Chinese pharma companies look West

Updated: 2013-05-20 07:38

By Liu Jie in Beijing and Cecily Liu in London (China Daily)

|

||||||||

|

Zhejiang Hisun Pharmaceutical Co's pavilion at a fair in Beijing. By setting up a joint venture with US-based Pfizer Inc in September, Hisun made a breakthrough in China's pharmaceutical industry by taking a controlling stake in the JV with Pfizer, the world's largest drug-maker by sales. Provided to China Daily |

Many seek partnerships, mergers and acquisitions to build brands

Several Chinese pharmaceutical companies have been recognized by the overseas medical industry largely because of their partnerships with multinational giants.

Zhejiang Hisun Pharmaceutical Co set up a joint venture with US-based Pfizer Inc in September 2012. Simcere Pharmaceutical Group has established a partnership with MSD - known as Merck & Co in the US and Canada - and Bristol-Myers Squibb Co. Chinese biotech company Sino Biological Inc reached an agreement with Life Technologies Corp for protein product distribution and development worldwide. Shanghai Fosun Pharmaceutical (Group) Co has become the largest single shareholder of US-based medical care company Saladax Biomedical Inc.

Insiders say the collaborations are mainly driven by foreign drug-makers' desire to leverage their Chinese counterparts' distribution networks, local market knowledge and administrative resources to take a bigger market share, especially in the grassroots sector in China.

"On the flipside, the Chinese companies are also ambitious. They are eager to get international market access, realize technical upgrades and even build their brands through platforms abroad," said Zhang Fabao, a member of China Pharmaceutical Technology Organization Expert Committee.

"That can be seen as a shortcut for Chinese pharmaceutical enterprises to go global and a win-win strategy for both sides," he added.

Bilateral partnership

Hisun got a breakthrough in China's pharmaceutical industry by taking a controlling stake in the joint venture with Pfizer, the world's largest drug-maker by sales. Hisun has a 51 percent share in Hisun-Pfizer Pharmaceuticals Co, with a total investment of $295 million and registered capital of $250 million. Pfizer holds the remaining stock.

The joint venture focuses on the manufacturing and commercialization of branded generics, or high-quality and low-price off-patent medicines, in China and around the world. Hisun contributed a strong portfolio - 75 products, wide market reach in China and expertise in the production and commercialization of generics, while Pfizer offers, in addition to eight products, its research and development, marketing and manufacturing capabilities.

The operational revenue of the joint venture is expected to exceed $2 billion yuan, said Wu Xiaobin, country manager of Pfizer China.

The establishment of the joint venture will help transform Hisun into a branded generics company from an active pharmaceutical ingredients manufacturer. Pfizer should also be able to strengthen its presence in China, said Xu Lingni, an analyst at domestic brokerage China Investment Consulting Co.

Founded in 1956, Hisun is traditionally an active pharmaceutical ingredients producer and launched its overseas registration in 1989. Now, 80 percent of its API products are exported to more than 30 nations and regions.

"However, the added value of API is very low and decreasing. Hisun needs to upgrade its business. Entry into branded generics is a practical and profitable way," said Xu.

"The negotiations (between Hisun and Pfizer) took more than a year. It's really tough with rounds and rounds of bargains and discussions. We got stuck on the controlling stake," said a senior executive of Hisun, speaking anonymously.

Unlike large State-owned Hisun, private company Simcere seems more flexible. It was determined to seize the chance to cooperate with foreign giants. In September, the Jiangsu-based biopharmaceutical company set up a joint venture with the world's second-largest drugmaker, MSD.

In the joint venture, concentrating on therapies for cardiovascular diseases, Simcere holds a 49 percent stake. It contributed two medicines specifically tailored to Chinese patients, while MSD provided four of its off-patent innovative drugs.

The new joint venture is focusing on the Chinese market currently without ruling out expansion in overseas markets in the future, said Ren Jinsheng, founder, chairman and chief executive officer of Simcere.

Analyst Xu believes global expansion will be realized in the near future. "MSD needs economic manufacturing and a reliable producer of its off-patents medicines so Simcere is a good choice," she added.

Simcere is one of the Chinese biopharmaceutical companies with strong research and development capabilities. Prior to joining hands with MSD, it had collaborated with US-based Bristol-Myers Squibb Co. The latest venture involves the co-development of a preclinical small molecule inhibitor, which is currently inactive in Bristol-Myers Squibb's pipeline. This research, if it succeeds, will help prevent cardiovascular disease.

Under the agreement, Simcere will receive exclusive rights to develop and commercialize products in China, while Bristol-Myers Squibb will retain exclusive rights in all other markets. However, Simcere will receive a percentage of profits from the commercialized products sold in overseas markets.

Before that, the two sides had an agreement on the co-development of an oncology compound that proved to be a success, according to Francis Cuss, senior vice-president of Bristol-Myers Squibb Research.

For domestic biological company Sino Biological Inc, the situation is unique. The Beijing-based company has its self-developed proteomics products, which are technologically advanced but lack brand recognition globally.

To build brand and enter the international market, it reached an overseas distribution and R&D agreement with Life Technologies Corp, a US-based global biotechnology major. All the products - more than 6,000 human derived proteins and antibodies made by the Chinese side - sold abroad will be under the joint brands of Sino Biological and Life Technologies. The two companies will also jointly develop new products, leveraging R&D synergies to introduce innovative products more quickly.

"Our China-made edge products are to be first sold in the United States, then expanded into Europe and South America," said Xie Liangzhi, president and CEO of Sino Biological, adding that he believes leveraging the multinational's platform to brand his young business in developed markets will be efficient and cost-saving.

