Gearing for world without PCs

Updated: 2013-05-20 07:40

By Gao Yuan (China Daily)

|

||||||||

|

Dell Inc, the world's third largest PC producer by shipments, is shifting its core business from PC manufacturing to software because of the global recession in the PC market. Provided to China Daily |

Manufacturers seek out other options to keep profit margins

Dell Inc, the world's third-largest personal computer manufacturer and one of the most time-honored players in the hardware-making industry, is betting on a 1-year-old software unit to redefine its brand after the global PC market started to suffer from declining sales and the company announced it was going private.

Company executives said developing Dell's software and corporate technology service arms is a critical step for the company's transition in the post-PC era.

Dell's software group is projected to bring the company $2 billion to $3 billion in revenue over the following three years with 60 percent of the current revenue generated out of the United States, said John Swainson, president of the unit.

Software group

The IBM Corp veteran and former chief executive officer of software company CA Technologies Inc was recruited by Michael Dell, founder and CEO of the Texan company, only last year to build a software group from scratch.

"The biggest accomplishment is in one year we successfully created the software group and made a number of acquisitions to give us what I would call critical math around the business," said Swainson.

Dell started to push the growth of its software group through mergers and acquisitions well before the establishment of its own unit.

In August 2010, Dell launched a high-profile bidding war for storage company 3Par against the world's largest PC maker Hewlett-Packard Co. Although HP won the bid eventually, spending $2 billion, it marked the start of Dell setting off on its acquisition spree to build competitiveness in its corporate software sector.

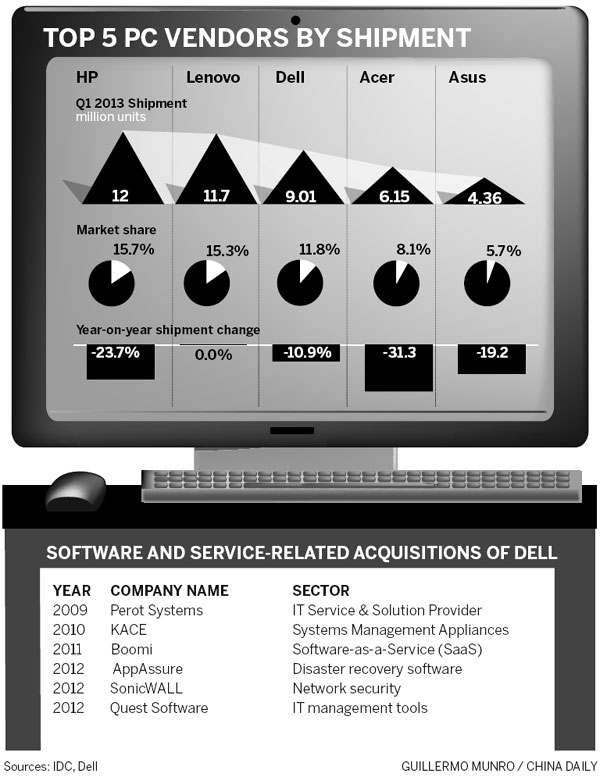

Dell's previous purchases include software developer Quest Software, security appliance developer SonicWall Inc and disaster recovery specialist AppAssure.

On May 6, Dell announced it was acquiring Enstratius Inc, a provider of cloud management software. The acquisition represents Swainson's latest effort to add muscle to the software unit.

As of today, the group's software group has more than 1,600 engineers and 2,500 sales personnel.

Going private

In February, company CEO Michael Dell said he will cut loose from Wall Street and take Dell private at a cost of $24.4 billion, the biggest leveraged buyout since the financial crisis.

Dell executives later told Bloomberg News the company will focus on expansion of the software and services segments in a strategy to expand its offerings for large companies, with the goal of becoming a full-service provider of corporate computing services in the mold of the highly profitable IBM.

"The whole point of going private is to be able to accelerate the transformation - and the software business is a part of that transformation," Swainson told China Daily in late April, adding he does not anticipate any long-term change or even big short-term changes in terms of company objectives.

As a subsidiary of its hardware maker, Dell's software business will feature four major areas: cloud computing, security, data analytics and mobile Internet. Tom Kendra, vice-president and general manager at Dell Software, said these areas will cover most of the key aspects for enterprise-level software business and give Dell sufficient strength to compete with other software providers.

Dell said its software products' mobility features will help them to attract new customers because an increasing number of companies want mobile office programs to raise efficiency.

The company is offering an "end-to-end solution" to help its customers take advantage of new technologies such as the consumerization of IT, cloud computing, data insights, security and business intelligence.

The company is also underscoring its software reseller network. The company has launched a support platform allowing its channel partners to sell Dell-branded software products in a uniformed structure.

"Software is the catalyst to modernizing today's IT environments, enabling organizations to do more and achieve greater business results," said Swainson.

Global PC makers are vigorously looking for new profit boosters as lackluster world PC demand is pushing them into a corner.

Global PC shipments are likely to witness a double-digit slump in the second quarter of this year as demand in China, which accounted for more than one-fifth of global demand, shrank faster than expected, industry research company IDC warned in April.

Some PC makers have already begun readying themselves for the impact as the first evidence of the shift showed up about five years ago.

Lenovo Group Ltd, China's top PC maker and the world's second largest, is eyeing enterprise-level business to spur profit margins although the Beijing-based company was able to outpace the market in the last quarters.

"We are looking for sectors that could help generate profit in the post-PC era," said Chen Xudong, senior vice-president and general manager of Lenovo's China unit. "Enterprise-level server and storage markets will surely fill this need."

'Not science'

Dell's longtime rival HP started to enter the software market in mid-2005. Its software business revenue grew 14 percent year-on-year in the fourth quarter of last year with an operating margin of more than 27 percent, according to the company.

Swainson estimated a reasonable scale for Dell's software group is somewhere around $5 billion, but he refused to predict when the company could hit the target.

"It's not science, but there is some benchmark if you look at the software business of HP," said Swainson.

Industry insiders said Dell's ailing PC business made the growth of the software unit more urgent.

Data from research company IDC showed Dell's global PC shipments saw a decline of more than 10 percent in the first quarter of this year. The company's shipments in the United States dropped by 14 percent.

Currently, Dell software's major target customers are in the US, Australia and West Europe.

Markets such as China are not yet being explored because expanding business in non-English speaking countries could cost extra money and energy.

As the world's top growing information technology market, China should generate $100 million in revenue for Dell software in the future given the company's current portfolio, although the company has so far received less than $10 million in revenue from the China market, according to Swainson.

Dell has to translate the products to feed demand in Asian countries and, in some cases, the company has to re-engineer the products and then set up a brand new sales infrastructure, according to Swainson.

"We have got a lot of work to do to localize the company's software products in China. For example, the translation and sales infrastructure," he said.

"Asia-Pacific makes up a very small percentage of our business so we see great potential to grow in China, Japan and South Korea."

Dell software received about $50 million in revenue from the Asia-Pacific region.

"It may be not a very good number but it should be way bigger in the future," said Swainson.

gaoyuan@chinadaily.com.cn

(China Daily 05/20/2013 page17)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|