Retail chains made to raise management abilities

Updated: 2013-08-23 07:48

By Yao Jing (China Daily)

|

||||||||

Faced with slowing economic growth, retail chains in China are being forced to further improve their management and marketing capabilities to go through the sluggish period, said a report released on Thursday by Deloitte Touche Tohmatsu Ltd.

The report - China Power of Retailing 2013 - reviewed the country's retail industry over the last year, and is based on a survey conducted by Deloitte and the China Chain Store & Franchise Association of 192 retail companies and 108 retail stores in China.

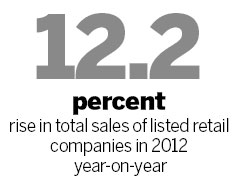

The total sales of listed retail companies rose 12.2 percent year-on-year in 2012, a much slower growth rate than in recent years. Their net profit, which decreased 7.7 percent from 2011, posted the first drop in recent years, said the report.

The sales growth of China's top 100 retail chains eased to 10.8 percent year-on-year, the lowest point in six years.

"The retail industry is facing challenges due to rising operational costs as employee compensation increased and logistics spending continued to rise," said Long Yongxiong, a consumption and transportation industry joint leader at Deloitte China.

At the same time, the booming online retail sector is grabbing market share from traditional retailers with its advantages of lower prices, convenient payment systems and door-to-door delivery, Long pointed out.

Under a major assault from e-commerce firms, the profit margins of the physical retail market in China fell from 5 percent in 2005 to nearly 2.5 percent last year. Tesco Plc, Carrefour SA and Wal-Mart Stores Inc have all remained below that benchmark, a Kantar Retail report said.

"As for single stores, the turnover of foreign retailers is much higher than that of local retail companies in our top 100 retail rankings. I think local retailers have to improve their marketing and operational capabilities to catch up with foreign competitors," said Long.

Still, foreign retailers are also seeing declining sales and are struggling with lackluster conditions in the marketplace.

In 2012, United States-based Wal-Mart closed five outlets in China, including three convenience stores, and France's Carrefour closed two stores in the country, the National Business Daily reported. UK chain Tesco also closed four stores in China last year and another one this year.

The report suggested that China's current urbanization drive will present more opportunities for retailers as the rising proportion of urban consumers will change the consumption structure and boost the consumption level in third and fourth-tier cities.

Among the top 10 new retailers listed on the top 100 of retail companies in 2012, nearly 50 percent of them came from smaller cities.

Also, an increasing number of retailers have started expanding to other sectors to boost sales and lift profits.

Walmart said earlier this year that it would expand online mobile phone sales in China. And local players are gradually developing new retail projects, such as shopping malls and convenience stores.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Newly born panda cub at Washington zoo doing fine

Market regulators need to fix loopholes

Singapore PM aims to cement relations

Experts call for details on rumor cases

Joint sea drill shows improved relations

Bo insists he did not abuse power

UN to probe alleged chemical attack

Using stray cats for rat control sparks debate

US Weekly

|

|