Li Ning shares dive 14% on fund-raising plan

Updated: 2013-01-26 15:42

By Oswald Chan in Hong Kong (China Daily)

|

||||||||

Shares of Li Ning Co Ltd fell more than 14 percent on Friday after the struggling mainland sportswear brand said it would issue up to HK$1.87 billion ($241 million) in convertible securities to fund its restructuring.

The stock dived to HK$5.3 per share, its lowest level since January 2 while the benchmark Hang Seng Index was flat in Friday trading, which was also the share's biggest decline since it started trading in June 2004. The company halted its share trading on Thursday before announcing the convertible bond issuance plan on Friday.

|

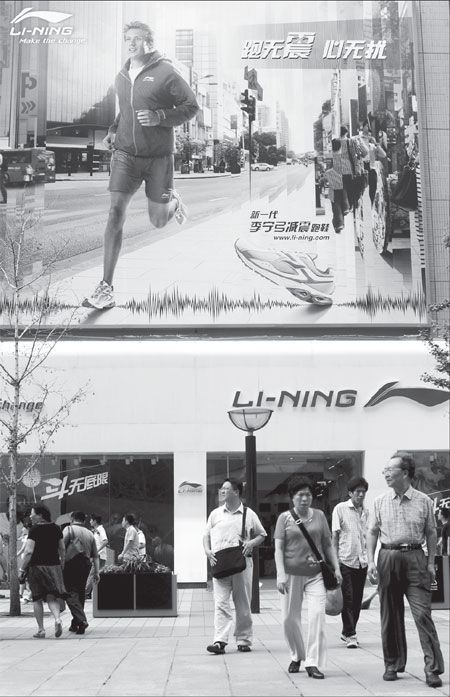

Pedestrians walk near a Li Ning Co Ltd store in Beijing. Li Ning's shares fell more than 14 percent on Friday after the mainland sportswear producer said it would issue up to HK$1.87 billion ($241 million) in convertible securities to fund its restructuring. Keith Bedford / Bloomberg |

Qualifying stockholders will be offered one convertible security for every two shares, the company said in a statement to the Hong Kong stock exchange. Each security can be converted into one share at HK$3.5 each, 44 percent lower than the stock's last closing price before the announcement released on Friday.

Sportswear retailer to Viva China Holdings Ltd, US private equity fund TPG Capital and Singapore's sovereign fund GIC have agreed to subscribe to the convertible securities. Li Ning also said that GIC, TPG Capital and Viva China had given their "irrevocable undertakings" to the company.

"The steep discount the company is willing to offer reflects its urgent need for capital to support the transformation plan, and the recovery could be slower than expected," Jerry Peng, a Shenzhen-based analyst at Guotai Junan Securities Co Ltd said by phone.

"Issuing convertible bond at such deep discount to some prescribed investors will heavily dilute the rights of the existing shareholders. Shareholders who buy the share at above HK$6 per share level will be particularly hard-hit by the company's decision," Core Pacific-Yamaichi Head of Research Castor Pang told China Daily.

"I would recommend investors to avoid this stock because it seems that (the) corporate governance standard of the company is at stake at the present moment," Pang cautioned.

The retailer in last December predicted a "substantial" full-year loss because of costs for a plan to revive growth, after reporting an 85 percent drop in first-half profit.

Li Ning has said it plans to boost sales by investing in marketing, clearing old inventory and "improving product freshness" as competition from Nike Inc, Adidas AG, and Anta Sports Products Ltd increases.

The efforts, which will include buying back inventory, will cost between 1.4 billion yuan ($225 million) and 1.8 billion yuan, the retailer said last month.

In January last year, Li Ning sold 750 million yuan of convertible bonds to TPG Capital and Singapore's sovereign fund to raise money for more stores and product development.

Viva China will underwrite 60 percent of the securities announced on Friday, with TPG underwriting 40 percent.

Gymnast Li Ning was the final torchbearer at the opening ceremony of the 2008 Beijing Olympic Games. He won three gold, two silver and one bronze medals in the 23rd Los Angeles Olympic Games in 1984, and founded the company after retiring from athletics, according to the retailer's annual report.

oswald@chinadailyhk.com

Li Ning warns of loss over plan to buy inventory

Li Ning shares fall amid $175m stake reshuffle

Olympic gymnast Li Ning sells 25% stake for $175m

Li Ning closes only Hong Kong store

Li Ning lets CEO go as prospects appear dim

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|