UBS to reshuffle business in China

Updated: 2013-02-01 10:38

By Hu Yuanyuan (China Daily)

|

||||||||

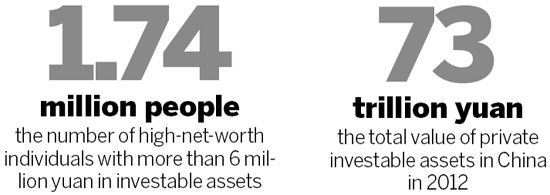

By the end of 2012, the number of Chinese high-net-worth individuals - those with investable assets of more than 6 million yuan - will reach 1.74 million, an increase of 17 percent from the end of 2011.

While the emerging affluent population in China provides more opportunities for wealth management business, the rigorous regulations also make it more difficult and challenging for investment banking businesses.

"In the past, two-thirds of UBS' entire capital was tied up within the investment bank, but it only contributed one-third of the group's overall profitability over the last two years," Weber said.

"In the future, investment banking will contribute the same amount to our overall profitability, but will only tie up roughly one-third of the bank's capital. So it is a much more efficient allocation"

|

|

In China, UBS has a multi-entity domestic platform, which allows it to develop its core businesses - wealth and asset management and investment banking.

UBS (China) Ltd supports the wealth management and credit and rates businesses.

UBS SDIC Fund Management Co Ltd is a joint venture with the State Development Investment Corp in which, for the first time, a foreign partner holds the maximum 49 percent equity stake.

UBS Global Asset Management (China) Ltd is engaged in domestic non-securities equity investment management and advisory services.

According to Weber, this year's capital market will be much better than the previous three years.

"We expect up to a 20 percent growth in the China equity market this year. If you look at the initial numbers that we started with this year, you've already have a good run in the first few weeks," Weber said.

For Weber, the core challenge UBS faces in China is how to maintain the bank's leadership position in the market.

According to financial services provider Dealogic, in 2012, UBS ranked first in core investment banking revenue for Asia excluding Japan and fourth for China.

It ranked second in completed mergers and acquisitions in China; and third in equity capital market bookrunning.

The bank participated in eight out of the 10 largest Hong Kong IPOs, of which all the issuers were Chinese companies.

"For our team in China, their task is about how to pick up speed now," he added.

huyuanyuan@chinadaily.com.cn

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|