Being bullish on convertible bonds in 2013

Updated: 2013-01-21 11:16

By Chen Jia (China Daily)

|

||||||||

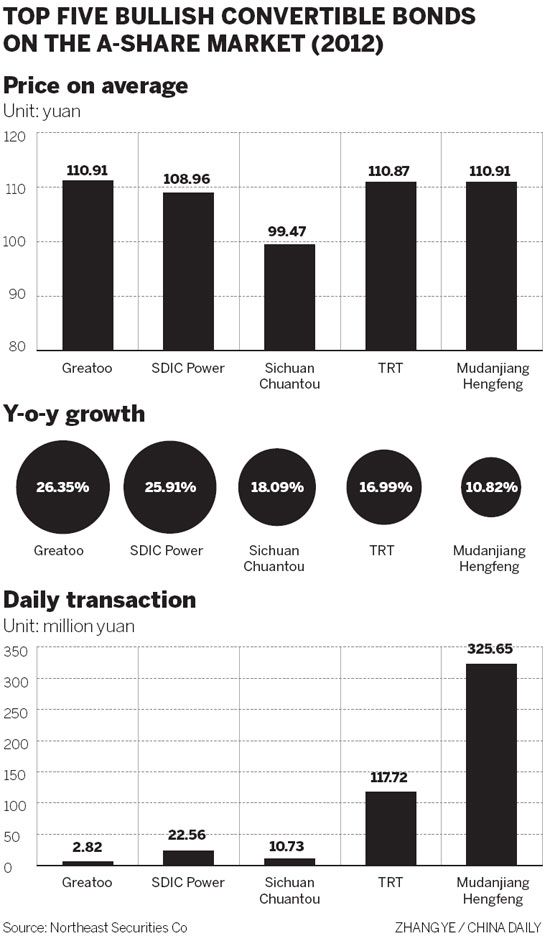

Zhao Xu, a securities analyst with Northeast Securities Co, expects the operational conditions and net income for listed companies may remain on a steady growth track this year amid a recovery in the macroeconomy.

He forecast GDP growth may accelerate to 7.8 percent in 2013, supported by the remaining prudent monetary policy and proactive fiscal policy.

"The securities market is likely to turn bullish modestly in the first half and there will be more structural investment opportunities for convertible bonds," Zhao said. "The new leadership's determination for economic reforms and the urbanization policies will be a stimulus for the rebound of the securities market."

|

|

Chang Jian, an economist in China with Barclay's Securities, wrote in a research note that "urbanization can be a key driving force for the Chinese economy in the coming decade or two".

It will require more infrastructure and consumer goods and provide stronger growth momentum for the industrial and service sectors, she said.

Related to the convertible bond market, China's mainland stock market gained a cautious outlook from analysts this year.

"In the second half, it will be more stressful for the stock market and that will bring pressure to bear on convertible bond valuations," said Zhao.

The Shanghai Composite Index is likely to fluctuate between 2100 and 2600 this year, he predicted. The Chinese economy ended 2012 on a somewhat positive tone, with the Shanghai A-share index rising by 1.6 percent to 2269.13.

Besides the macroeconomy, the convertible bond market is also influenced by the bond supply-demand situation, said Xu from the CICC.

"The issuing pace for convertible bonds is likely to be slower than the market expectation in the first six months because the assessment value of the bonds is still at a low level," said Xu.

However, capital may increase faster in this market as the securities companies and fund management institutions including qualified foreign institutional investors are increasing convertible bond in their investment portfolios, he added.

chenjia1@chinadaily.com.cn

Year-ender: China's stock market

Stocks up on bullish China and US figures

China approves more QFIIs in 2012

Green sector buoys Chinese stocks

Ping An to issue $4.1b convertible bonds

ICBC to raise 25b yuan in convertible bonds

- Chinese brokerages' profits tumble

- Chinese solar firms' shares soar in New York

- Reviving the stock market

- Chinese investors hope for better in 2013

- China may OK interbank debt trade on exchanges

- Signs of recovery doing little for stock markets

- China promotes establishment of OTC market

- All must share security burden

- Companies raised 650m yuan via bonds in 2012

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|