Experts call for break-up of SOE monopoly on debt concerns

Updated: 2013-05-29 08:03

By Shi Jing in Shanghai (China Daily)

|

||||||||

|

A Sinopec gas station in Nantong, Jiangsu province. The company's earnings per share were 0.179 yuan (3 US cents), compared with Exxon Mobil Corp's $2.12. Provided to China Daily |

Move would help innovation and economic restructuring

If you're still wondering why the Chinese stock market has persistently underperformed those of other major economies, despite above-average economic growth, consider this: Ballooning debt is acting like a millstone around the necks of many listed enterprises, dragging down profits, and possibly pulling them into the financial abyss.

|

The combined outstanding debt of all A-share listed companies at the end of 2012 was 8.2 trillion yuan ($1.33 trillion), according to research from investment newspaper Investor China.

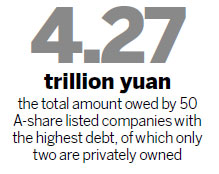

The 50 companies topping the debt list owed an aggregate 4.27 trillion yuan, or 52 percent of the total.

Of those 50, 37 are State-owned, while six are controlled by local governments. Just two can be classified as strictly privately owned.

Ready access to cheap credit from banks and other sources, including the capital markets, is one of the privileges that SOEs enjoy, said Liu Shengjun, the executive deputy director of CEIBS Lujiazui Institute of International Finance.

"SOEs and other enterprises with government backing can secure bank loans at preferential interest rates that are much lower than those that apply to private sector borrowers. The problem has been there for years," he said.

Private-sector enterprises often have to pay above 10 percent a year to secure loans, while the average interest their government-controlled counterparts pay was only about 5 percent, according to Investor China.

The interest for loans in the curb market, a market for trading in securities not listed on the stock exchange and a major source of funding for small-to-medium-sized enterprises in the private sector, is even higher, at 40 percent a year or more.

"To solve the difficulty of private companies seeking financing, liberalization of bank interest rates is inevitable," added Liu.

"Also, private capital should be allowed into banking. But on top of all that, the privilege of SOEs should be broken.

"Only when the monopoly of SOEs is broken can economic restructuring and innovation be possible."

An even more dangerous trend is that many enterprises have been borrowing foreign currency, particularly US dollars, to take advantage of the plentiful supply of cheap credit.

This could create major problems for them when the Federal Reserve of the United States abruptly ends its monetary stimulation program, called quantitative easing, economists have said - and this could happen sooner than many had expected.

Last week, Reuters cited Charles Evans, president of the Federal Reserve Bank of Chicago, as saying that he expected the Fed to continue full-speed ahead with its bond-buying program - called quantitative easing - throughout the summer but end it abruptly in the autumn if the jobs market improves by then.

Analysts have long noted that the servicing costs for such high levels of debt, even at preferential rates, present a severe drag on the earning potential of SOEs.

For instance, China Petrochemcial Corp (Sinopec Group) issued 80 billion yuan's worth of bonds in 2012, a 1,500 percent rise year-on-year, which made Sinopec Group the largest issuer of bonds last year.

Sinopec's gross debt grew to 718.7 billion yuan, 81.5 billion yuan more than the year before.

To lower its financing costs, Sinopec borrowed low-cost short-term dollar loans last year, which added another 30.8 billion yuan of loans to the group.

Its results in the first quarter of this year showed that the corporation made total net profit of 15.8 billion yuan in the first three months - up 18.1 percent year-on-year, but down 32.8 percent compared with the previous quarter.

Basic earnings per share were 0.179 yuan, lower than market expectations of 0.21 yuan.

Compare that performance to its western rivals.

Earnings per share at Exxon Mobil Corp, for instance, reached $2.12 in the first fiscal quarter, 72.5 times of that of Sinopec, while earnings per share at Dow Chemical Co reached $0.46 in the first fiscal quarter, almost 15 times of that of Sinopec.

Zhang Qi, a senior analyst at Haitong Securities Co Ltd in Shanghai, said that investors should not be too disheartened as the less-than-stellar performance of China's SOEs - many of which are in iron and steel, shipbuilding and heavy chemical industries - is largely a result of global price fluctuations for bulk commodities.

"There have been production difficulties for the entire manufacturing industry over the past two years," said Zhang.

"In addition, SOEs have taken on the heavy burdens of larger workforces and the replacement of machinery.

"Issuing bonds overseas will help facilitate their overseas operations, where the renminbi is not commonly used."

shijing@chinadaily.com.cn

(China Daily 05/29/2013 page16)

Michelle lays roses at site along Berlin Wall

Michelle lays roses at site along Berlin Wall

Historic space lecture in Tiangong-1 commences

Historic space lecture in Tiangong-1 commences

'Sopranos' Star James Gandolfini dead at 51

'Sopranos' Star James Gandolfini dead at 51

UN: Number of refugees hits 18-year high

UN: Number of refugees hits 18-year high

Slide: Jet exercises from aircraft carrier

Slide: Jet exercises from aircraft carrier

Talks establish fishery hotline

Talks establish fishery hotline

Foreign buyers eye Chinese drones

Foreign buyers eye Chinese drones

UN chief hails China's peacekeepers

UN chief hails China's peacekeepers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Shenzhou X astronaut gives lecture today

US told to reassess duties on Chinese paper

Chinese seek greater share of satellite market

Russia rejects Obama's nuke cut proposal

US immigration bill sees Senate breakthrough

Brazilian cities revoke fare hikes

Moody's warns on China's local govt debt

Air quality in major cities drops in May

US Weekly

|

|