China shares deepen downward spiral as banks sink

Updated: 2013-06-24 13:29

(Agencies)

|

||||||||

HONG KONG - Chinese mainland shares tumbled again, weighing on Hong Kong markets on Monday, with mainland banks weak after official news reports over the weekend suggested Beijing will not change its tightening policy.

Losses accelerated after the People's Bank of China commented late Monday morning that liquidity in the country's financial system is "reasonable", repeating a line from a Sunday commentary in the official Xinhua news agency.

The commentary also said the latest spike in money market rates was a result of market distortions caused by widespread speculative trading and shadow financing. The central bank , in its quarterly report on Sunday, pledged to "fine tune" existing "prudent" monetary policy.

At midday, the Hang Seng Index slid 1.6 percent to 19,943.9 points. The China Enterprises Index of the leading Chinese listings in Hong Kong shed 2.7 percent, holding at chart support at 8,991.9 points, a level that was firm support in September 2012 and October 2011.

The CSI300 of the top Shanghai and Shenzhen listings tumbled 4 percent to 2,224.4, breaking below chart support at about the 2,242-point level formed in mid-December. The Shanghai Composite Index dived 3 percent.

Losses in both Hong Kong and China came in relatively weak volumes.

"I think the market is expecting 'fine-tuning' to mean a tightening of liquidity moving forward, especially after the way official media talked about shadow financing over the weekend," said Cao Xuefeng, Chengdu-based head of research at Huaxi Securities.

"People are quite jittery ahead of the first of two open-market operations for the week tomorrow. In this market environment, it's tough to call a bottom," Cao added.

Monday's slide came despite the overnight repo rate , a key gauge of liquidity in China's interbank market, falling by 193 basis points to 7.32 percent on a weighted-average basis on Monday morning, its lowest since last Tuesday.

Among the biggest losers were smaller banks seen as more reliant on short-term interbank funding, such as China Minsheng Bank , Industrial Bank and Ping An Bank.

Minsheng Bank slumped 9.4 percent in Shanghai and 6.4 percent in Hong Kong. Minsheng's Shanghai shares, among the more popular stocks among A-share investors this year, have tumbled 21 percent from a May 28 peak. They are still up 9 percent on the year, versus a 12 percent slide on the CSI300.

Among the "Big Four" Chinese banks listed in Hong Kong, Agricultural Bank of China (AgBank) and Industrial Bank of China (ICBC) had the biggest percentage losses, 2.9 and 2.4 percent, respectively.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

H7N9 bird flu less deadly than H5N1

Snowden exposes more US hacking, then flies

China shares dive again

Xi vows bigger stride in space exploration

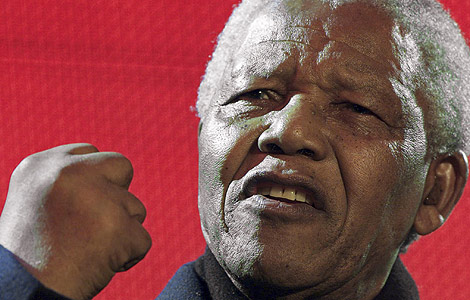

Mandela's condition critical

Suspect in shooting spree detained

Mountaineers killed in Pakistan

Foreign firms eye new 'opening-up'

US Weekly

|

|