Li tells auditors to help curb graft

Updated: 2014-01-10 01:07

By AN BAIJIE and ZHAO YINAN (China Daily)

|

||||||||

Premier Li Keqiang urged audit agencies on Thursday to play a major role in boosting clean governance and preventing financial risks.

They should enhance supervision of public funds, and officials misusing or embezzling funds must be severely punished, he said.

Li made the remarks after hearing the annual report of the National Audit Office, which held its yearly conference from Dec 24 to 25.

The premier told the agencies to keep a close eye on the construction of government buildings. He pledged in March that the government would not approve any new projects for government buildings.

Li also urged auditors to strengthen their vigilance of the financial system to prevent potential risks, as well as revitalizing capital.

His comments follow credit crunches in China's money markets in June and December.

The money shortage last month prompted the central bank to inject liquidity into the market through short-term operations.

Ma Jun, a professor of public governance at Sun Yat-sen University in Guangzhou, said many corrupt officials were initially exposed through auditing.

Liu Jiayi, head of the National Audit Office, said on Dec 27 that audit authorities found more than 970 clues to corruption cases and transferred these to judicial authorities between January and November.

Liu told China Central Television in October that a clue offered to the disciplinary watchdog resulted in the investigation into Liu Zhijun, former minister of railways, who was later sentenced to death with a two-year reprieve for bribery and abuse of power.

Mei Xingbao, an external supervisor for the Bank of China, said auditing, including audits of finances and efficiency, can detect potential financial risks at an early stage and help banks to prevent losses.

Mei said one cause of last year's money shortage was that many commercial banks failed to spot the risks of problematic loans amid rapid credit expansion.

"Such problems should have been found during internal audit. The fact that they got away from auditors shows loopholes in the system.

"Although auditing is not the fundamental method to erase such concerns, it offers a chance for financial institutions to remedy the situation before mistakes begin to snowball," he said.

Late last month, the Chinese Academy of Social Sciences said some local governments have interfered with auditing work, affecting the authenticity of audit results.

Hou Liqiang contributed to this story.

Contact the writers at anbaijie@chinadaily.com.cn and zhaoyinan@chinadaily.com.cn

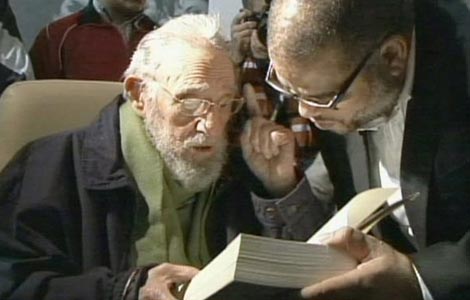

Fidel Castro makes rare public appearance

Fidel Castro makes rare public appearance

Migrants feel pain of separation

Migrants feel pain of separation

Websites to be liable for sales of bad food, medicine

Websites to be liable for sales of bad food, medicine

Largest sushi mosaic created in HK

Largest sushi mosaic created in HK

UK police pick through US helicopter crash site

UK police pick through US helicopter crash site

Riding the waves down under

Riding the waves down under

The long-living rich in China

The long-living rich in China

US skiing star Lindsey Vonn out of Sochi Olympics

US skiing star Lindsey Vonn out of Sochi Olympics

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Abe's new frontiers: Africa, Middle East

Rodman sorry for Bae comment

Reunion proposal rejected by DPRK

Apology urged for insulting Chinese

China's oil pipelines riddled with defects

Higher targets set for emission reduction

Inoculations drop after vaccine scare

China reports new human H7N9 case

US Weekly

|

|