Production to slow down: HSBC

Updated: 2013-12-17 07:34

By Chen Jia (China Daily)

|

||||||||

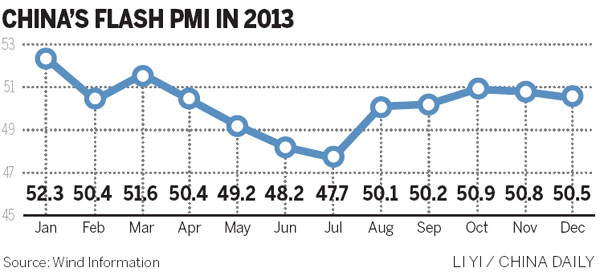

Preliminary manufacturing PMI shows weaker growth in December

China's manufacturing sector will likely see the slowest expansion in three months in December because of lower output growth, HSBC Holdings Plc said on Monday.

A preliminary reading of the Purchasing Managers' Index for the manufacturing industry edged down to 50.5 in December from 50.8 in November, the lowest level since October, the bank said in a report.

|

Workers assemble heavy equipment at a factory in Qingzhou, Shandong province. A preliminary reading of the Purchasing Managers' Index for the manufacturing industry edged down to 50.5 in December from 50.8 in November, the lowest level since October, HSBC Holdings Plc said in a report. Wang Jilin / For China Daily |

The production output sub-index slipped to 51.8 in December from 52.2 in November, pressuring the index.

Meanwhile, the new orders sub-index hit a nine-month high of 51.8 in December, compared with 51.7 in November, while the new export orders sub-index rose to 50.3 from 50.2 last month, suggesting stable market demand.

A reading above 50 indicates expansion, while one below that level signals contraction.

The official PMI data for December will be released on Jan 1 by the National Bureau of Statistics and the China Federation of Logistics and Purchasing. HSBC will release its final PMI data on Jan 2.

Qu Hongbin, chief economist in China at HSBC, said that although December's preliminary manufacturing PMI reading slowed marginally from November's final reading, it still stands above the third quarter's average reading of 49.7.

The latest reading implies that the manufacturing sector's recovery, which started in July, is still holding up, Qu said.

He believes that China's GDP growth will stabilize at about 7.8 percent year-on-year in the fourth quarter.

Zhang Zhiwei, chief economist in China at Nomura Securities Co Ltd, said that the slowdown in the PMI data "suggests that growth momentum has started to weaken".

"This trend is likely to continue in the first half of 2014, as market interest rates keep rising and pushing up financing costs for enterprises," said Zhang.

Figures from the central bank showed that new loans came in at 625 billion yuan ($103 billion) in November due to stronger retail and short-term corporate loans, rebounding from 506 billion yuan in October. Off-balance sheet lending saw a broad-based recovery to 377.9 billion yuan in November from 184 billion yuan in October but was still below the August-September levels.

A report from Barclays Capital said that short-term bill issuance has increased, as rising funding costs have probably led companies to rely more on short-term financing.

According to the NBS, industrial output growth in November slowed to 10 percent year-on-year from 10.3 percent in October, which may indicate that the GDP growth rate in the last quarter may be at 7.6 to 7.8 percent, compared with 7.8 percent in the third quarter and 7.5 percent in the second, analysts said.

chenjia1@chinadaily.com.cn

(China Daily 12/17/2013 page13)

US first lady visits children in medical center

US first lady visits children in medical center

Harvard reopens after bomb scare

Harvard reopens after bomb scare

Snowstorms cause chaos for travelers in Yunnan

Snowstorms cause chaos for travelers in Yunnan

Kerry offers Hanoi aid in maritime dispute

Kerry offers Hanoi aid in maritime dispute

Cuddly seal enjoys some me time

Cuddly seal enjoys some me time

Shoppers dropping department stores

Shoppers dropping department stores

Moon rover, lander photograph each other

Moon rover, lander photograph each other

Snow hits SW China's Yunnan province

Snow hits SW China's Yunnan province

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China hopes trade meeting with US fruitful

Japan to bolster

military build-up

Continuity in DPRK policies expected

China keen on natural gas

China outlines diplomatic priorities for 2014

China's US debt holdings pass $1.3 trillion

Clashes with US can be avoided: FM

Kerry offers Hanoi aid in dispute

US Weekly

|

|