Li: Yuan set for depreciation

Updated: 2011-11-19 13:32

By Wei Tian and Tania Lee (China Daily)

|

|||||||||

Central bank's MPC member predicts a decline as nation's trade surplus weakens

BEIJING -Although the yuan is currently facing appreciation pressure, it's possible that the currency will face depreciation pressure within two years, when China's trade surplus falls to zero, Li Daokui, a member of the central bank's monetary policy committee, said on Friday.

|

|

|

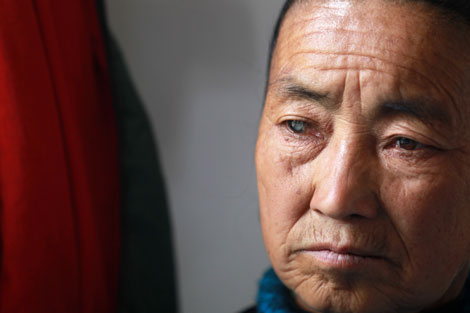

A woman poses for a photograph with an art installation depicting a bundle of a hundred yuan notes in Beijing. The Chinese currency may face depreciation pressure within two years, according to a central bank adviser.[Photo/Agencies] |

"The trade surplus will come down to something around 1.5 percent, or certainly below 1.6 percent this year, and that figure will fall to zero within less than two years," Li said at a conference for economists held in Beijing.

Meanwhile the current account balance is coming down as well, "and we're on pace to be less than 4 percent", Li said.

Despite calls from the United States urging stronger and faster yuan appreciation, the market will eventually find a good answer to all the political pressures, said Li, who called on the public not to be irritated by the situation, commenting: "This is daily politics."

At a recent summit of the leaders of the Asia-Pacific economies, President Hu Jintao said China is following a responsible exchange-rate policy and shouldn't be blamed for US economic woes. Hu's comments came after US President Barack Obama expressed concern about the low level of yuan appreciation.

The mid-point of the yuan's exchange rate against the US dollar stood at 6.3548 on Friday, a drop of 0.6 percent in the past two weeks.

But that decline followed an appreciation of 5 percent since the beginning of this year.

The depreciation pressure on the yuan is accumulating, because currency depreciation against the US dollar has been a universal phenomenon among emerging economies this year, said Mei Xinyu, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation under the Ministry of Commerce, in an online research note.

The Chinese currency has risen 3 percent against the dollar since September, but the currencies of the other BRICS countries (Russia, Brazil, India and South Africa) have fallen at least 4 percent during the same period.

One of the reasons for the declines was the appreciation pressure on the dollar as the global economic downturn and uncertainties about the macro policies of emerging economies are highlighting the dollar's role as a "safe haven" currency.

In response to Li's comments, Gary Locke, the US Ambassador to China who attended the same conference, said that China should let the yuan "float freely" and allow the market to determine the exchange rate.

Locke also indicated that he is in talks to increase the duration of US visas for Chinese citizens from one year to five.

However, the ambassador stated that reform would only take place if the Chinese reciprocated with a similar extension for US citizens.