PBOC conducts record reverse repos to ease liquidity

Updated: 2012-10-30 17:40

(Xinhua)

|

||||||||

BEIJING -- The People's Bank of China, the country's central bank, on Tuesday pumped massive liquidity into the interbank market through open market operations.

The central bank injected a record high of 395 billion yuan ($62.7 billion) into the financial system via reverse repos in order to ease a cash squeeze at the end of the month, according to a statement from the PBOC's website.

The central bank conducted seven-day reverse repos worth 290 billion yuan and offered 105 billion yuan in 14-day contracts. Bid interest rates remain stable at 3.35 percent and 3.6 percent, respectively, the statement said.

Shi Lei, an analyst at Ping'an Securities, said PBOC's massive repo injection demonstrates its intention to stabilize market rates and bring them down to its target range.

The central bank prefers reverse repos over reserve requirement ratio cuts when easing money supplies to prevent a rebound in housing and commodity prices.

"Open market operations will become the central bank's most important monetary policy tools in managing liquidity," said Guo Tianyong, a banking researcher at the Central University of Finance and Economics.

- DPRK's Musudan missile launch appears to have failed

- No one can be impeached for being unpopular: Rousseff

- Cruz teams up with Fiorina against Trump in GOP race

- Russia launches rocket from newly-built Vostochny Cosmodrome

- Iraqi parliament approves partial cabinet reshuffle

- S. Korea, US sign space cooperation agreement

Top 10 dazzling new car models at Beijing auto show

Top 10 dazzling new car models at Beijing auto show

London's Big Ben to fall silent for urgent repairs

London's Big Ben to fall silent for urgent repairs

Rare snub-nosed monkeys at Beijing Zoo

Rare snub-nosed monkeys at Beijing Zoo

Human-like robots say 'hi' to President Xi

Human-like robots say 'hi' to President Xi

Animals turn savvy earners from entertainers

Animals turn savvy earners from entertainers

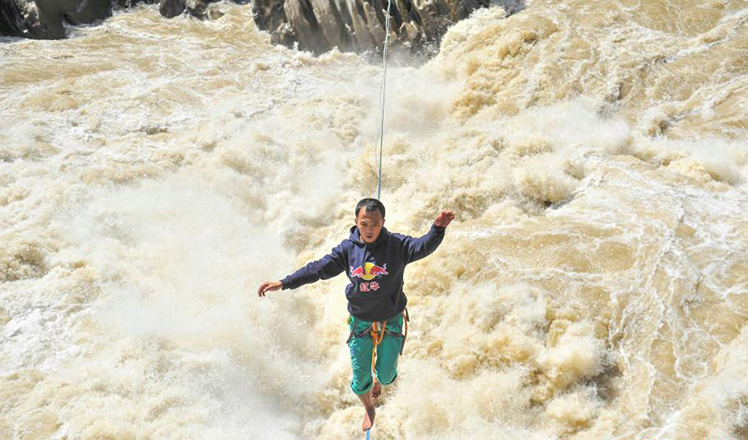

Slackline walker conquers Tiger Jumping Gorge

Slackline walker conquers Tiger Jumping Gorge

Top 6 domestic new-energy vehicles at Beijing auto show

Top 6 domestic new-energy vehicles at Beijing auto show

30th anniversary of the Chernobyl nuclear disaster marked

30th anniversary of the Chernobyl nuclear disaster marked

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|