HK real estate firm to focus on residential housing

Updated: 2013-07-05 15:11

By Zheng Yangpeng in Chengdu (chinadaily.com.cn)

|

||||||||

Shui On Land's strategy change is a response to the company's poor business performance over last two years. Shui On's net profit fell 41 percent to 2.03 billion yuan ($331 million) last year.

A major reason for Shui On Land's weak performance was the resettlement difficulties with the company's two projects in Shanghai. The resettlement is not yet finished, which has hit company's cash flow.

"The households to be relocated demand very high compensation because they knew the developer is Shui On," Lo said, adding he would no longer invest in projects which involved the costly resettlement of people.

"Commercial property involves huge investment and the return cycle is very long. It would be difficult for the former company to support such a task," Lo said.

Having been a consultant in the company over the past two years, Lo this year jumped to the front line and resumed the leadership in setting up development and business strategies.

Premier assets from Shui On will be injected into the new company, which include land for commercial use in Shanghai, Chongqing, Wuhan and Foshan. Lo said this land is located in city centers, and resettlement has been completed.

The new Shui On Land will buy residential sites in first and second-tier cities in the future. Lo said he will invest in more small-scale residential projects to improve his company's earning ability.

"Mainland developers take only one year to pre-sell the residential project after they have bought the site. We are able to speed up development," he said.

Lo said one of the challenges for Hong Kong developers in the mainland market is developers are more familiar with the policies and market environment.

But Hong Kong developers also have strength in design, operations and management. For Shui On, its large land stock, including 1 million square meters that is being developed and 4 million yet to be built on, allowed it to reduce risk by portfolio management, Lo said.

Lo dismissed fears over any bubble in China's residential property market, saying there are still many good projects on the mainland.

Joey Chestnut wins 7th contest with 69 dogs

Joey Chestnut wins 7th contest with 69 dogs

Lisicki, Bartoli to vie for new Wimbledon crown

Lisicki, Bartoli to vie for new Wimbledon crown

Muscle Beach Independence Day

Muscle Beach Independence Day

Tough workout for Li Na in war of words

Tough workout for Li Na in war of words

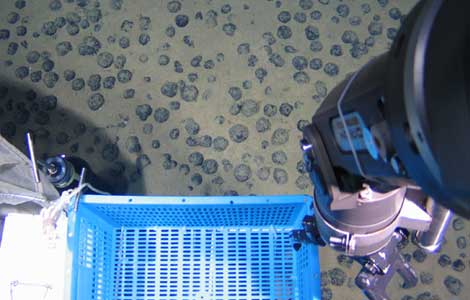

Submersible taps mineral deposits in S China Sea

Submersible taps mineral deposits in S China Sea

Ecuador finds spy mic for Assange meeting

Ecuador finds spy mic for Assange meeting

US martial artists arrive at Shaolin Temple

US martial artists arrive at Shaolin Temple

July 4 in Prescott: Balance of grief, patriotism

July 4 in Prescott: Balance of grief, patriotism

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Gunman shoots two, commits suicide in Texas

Baby formula probe to shake or reshape industry?

Passenger detained over bomb hoax in NE China

High rent to bite foreign firms in China

Egypt's prosecution imposes travel ban on Morsi

Russia more impatient over Snowden's stay

Mandela still 'critical but stable'

Figures show shifts in US, China economies

US Weekly

|

|