Unusual share dealing keeps focus on Suntech

Updated: 2013-03-16 08:03

By Xie Yu in Shanghai (China Daily)

|

||||||||

|

A Suntech Power Holdings Corp booth at the China Photovoltaic Conference and International Photovoltaic Exhibition in Beijing last year. Industrial analysts said the solar panel maker may go bankrupt if it fails to restructure its heavy debts. [Photo/China Daily] |

NYSE contacts firm after debt lifeline staves off immediate bankruptcy

Suntech Power Holdings Corp, one of the world's largest solar panel makers, has been contacted by the New York Stock Exchange regarding unusual trading of its American depositary shares.

In a statement, the China-based manufacturer said it was aware of "recent market rumors and third-party reports regarding its financial position", but that it "was not aware of the events that triggered (Thursday's) unusual trading activity".

Suntech's shares fell sharply on Thursday and closed down 19 percent at $0.67 in New York.

The unwelcome attention came just days after the firm announced it is closing its only US manufacturing plant next month, a week after its founder was ousted as chairman.

The company blamed the planned closure of the Arizona facility on higher production costs "exacerbated" by US tariffs on Chinese-made solar cells and aluminum frames, as well as a global oversupply.

Suntech, based in Wuxi, Jiangsu province, also said in a statement it has reached an agreement with some of its lenders to defer its obligations on a $541 million loan, which was due to mature on Friday, by two months, giving the company more time to restructure its debts.

More than 60 percent of the holders of the notes, which are convertible into stock, have agreed not to exercise their rights until May 15.

But the latest development did little to improve market confidence.

"Based on its stressful financial condition, bankruptcy is highly possible for Suntech, although that would do no good to any of the interested groups, from the company to the debt owners, or local government," said Cheng Peng, a partner with Adfaith Management Consulting.

"If Suntech falls, it would be a huge hit to China's solar industry, which has experienced lots of turbulence since late 2009.

"The failure of Suntech might also hurt other high-technology companies listed overseas, or those seeking IPOs overseas," Cheng added.

Media reports earlier in the week suggested that the Wuxi government was likely to step in and take the company over, through the State-owned Wuxi Guolian Development (Group) Co.

Rather than acquiring the entire Suntech Power Holdings Co, they suggested that Guolian was likely to assume the Wuxi Suntech manufacturing subsidiary, with other assets being sold to repay debts.

The Wuxi government was not available for comment on Friday.

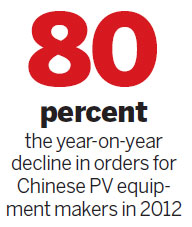

Orders for Chinese PV equipment slumped 80 percent year-on-year in 2012, the China PV Industry Alliance said in its latest report.

It said up to 90 percent of Chinese polysilicon makers had halted production, and 80 percent of solar panel producers had shut down or sharply reduced output.

According to Bloomberg, meanwhile, some of the remaining 40 percent of Suntech's bondholders said they had not been contacted by the company, despite its assurance of a financial lifeline.

Trondheim Capital Partners LP, a distressed-debt hedge fund, was reported by Bloomberg to own enough of the Suntech bonds "to make it worthwhile to file a petition to sue if they don't pay".

Suntech didn't contact Trondheim before announcing the forbearance agreement.

"We believe Suntech's day of reckoning is at hand with no legal deal to defer maturity, principal unlikely to be paid, and bondholders set to file involuntary bankruptcy this Friday," said Maxim Group analyst Aaron Chew in a note to clients.

David King, Suntech's CEO, said the company is working on reaching a mutually agreeable restructuring of the notes with the bondholders.

xieyu@chinadaily.com.cn

- Suntech to shut lone US plant, blaming high costs

- Suntech's fate dims amid conflict

- Suntech allegations 'baseless'

- Suntech brands new allegations by US energy rival "baseless"

- Suntech gets $32m emergency loan from local gov't

- Suntech gets $32m emergency loan from local government

- Suntech tries to boost ADS prices

- Suntech freezes assets of troubled partner

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|