US bank signs asset manager agreement with ICBC

Updated: 2013-11-05 17:19

By Yang Ziman (chinadaily.com.cn)

|

||||||||

US bank Brown Brothers Harriman & Co has signed an agreement with the Industrial & Commercial Bank of China Ltd that would enable BBH to help some of the world’s biggest asset managers increase their access to China.

The agreement was signed as regulators in Hong Kong and Beijing are considering a program that would allow mutual funds in Hong Kong to be sold on the Chinese mainland and vice versa.

If the program is implemented, Hong Kong would act as a gateway for global money managers seeking access to China.

Under current rules, foreign investment can only gain access to China through joint ventures with Chinese firms.

"We have structured a memorandum of understanding with ICBC in China; they have the Chinese distribution and client base and we have global investment expertise and experience," said Douglas Donahue, managing partner at BBH.

At the end of May, assets in China's mutual-fund industry totaled 3.98 trillion yuan ($653 billion), equivalent to 4 percent of deposits in the banking system, managed by 81 asset-management companies, according to the Asset Management Association of China.

US, Russia fail to agree Syria peace talks date

US, Russia fail to agree Syria peace talks date

India launches exploratory spacecraft to red planet

India launches exploratory spacecraft to red planet

Taking risks in a firestorm

Taking risks in a firestorm

Biden to emphasize Asia pivot on tour

Biden to emphasize Asia pivot on tour

China vows to cooperate in global fight against ivory smuggling

China vows to cooperate in global fight against ivory smuggling

US mall on lockdown after shots heard

US mall on lockdown after shots heard

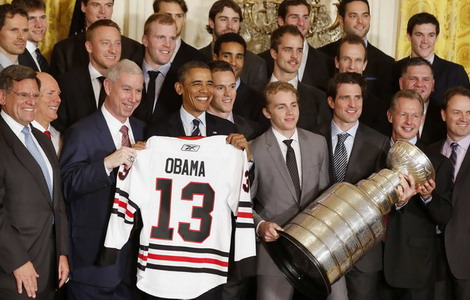

Blackhawks honored at White House

Blackhawks honored at White House

Kerry denies tensions between US, Saudi Arabia

Kerry denies tensions between US, Saudi Arabia

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

China seeks collaborative efforts on global nuclear safety

Alipay partners with UATP

Franchisors look to follow KFC’s lead

Govt to focus on better service

Canadian province closes debt issue in HK

US media under attack for 'double standards' on terror

Biden to emphasize Asia pivot

Pollution 'to ease in five to 10 years'

US Weekly

|

|