Moving toward a world without cash

Updated: 2013-02-07 07:36

By Hu Yuanyuan (China Daily)

|

||||||||

|

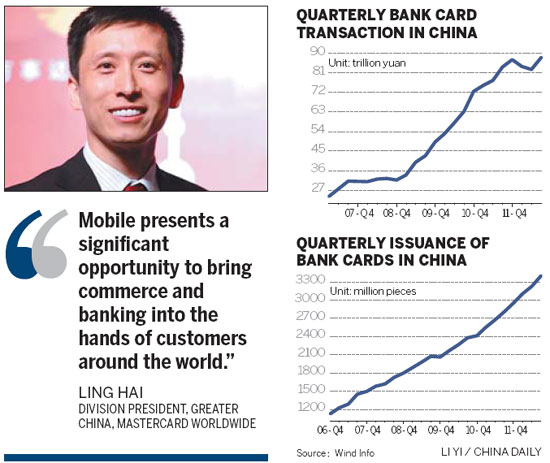

A model decorated with bank cards at an international finance exhibition in Beijing. Statistics from China's central bank showed that around 3.4 billion bank cards had been issued in the country by the end of the third quarter of 2012, up 21.2 year-on-year. Gong Wenbao for China Daily |

Card issuers look to credit and debit as the financial backbone of the future economy

Ling Hai, division president of Greater China for MasterCard Worldwide, has more than 10 bank cards in his wallet - all bearing the MasterCard logo but jointly issued with different Chinese banks.

At one time, when his company launched its No Cash Month campaign in March 2012, he had almost nothing in his wallet apart from his cards.

The campaign, an internal one within MasterCard's Asia-Pacific region, attracted a total of 1,000 employees from 41 teams. They competed with each other to see which team used the least cash or money options such as vouchers in their daily lives in that month.

It turned out Japan had the highest percentage of non-cash transactions, followed by Taiwan and then South Korea.

"Since last year, we've been committing ourselves to a new vision - a world beyond cash. And all our business strategies will center on the theme of reducing the use of cash as much as possible in today's society," said Ling, 43.

The campaign, Ling said, was a part of that commitment.

"Working in a payment technology company, if we cannot take the lead in using non-cash payment channels, how can we expect our customers, our cardholders to use them?" Ling asked.

The result of the campaign also revealed the huge market potential for the company.

Out of all MasterCard employees in the Asia-Pacific, the Middle East and Africa, fewer than 14 percent pay for goods with cash. Globally, nearly 85 percent of purchases by non-MasterCard employees are paid for with cash, according to the company's statistics.

However, employees found out that not using cash in their everyday lives was not all that easy: There are many places where bank cards are not accepted.

"They pass the information on to their colleagues who are in charge of the bank card acceptance business. Why don't those places accept bank cards? How do we encourage them to accept them? Thinking about this drives their colleagues to develop new products and services," said Ling. "Bear in mind no-cash activities can bring lots of benefits."

Innovation in China

According to Ling, the company's core business in China remains cooperating with issuing banks.

"Launching a variety of card products with Chinese banks to cater for the different demands from different customers has been the core business for us over the past years," Ling said. "Meanwhile, we will continue our commitment to innovation and brand marketing."

Visa, MasterCard and China UnionPay are the major players in the electronic payment industry.

As MasterCard is a publicly listed company, Ling said he cannot disclose its growth target this year, but it will lay out a target based on the industry benchmark.

Statistics from China's central bank showed that around 3.4 billion bank cards had been issued by the end of the third quarter of 2012, up 21.2 percent year-on-year. Among them, 3.08 billion were debit cards, up 21.4 percent year-on-year, and 318 million were credit cards, up 18.8 percent year-on-year.

Ling said the company is still confident in China's economy despite the recent slowdown in the nation's economic growth rate.

Cross-border business is a major element of MasterCard's business in China.

"With the development of tourism and the increasing use of electronic payment by Chinese consumers, we believe more bank cards will be issued and our business will continue to grow," said Ling

The company will strengthen cooperation with different banks to tap different cities.

In first-tier cities such as Beijing, Shanghai and Shenzhen, MasterCard has mainly joined hands with large banks to provide products and services to customers.

Along with the booming wealth in second- and third-tier cities, demand from local residents' overseas tourism and buying sprees is also rising.

"To meet the needs of these consumers, we will cooperate with some regional banks as well as small and medium international banks," said Ling.

For instance, MasterCard issued its World Card in cooperation with Shanghai Rural Commercial Bank last October.

Visa Inc, a major competitor of MasterCard, made a similar move. Visa recently partnered with Haikou Bank to issue a single currency credit card in China. It was the first time Visa cooperated with a regional city commercial bank to issue a single currency credit card as it eyed up opportunities in second- and third-tier cities.

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|