"Business partnerships are like a marriage," said John Lechleiter, chairman, president and CEO of Ely Lilly & Co, explaining that the partners must have common goals and philosophies as well as mutual respect and mutual admiration. An adaptation period is also necessary.

At present, a large part of the collaborations between Chinese and foreign pharmaceutical companies are in the branded generics sector.

Since 2011, many innovative blockbuster drugs made by pharmaceutical giants have begun to come off-patent while the development of new ones has not been finalized. Insiders call it a patent cliff.

According to Datamonitor Plc, a UK-based market research company, there will be more than 30 blockbuster drugs due to go off-patent and lose their price protection between 2011 and 2016. Their sales were nearly $60 billion in 2011. That means the market is beginning to be flooded with generics, priced much lower than innovative medicines. Demand for these off-patent drugs will boom given their recently acquired affordability.

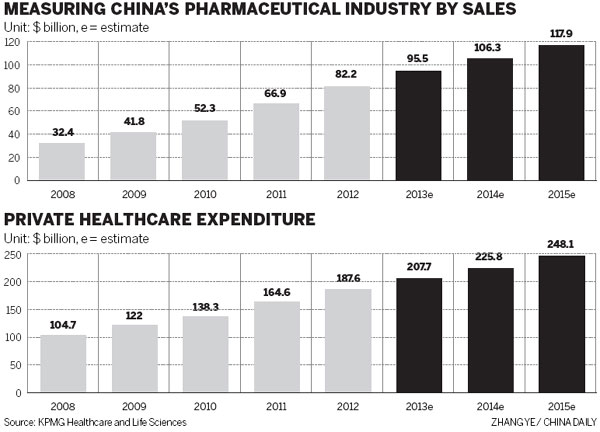

Norbert Meyring, head of KPMG Healthcare and Life Science in China and Asia-Pacific, said: "The patent cliff, faced mostly by multinationals, will lead to more acquisitions and joint ventures in China." Multinationals that mainly rely on patented drugs are striving to use high-quality branded generics to offset their losses in this patent cliff time so they are anxious to find the right Chinese manufacturers to expand production capacity, he added.

Chinese pharmaceutical companies have accumulated rich experience in the production of generic medicines.

Furthermore, production costs in China, although increasing in recent years, are comparatively low. The cost-performance is still lucrative for international giants, said Shi Lichen, a partner of domestic consultancy firm Alliance PKU Management Consultants Ltd.

He added that Chinese companies are gradually maturing. Depending on their manufacturing strength, the domestic leading players are confident of entry into the international generics market. Together with the enhancement of their R&D capabilities, they believe, through cooperation with international majors, the innovative sector will not be beyond their reach in the near future.

"Chinese partners should be clear-headed, avoiding becoming just manufacturing bases for multinational companies," said Shi. He urged Chinese companies to make full use of cooperation opportunities to learn management and research expertise from international majors instead of being devoted solely to production. "Market access just indicates short-term profits, whereas increasing soft strength is a long-term investment," Shi said.

Li Dongjiu, senior vice-president of Shanghai Fosun, said he believes the Sino-foreign cooperation, in any kind of model, is natural and both sides are profit-driven. "In the internationalized market, collaborations and exchanges over technology, capital, talent or information are natural and necessary," he said. "Chinese companies are growing. The international pharmaceutical market is huge with potential in various areas. We welcome both competition and collaboration at home and abroad."

Shanghai Fosun Pharmaceuticals (Group) Co is a pioneer of globalization. It is expanding its overseas business in part via small-sized mergers and acquisitions. In addition to the acquisition of Saladax Biomedical, Wanbang Biopharma Co, a subsidiary of Fosun Pharmaceutical, reached an agreement with German company Biotest AG at the end of last year in which Wanbang will sell Biotest's human serum albumin on the Chinese mainland. Human serum albumin is the most abundant protein in human blood plasma.

"We are introducing foreign products to China while leveraging their platform to deliver our products and technologies abroad," said Li, stressing that Fosun's overseas expansion should be based on domestic development, with the domestic market a priority before going abroad.

"We are eyeing fast-growing counterparts in the US, Europe and Japan for mergers and acquisitions. They should have strong R&D capabilities and be unique in terms of products, technology or distribution teams," he said.

Although Chinese companies have gradually won recognition in the medical industry in developed markets, they are little known by Western customers. Many Westerners are surprised to hear of the existence of Chinese medicines other traditional herbal remedies.

Derrick Board, 57, from England, said he was shocked to learn Chinese pharmaceutical companies exist. He said Chinese homemade herbal medicine and acupuncture were all he knew about Chinese treatments.

Describing his impression of Chinese medicine, he said "curious, interesting, alternative, historical and wholesome" are adjectives that immediately come to mind.

"I would be happy to use Chinese medicine and Chinese medical equipment if they gain European Union certifications," said Board.

John Edwards, 48, also from England, holds the same view as Board. He had never heard of, but was happy to try, Chinese pharmaceuticals. However, he said he would use the word "unethical" to describe his impression of Chinese medicine. "I think Chinese medicine has an annoying habit of using endangered and nearly extinct animals," Edwards said.

Zhang, of the China Pharmaceutical Technology Organization Expert Committee, said: "Getting the West to really understand Chinese medicines, particularly modern Chinese medicines, will be really tough work. Market access is the first step. Brand-building will take time."

Contact the writers at liujie@chinadaily.com.cn and cecilyliu@chinadaily.com.cn

(China Daily 05/20/2013 page13)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|