E-commerce takes a big toll

Updated: 2013-04-08 07:57

By Wei Tian (China Daily)

|

||||||||

|

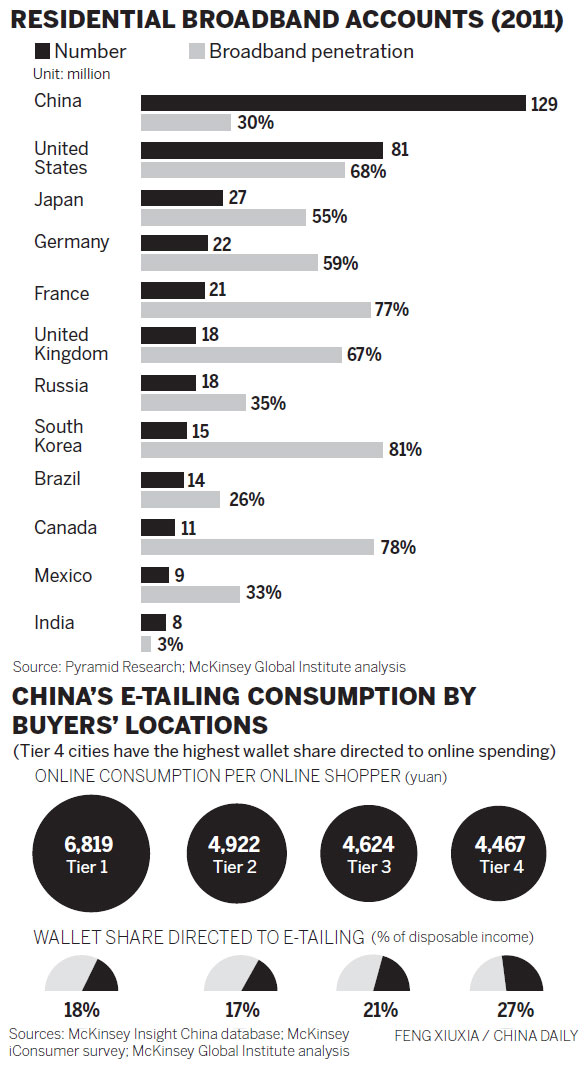

The annual spending of every online shopper averaged 6,819 yuan ($1,098) in first-tier cities, accounting for 18 percent of the person's total disposable income, according to a report by McKinsey Global Institute. Provided to China Daily |

Cyber shopping has potential to change urban landscape: Experts

China's fast-growing e-tailing market could help unleash private consumption and drive the next stage of economic development, with more opportunities lying in less-developed areas where physical stores are expanding too slowly to meet demand.

Millions of consumers can now log on and purchase goods they could only dream of acquiring just a few years ago. With $190 billion to $210 billion in sales, China came very close to equaling the United States as the world's largest e-tailing market in 2012.

As the size of China's big-spending class continues to expand, the country's e-tailing market may reach $420 billion to $650 billion in sales by 2020, equaling the size of today's United States, Japanese, UK, German and French markets combined, according to a report by McKinsey Global Institute, the research arm of global management consulting firm McKinsey & Co.

"By then, China's e-tailing market will rise to 15 to 20 percent of the country's total retail sales of social consumer goods, up from the currently level of 5 to 6 percent," said Chen Yougang, an MGI partner and one of the authors of the report.

The report found the e-tailing market, which encompasses online sales to consumers by merchants of all sizes, is already having an incremental effect on private purchasing.

"Online shopping has a clear incremental effect on overall consumption and could raise private consumption by an extra 4 to 7 percent by 2020," Chen said.

Cyber space is not just a replacement channel for purchases that would otherwise take place offline. Nearly half of every dollar spent online represents incremental consumption, based on an analysis of data covering 266 cities in China.

This effect is even more profound in China's small and medium-sized urban areas, which generally lack compelling brick-and-mortar retailers, according to the report.

At the moment, cities with relatively high online shopper penetration include Changsha, Guilin and Jiujiang, which are inland cities tending to have relatively lower per capita consumption.

The yearly spending of each online shopper was 6,819 yuan ($1,098) in first-tier cities, accounting for 18 percent of total disposable income.

Although only 4,467 yuan is directed to e-tailing in fourth-tier cities, it accounts for 27 percent of income.

"E-tailing is only one of many drivers that will contribute to China's new model for economic growth, but it is fast becoming an area in which China could lead the world in innovation rather than relying on its historical labor cost advantage," said Richard Dobbs, one of the report's authors and a director of MGI.

China has the world's largest online population, with 129 million residential broadband accounts, dwarfing the 81 million accounts in the United States in 2011. But broadband penetration remains at only 30 percent, indicating enormous room for further growth in the e-tailing market.

"Realizing the full potential of e-tailing in China will require investment in large-scale expansion of broadband and 3G+ coverage, data analysis capabilities and logistics infrastructure," said Chen.

Labor productivity in China's retail sector is only two-thirds of the US level today, but if China's e-tailers catch up with their counterparts in other major markets, the overall sector's performance could rise by 14 percent by 2020, McKinsey estimated, adding that productivity improvement is also an imperative for China's e-tailers to address the shortage of high-skill labor.

E-tailing is also a young and wide-open market that allows small, innovative businesses to gain traction very quickly.

While large business-to-consumer sites are the clear leaders in other countries, nearly 90 percent of China's e-tailing industry operates on marketplace sites that host a wide universe of small and medium-sized enterprises and microbusinesses, providing them with the tools to set up online storefronts, list items and collect payment.

In comparison, only 24 percent of the e-tailing market is market-based in the US.

Taobao, one of China's largest online marketplaces, alone had more than 6 million registered sellers as of the last count. This model offers Chinese entrepreneurs the ability to launch new ideas with minimal start-up costs and access to huge aggregated traffic.

"Chinese retail is still largely regional, reflecting the difficulties of scaling up traditional store networks across such a large and diverse developing country," Chen said.

The emergence of large national chains has been a milestone in the retail development of most countries, but Chinese retail is coming of age during an era of profound digital disruption - and that raises distinct possibilities for its future evolution.

"China could develop a balanced mixture of physical and digital retail, with national brick-and-mortar chains eventually dominating some product categories and online channels capturing others," said Chen.

But the extraordinary growth of e-tailing could lead to an alternative scenario in which China forgoes the national expansion of physical stores commonly seen in Western markets, instead moving directly to a more digital retail environment. Such a shift could have broad implications for China's urban development.

"E-tailing has the potential to create a profound 'leapfrog' effect on China's broader retail industry," said Chen.

As e-tailing matures, it could lift the efficiency of the entire retail sector and reduce the need to build out extensive networks of physical stores."

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|