Senate leads hunt for shutdown and debt deal

Senate leads hunt for shutdown and debt deal

Chinese education for Thai students

Chinese education for Thai students

Rioting erupts in Moscow

Rioting erupts in Moscow

Djokovic retains Shanghai Masters title

Djokovic retains Shanghai Masters title

Working group to discuss sea issues

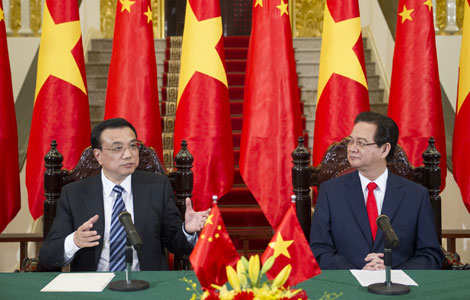

Working group to discuss sea issues

Draft regulation raises fines for polluters

Draft regulation raises fines for polluters

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Over 380 detained in Moscow riot

86 trapped at Mount Qomolangma camp amid snow

Going green can make good money sense

Senate leader 'confident' fiscal crisis can be averted

China's Sept CPI rose 3.1%

No new findings over Arafat's death: official

Detained US citizen dies in Egypt

Investment week kicks off in Dallas

US Weekly

|

|