ENN to expand in US market

Updated: 2013-03-16 08:03

By Du Juan (China Daily)

|

||||||||

Chinese energy company to build 48 more natural gas filling stations

ENN Group Co Ltd, a private Chinese energy company, said it plans to expand the number of its natural gas filling stations in the United States to about 50 this year from the two it owns in the western state of Utah.

The company added that the plans have been welcomed by the US government.

This is the first time that a Chinese company has invested in the US natural gas distribution business, said Jiang Yu, director of international business at ENN.

"The output of unconventional natural gas is increasing rapidly in the US, boosted by the development of the shale gas sector, which will lead to lower prices for natural gas as fuel compared with diesel and gasoline," he said.

"This has created good opportunities to invest in the business."

Jiang told China Daily that the company started the project early last year, and that the plans to set up about 50 natural gas filling stations will depend on market response.

The cost of a single natural gas station is more than 10 million yuan ($1.6 million), said Ma Ji, a natural gas industry analyst at JYD Online Corp, a bulk commodity consultancy in Beijing.

As a company that started its Chinese natural gas distribution business in 1993, ENN has rich experience in upstream and downstream projects.

The company is in talks with US natural gas suppliers to ensure supplies for the stations, said Jiang.

"Previously, most equipment was designed for gas distribution networks in cities, but we'll cooperate with US gas suppliers to develop equipment specifically for transportation," he said.

ENN plans to build filling stations along highways for heavy-duty trucks, which take up a big percentage of US transportation-fuel consumption.

The company signed a deal last month with Westport Innovations Inc - a Canadian company specialized in natural gas engines - to promote the use of natural gas as fuel for the local logistics industry.

"Based on its mature and rapid exploration of unconventional gas resources, the US government is trying to reduce its dependency on oil. Thus, the US government should be supportive of the projects," said Liao Na, the vice-president of Shanghai-based energy consultancy ICIS C1 Energy.

Jiang said that both the US federal and state governments welcomed ENN's plans, which have the potential to create jobs, increase tax revenues and improve the US' energy consumption structure.

"The US is the best choice in terms of market scale or resources," she said.

However, ENN will still develop its natural gas filling stations business in China even though the country is not fully prepared at present, according to Jiang.

"Chinese logistics companies would be glad if the use of natural gas reduced their costs," he said. "It might take three to five years in China to establish a complete natural gas supply network. The network currently lags behind the diesel and gasoline systems."

Also, natural gas prices in China are not as cheap as in the US, and the country has faced natural gas shortages, said Liao.

"The issue of how to ensure stable natural gas resources will be the biggest challenge for ENN if it wants to emulate the model it's applying in the US in China," she said.

As the Chinese government tries to reduce carbon emissions by raising natural gas consumption, three top State-owned oil companies have been accelerating the establishment of gas filling stations across the country.

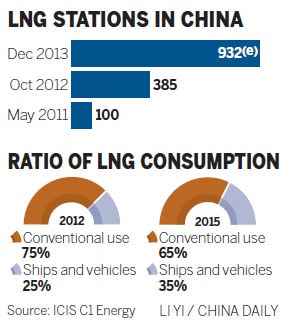

According to data from C1 Energy, there were 385 LNG stations in operation in China by the end of October, twice as many as in the same period the previous year, and the number will likely reach 932 by the end of this year.

China National Petroleum Corp, the country's largest oil and gas producer and supplier, plans to build 126 LNG stations in Henan province by the end of the 12th Five-Year Plan period (2011-15), and to develop 720 stations in Shandong province during that period.

dujuan@chinadaily.com.cn

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|