Securities regulator shares audit data with US counterparts

Updated: 2014-01-11 07:55

By Cai Xiao in Beijing and Xie Yu in Shanghai (China Daily)

|

||||||||

The China Securities Regulatory Commission has shared the audit details of four Chinese companies listed abroad with overseas regulators, in a further move to crack down on illegal activities and protect the interests of investors, the watchdog said on Friday.

In May, a memorandum of understanding was signed by the CSRC, China's Ministry of Finance, the audit regulator in the United States and the Public Company Accounting Oversight Board in the US.

Since March 2013, the CSRC has been making available to foreign counterparts the audit details on Chinese companies listed abroad and is also seeking cooperation projects with overseas regulators.

"We'll continue to fulfill our commitments under the bilateral and multilateral cooperative MOUs and strengthen cooperation with overseas regulators to crack down on illegal listing and trading activities, protect investors' interests and maintain the reputation of Chinese companies," said Deng Ge, a CSRC spokesman.

At the same time, the CSRC is also boosting regulations on new share issuance and underwriting activities.

Fifty-one Chinese companies are preparing to go public after a 14-month IPO hiatus, and the CSRC has asked securities associations and stock exchanges to conduct checks on the underwriting work of those companies.

"We must emphasize that the market-oriented IPO reform does not mean that issuers and underwriters can do anything they like. The CSRC will investigate and punish illegal activities," Deng added.

The commission said at the end of November that China would resume listings in January after the IPO suspension. After that, a reform plan for new listings has been implemented to boost the country's stock market image in the long term.

Under the reform plan, the CSRC will only be responsible for examining the applicants' qualifications, leaving investors and the markets to make their own judgments about a company's value and the risks of buying its shares.

The commission's statement was released after Chinese drug maker Jiangsu Aosaikang Pharmaceutical Co Ltd on Friday became the first company to delay its listing after the IPO suspension.

Aosaikang had said on Thursday it planned to issue about 55.47 million shares at 72.99 yuan ($12) per share, which would represent a price-to-earnings ratio of 67 times.

The average PE ratio of the pharmaceutical companies listed on Shenzhen's Nasdaq-style ChiNext board, where Aosaikang planned to go public, is roughly 55.31, the State-run Shanghai Securities Journal reported.

"Authorities have made their stance quite clear: they're against high IPO prices and aggressive dilution of shares belonging to original shareholders, but it seems companies are still trying to ignore that," said Simon Yue, an analyst at a Shanghai-based private equity firm.

"Aosaikang's IPO delay was probably ordered by the CSRC. Their IPO price was too high, and the dilution of old shares was too aggressive. The CSRC didn't want it to set a bad example, as more than 20 companies are about to go public in the next two weeks," said Zhou Yi, an independent financial commentator.

Magazine picks best US Air Force photos

Magazine picks best US Air Force photos

US to withdraw diplomat at India's request

US to withdraw diplomat at India's request

New Jersey braces for new disclosures in bridge scandal

New Jersey braces for new disclosures in bridge scandal

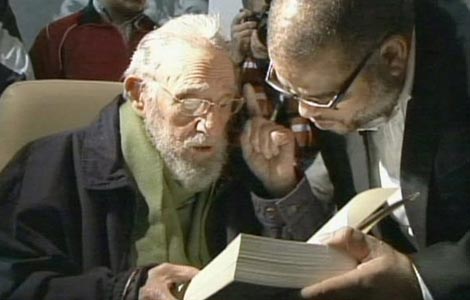

Fidel Castro makes rare public appearance

Fidel Castro makes rare public appearance

Migrants feel pain of separation

Migrants feel pain of separation

Websites to be liable for sales of bad food, medicine

Websites to be liable for sales of bad food, medicine

Largest sushi mosaic created in HK

Largest sushi mosaic created in HK

UK police pick through US helicopter crash site

UK police pick through US helicopter crash site

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US to withdraw diplomat at India's request

Top scientists awarded $826,000

Eight foreign scientists win Chinese sci-tech awards

New documents released in NJ bridge scandal

Nation 'has landed trading crown'

US regrets over India's expulsion of American diplomat

Fischer named as Fed vice chairman

China's space policy open to world

US Weekly

|

|