Chinese outbound acquisitions create win-win partnerships

Updated: 2015-04-25 04:00

By Cecily Liu(chinadaily.com.cn)

|

||||||||

Chinese firms are increasingly embarking on overseas mergers and acquisitions deals as a key way of expanding globally and in the process creating win-win partnerships, experts said.

They said that different from the M&A style of firms in mature markets, where the acquirer would make great changes to the target, Chinese firms generally keep their targets' management team and learn from them to develop new technology or products for the Chinese market.

These discussions were made at a forum on Friday in London, organized by the China Europe International Business School.

Wang Gao, co-director of CEIBS Research Centre on Globalisation of Chinese Companies, said that Chinese companies are going global to seek resources and capabilities to strengthen their competitiveness in the domestic markets.

After they grow stronger in home countries by using these new capabilities, they may leverage on their new capabilities to compete internationally, Wang said.

He said one example of win-win partnership created between the Chinese acquirer and the overseas target is ICBC's acquisition of a 20 percent share in Standard Bank for $5.5 billion in 2007.

"For ICBC, the acquisition helps them to assist their large customers to go abroad, especially in going to Africa, providing them with financing and other support," he said.

Secondly, the acquisition helps them to produce organization capability improvement, he said, explaining that although ICBC is the largest bank by market capitalization it can still benefit from learning more advanced management techniques from Standard Bank.

Meanwhile, this acquisition also provides benefits for Standard Bank, because the new injection of capital allows them to participate in the financing of bigger projects that they previously were unable to do, he said.

Despite these opportunities, it is important that Chinese firms realize that they need to focus on having a clear objective for the acquisition, bearing in mind that M&A is just the strategy to achieve the wider goal of globalization, said Ding Yuan, director of CEIBS Research Centre on Globalisation of Chinese Companies.

Yuan said that dangers of less successful globalization sometimes lie in the possibility of company management not having a clear view of the end goal. For example, M&A activities driven by the availability of excess capital or political order may not achieve the best results, whilst over optimism could lead to overpaying for the targets.

For example, many of the M&A deals relating to natural resources and commodities, like coal mines and oil fields, were struck at rather high prices, and now there is a great amount of impairment cost created.

Instead, they should focus on developing in-depth knowledge about the target firms, these firms' industry position, and consider the further scope for improvement of these firms before making a purchase.

They should also assess the target's technology advancement, research and development ability, management team competency and stability, and cultural fit with the parent company, he said. Chen Weiru, associate professor of strategy at CEIBS, adds that attention must also be paid to the cultural side of the new partnership in the post-acquisition integration stage to maintain respect, and to focus on the long term future growth rather than to capture short term value gain.

He said that central to the success of Chinese outbound M&A activities is the combination of Chinese and global advantages. Whilst Chinese advantages include market size, market growth, labor cost and easier and cheaper costs of finance, and global advantages include natural resources, brand image, marketing capability and technology and know how.

In photos: Strong earthquake struck Nepal

In photos: Strong earthquake struck Nepal

Stunts, Parkour, Action!

Stunts, Parkour, Action!

City starting to close gap with world fashion capitals

City starting to close gap with world fashion capitals

Across America over the week (from April 17 to 23)

Across America over the week (from April 17 to 23)

Honored for community work

Honored for community work

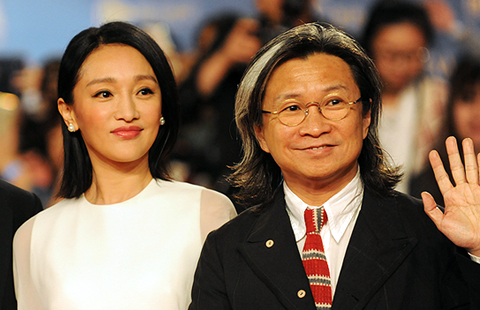

5th Beijing International Film Festival closes

5th Beijing International Film Festival closes

Top 10 auto lookalikes in China

Top 10 auto lookalikes in China

Flights cancelled as ash cloud pours from Chile volcano

Flights cancelled as ash cloud pours from Chile volcano

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US sending disaster response team, $1 million aid to Nepal

All-clear sounded at Statue of Liberty after bomb scare

Devastating Nepal quake kills 1,457

Ho Feng Shan: A man of compassion, courage

The real Apple Watch goes on sale Friday in China, US

China looks to top the bill in Hollywood productions

Panda to be inseminated via China

Chinese mourn passing of US officer

US Weekly

|

|