Construction machinery firms 'face tough, tricky year'

Updated: 2013-04-20 07:47

By Du Juan in Munich, Germany (China Daily)

|

||||||||

Conditions in China's construction machinery industry this year will continue to be tough and complicated after a dramatic drop in the past year caused by the economic slowdown, according to senior officials and business leaders.

Sales in the industry will see 13 percent growth this year compared with last year, provided the government meets its target of keeping GDP growth at 7.5 percent, said Su Zimeng, secretary-general of the China Construction Machinery Association.

Su was speaking in Munich during Bauma 2013, the 30th International Trade Fair for Construction Machinery, Building Material Machines and Mining Machines.

In the first two months of this year, sales of main construction machinery products in China dropped 24.4 percent year-on-year, with sales of excavators, the major equipment used in construction, falling 45.5 percent, the association said.

"Based on an analysis of China's macro economy, domestic demand for construction equipment will not increase any time soon," said Su. "However, the national policy of expanding domestic demand ... will benefit development of the industry."

He said the industry is making substantial progress with destocking, but it will take at least half a year to complete the process.

Patrick Olney, president of Volvo Construction Equipment, a subsidiary of Volvo Group, said during a new products exhibition at Bauma: "For the first half, China's construction machinery industry will continue to slow before it gradually shows an upward turn during the second half."

He said business in the industry will become flat, but the company will continue to invest in the Chinese market.

"We never expected the new Chinese government to pump in large (amounts of) investment and create huge opportunities for the construction machinery industry, but I believe even if we had a slowdown, in the long term we will see returns," he said.

Considering China as a "home market", and playing the role of a "Chinese company", VCE has invested up to 1 billion yuan ($160 million) in the past three years to increase capacity, establishing a technology center and design center in China.

"When we make investments in China, we know that they will deliver returns," Olney said.

The new Chinese leadership has introduced a series of policies to curb soaring house prices, which has affected the performance of the construction machinery industry.

Jiang Lin, deputy secretary-general of the association, told China Daily during Bauma: "The golden age for China's construction machinery industry has gone forever."

She said companies should not expect rapid growth in the industry. Instead, Chinese firms should learn from their foreign counterparts to make greater efforts on product innovation, quality, management and upgrading technology.

Jiang said China is experiencing "an inevitable process" to slow its economic growth rate and adjust its growth mode, which creates a period for the construction machinery industry to adjust its own development direction and learn from advanced foreign companies.

"People don't need to be too pessimistic about the future of the industry, since China is still developing, but at a slower pace," she said.

In 2012, the revenue of 13 key construction machinery companies dropped by 3.68 percent, and their total profit fell 34.2 percent year-on-year, according to figures from the association.

China's sales of main construction machinery products fell significantly in the past year, with sales of excavators, mobile cranes, rollers and pavers dropping more than 30 percent compared with the previous year, it said.

dujuan@chinadaily.com.cn

(China Daily 04/20/2013 page16)

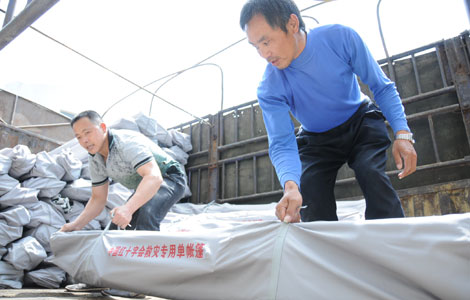

Relief materials dispatched to quake-hit areas

Relief materials dispatched to quake-hit areas

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

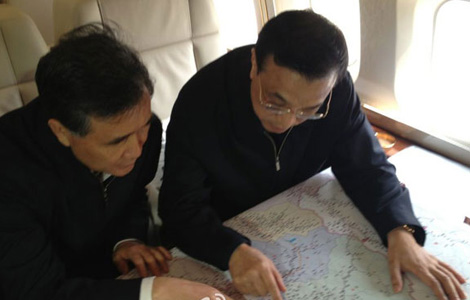

Premier heads for quake-hit zone in Sichuan

Premier heads for quake-hit zone in Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Firefighters rescue 27 quake survivors

Live report: Hundreds feared dead or injured in M7.0 Sichuan quake

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

US Weekly

|

|