More outbound investments expected

Updated: 2013-09-16 09:53

(bjreview.com.cn)

|

||||||||

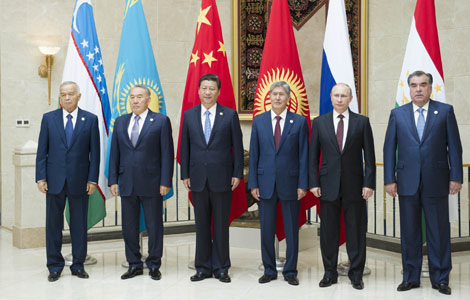

Against the backdrop of shrinking outbound investments around the world, China's outbound investments are increasing. China has now become the world's third largest investor, after the United States and Japan.

Chinese companies' investments can bring capital, jobs and market opportunities to destination countries—and more importantly, more vitality to local economies. According to the Pew Research Center's report issued in July, an estimated 33,000 jobs in the United States are directly offered by companies where the majority of shares are held by Chinese companies, and this number is continuing to rise. Even more jobs are indirectly provided by such companies.

Chinese companies can learn a lot in the process of investing and strengthen by getting more familiar with international rules, so as to enhance their level of internationalization and competitiveness.

In the past, Chinese investments focused on natural resources, but nowadays more attention is being paid to science and technology, food, real estate and brand management. On September 9, the US Government approved the purchase by China's Shuanghui International Holdings Limited of Smithfield Foods, Inc. This was the biggest case of Chinese food companies' outbound investment.

The investment destinations are also changing. In the past, most Chinese investments headed for Africa, but in the first half of this year, mainland companies' investments to regions and countries including Hong Kong, the United States, ASEAN, EU, Australia, Russia and Japan accounted for 78 percent of China's foreign direct investment. The United States has become the second largest direct investment destination of mainland companies, after Hong Kong.

However, in recent years, Chinese companies have encountered unfair treatment, sometimes by foreign government agencies and sometimes by foreign companies. Statistics show that the successful cases of foreign investment by Chinese companies are almost equal to failed cases, which implies the unfair treatment and prevention Chinese investors are encountering in some countries.

Some failed cases should be blamed on Chinese companies themselves. Some companies' investment capability is still at an elementary level, with little economic efficiency, and thus they easily fail.

How to eradicate doubts and misunderstanding is a big subject facing Chinese companies investing in other countries. At the same time, Chinese companies' managerial and operational capabilities need to be enhanced.

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

UN chief gets report on Syria chemical weapons

Succession proves a tricky art in business

Going global? Not so easy

Japan switches off nuclear reactor

Summers withdraws from Fed chair contest

Chinese FM hails US-Russia deal

More foreigners get green cards

Fallen celebrity blogger says Net needs cleanup

US Weekly

|

|