Nation faces shift to sustainable growth

Updated: 2013-06-25 03:04

By Chen Jia in Beijing and Fu Jing in Brussels (China Daily)

|

||||||||

|

|

|

An Agricultural Bank of China Ltd branch in Qionghai, Hainan province. Premier Li Keqiang said at a State Council meeting on June 19 that banks must make better use of existing credit and step up efforts to contain financial risks. MENG ZHONGDE / FOR CHINA DAILY |

Analysts see little chance of fund injections to prop up expansion

China's leaders seem to be bracing for painful therapy in return for sustainable growth, as they are determined to tame liquidity risks rather than pacify cash-strapped banks, which are the major driver of an investment-oriented economy.

Economists have interpreted the move as evidence that a policy shift from rapid growth to quality growth has made the central government less sensitive to lower GDP growth and more focused on adjusting the country's overall imbalances.

The authorities showed little willingness to pump fresh funds into the financial markets despite a worsening cash crunch that squeezed banks and prompted the country's key stock index to record its biggest daily loss in nearly four years on Monday.

The Shanghai Composite Index sank 5.3 percent to 1,963.24, the largest single-day loss since September 2009. Hong Kong's Hang Seng Index slid 2.2 percent, extending six weeks of losses.

However, the People's Bank of China, or central bank, reiterated on Monday its intention to maintain a prudent monetary stance and strengthen liquidity management to prevent excessive debt growth.

"Currently, overall liquidity in the domestic banking system is at a reasonable level," it said in a statement.

The statement came a day after a commentary from the official Xinhua News Agency that indicated the government is unlikely to pump cash into the banking system to contain financial risks.

It blamed speculation and non-bank lending, often called "shadow finance", for the problem.

The cash squeeze has seen banks put the brakes on new lending, which has in turn dragged on the economy.

Economists say there is a likelihood that the new cabinet, led by Premier Li Keqiang, may tolerate a lower growth rate in the remainder of 2013 while preparing to launch new development programs and policies.

Over the past few weeks, nearly all major investment institutions have cut back their forecasts for China's 2013 GDP, in some cases below the government's target of 7.5 percent.

Most international investors were confident of 8 percent-plus growth three months earlier.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

H7N9 bird flu less deadly than H5N1

Snowden exposes more US hacking, then flies

China shares extend losses

Xi vows bigger stride in space exploration

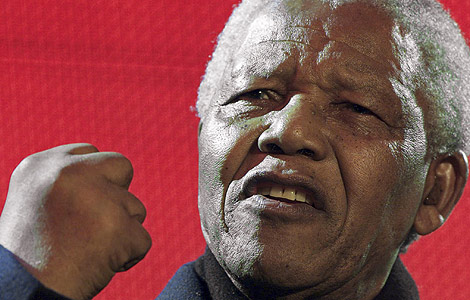

Mandela's condition critical

Suspect in shooting spree detained

Mountaineers killed in Pakistan

Foreign firms eye new 'opening-up'

US Weekly

|

|