HK private home devt up 80% in 2012

Updated: 2013-01-26 15:37

By Li Tao in Hong Kong (China Daily)

|

||||||||

New residential supply to reach 67,000 units in next 3 or 4 years

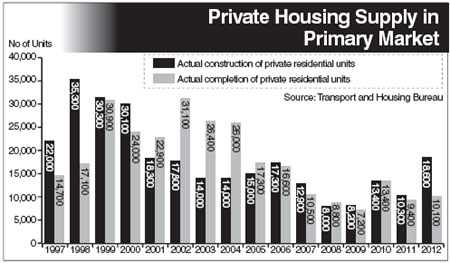

Hong Kong's housing starts of private homes reached 18,600 units in 2012, up 80 percent from the 10,300 in the previous year, representing the highest number since 2000, government figures showed on Friday.

The total number of registered completed residential units was 10,100 last year, slightly higher than the 9,400 in 2011, but fell short of the 13,400 in 2010, according to a Transport and Housing Bureau report.

|

|

The government report also revealed that the number of new completed units rose quarter-on-quarter during 2012. In the fourth quarter of last year, a total of 4,000 new home units were completed in the city, which compared with 3,800, 1,700, and 600 registered respectively in the previous quarters.

Totalling up all unsold completed units, those still under construction, as well as the potential supply from disposed land, total new private home supply will reach 67,000 units in the next three or four years, said the government.

Wong Leung-sing, an associate director from Research Department with Centaline Property Agency, said the outcome mirrored Hong Kong government's efforts in boosting land supply since 2011.

"The number of total completed residential units will continue to rise over the next few years, and is expected to register at 13,000 in 2013 over the 10,100 in 2012, and eventually reach the government's target of 20,000 by 2016," Wong told China Daily in a telephone interview.

Underscoring housing as his top policy priority, Chief Executive Leung Chun-ying in his maiden Policy Address in January unveiled a multi-prong approach to boost land supply The plan will offer 35,000 more units of new public and private homes in the next five years, compared with the previous corresponding period.

But the increasing new home supply is not expected to effectively cool the heated property market in the city. The latest Centa-City Lending Index (CCL) that measures overall local secondary residential property prices surged 2.11 percent - the largest weekly percentage gains in 101 weeks - to 118.38 upon its release on Friday, according to data released by Centaline Property Agency.

The latest reading surpassed the previous high of 116.81 registered before the government unveiled the new round of curbs on the property market in October which imposed a 10 to 20 percent Special Stamp Duty (SSD) on short term home resales within a three-year period and also slapped an unprecedented 15 percent Buyer's Stamp Duty (BSD) on home buyers who were not permanent Hong Kong residents.

"Property prices surged on a number of factors, including the influx of hot money, which is out of the Hong Kong government's control," said Wong, who believes that the government's initiatives, which could boost new home developments in the city, may still lack the timely effect in cooling home prices.

litao@chinadailyhk.com

- HK's Leung places housing priority in maiden policy address

- Property market won't rise sharply: analyst

- Housing projects prone to corruption

- Home prices rise in more Chinese cities

- Residential land prices up 2.26% in 2012

- New house sales surge in major Chinese cities

- China's property tax trial expansion in doubt

- Put housing prices in order

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|