Li says private investment needs boost

Updated: 2016-07-20 01:41

By Zhao Huanxin and Zhang Yue(China Daily)

|

||||||||

|

|

An employee works on an assembly line producing automobiles at a factory in Qingdao, Shandong province, March 1, 2016. [Photo/Agencies] |

"Conditions permitting, we should innovate methods to attract 'social investment' to these projects," Li told a meeting on Monday in Beijing attended by senior officials of some provinces and State Council departments.

The premier's remarks reflected his solutions to the knotty issue of the slowing growth momentum of investment by private enterprises. Officials have blamed the slowdown on the sluggish world economy, downward domestic pressure and overcapacity in some industries.

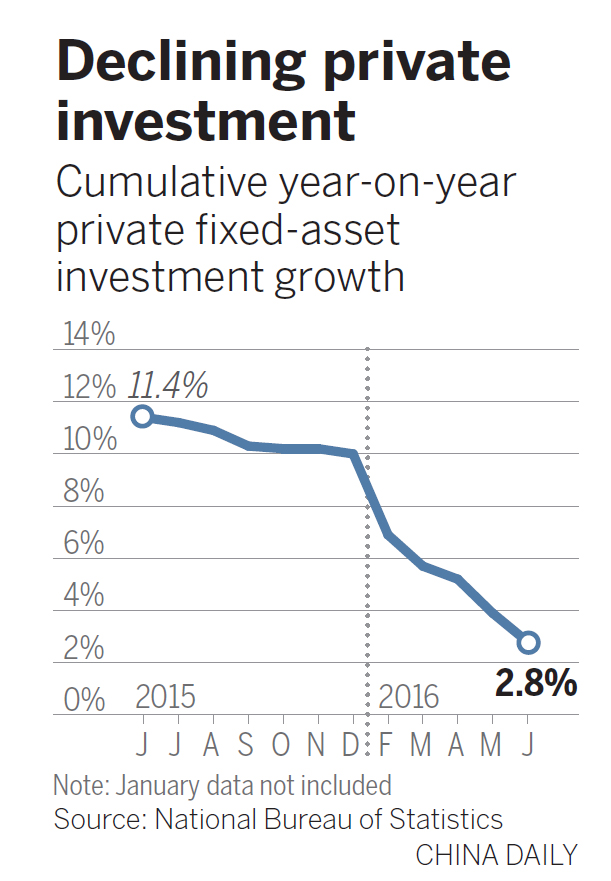

Private fixed-asset investment, which accounts for more than 60 percent of the country's total investment, slowed to a record low in the first half of the year, with growth sliding to 2.8 percent from double digits last year.

Li cautioned that a continued slump in private investment growth could spoil the country's efforts to maintain economic growth within the targeted range — 6.5 to 7 percent for the year — and to optimize the economic structure in coming years.

He called for innovation in investment modes and a ramping up of price reforms.

In particular, he said the Public-Private-Partnership financing mode should be promoted to divert more social funds to education, medical care, elderly care and other service sectors, as well as to infrastructure.

"While making use of the government funds, which are limited in amount, we must enhance the guidance of the flow of social funds," he said, adding that efforts must be made to prevent such funds from going to sectors that are beleaguered by overcapacity and are polluting the environment.

Boosting effective investment will have a wide range of influences, including promoting consumption and creating jobs, the premier said.

Li Jinbin, governor of Anhui province in East China, said at the meeting that many private enterprises had intended to invest in strategic new industries and public services that promise stable or high returns. However, Li said, investor access to these sectors remained difficult.

In response, the premier said market entrance barriers of all forms must be removed, discrimination eliminated, and costs cut for private and semi-public companies to invest. He also asked governments to repay their debts to companies.

In addition, stronger financial support should be given to small and micro enterprises.

The premier also said there is enough space for investment in China, given the enormous domestic demands.

Overall fixed-asset investment, a gauge of infrastructure spending, slowed further in the first half to 9 percent, the lowest growth rate in years.

Contact the writers at zhao-huanxin@chinadaily.com.cn

- Endangered elephants relocated by crane in Africa

- THAAD news met by DPRK missile launches

- DPRK top leader guides ballistic rocket test-firing

- Turkey's failed coup to further consolidate Erdogan's power

- Boris Johnson says UK not abandoning leading role in Europe

- Armed man attacked passengers on a train in Germany

Heavy rain, floods across China

Heavy rain, floods across China

Super-sized class has 3,500 students for postgraduate exam

Super-sized class has 3,500 students for postgraduate exam

Luoyang university gets cartoon manhole covers

Luoyang university gets cartoon manhole covers

Top 10 largest consumer goods companies worldwide

Top 10 largest consumer goods companies worldwide

Taiwan bus fire: Tour turns into sad tragedy

Taiwan bus fire: Tour turns into sad tragedy

Athletes ready to shine anew in Rio Olympics

Athletes ready to shine anew in Rio Olympics

Jet ski or water parasailing, which will you choose?

Jet ski or water parasailing, which will you choose?

Icebreaker Xuelong arrives at North Pacific Ocean

Icebreaker Xuelong arrives at North Pacific Ocean

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

Liang avoids jail in shooting death

US Weekly

|

|