Growth pangs

Updated: 2014-10-27 07:43

By Andrew Moody(China Daily)

|

||||||||

One of the challenges for China if it is trying to engineer a slowdown is whether it can achieve it without sending the rest of the world into recession and then being impacted itself again in second-round effects by the resultant fall in global demand.

Ballin at Standard Bank Group believes this is something Chinese policymakers will be very much aware of.

"There are these risks of a downward spiral. You can't just see this in terms of an isolated GDP growth decline. China is so much now integrated into the global supply chain so there is a synchronicity of risk to any slowdown," he says.

Zhu at the Shanghai Advanced Institute of Finance believes there is less of a risk of this than there was five years ago when in the wake of the financial crisis the world was completely reliant on China demand.

"You can't rule out the risk of a downward spiral since China remains so important. What the world needs, however, is a China soft landing rather than a hard one. This relatively stable decline in growth that we are seeing reduces the possibility of a crash, which was what everybody feared.

"We have also moved into a situation where it is not just China contributing to global growth although it remains very significant but also the so-called frontier economies of Indonesia, Pakistan and Turkey, which gives greater scope for China to slow without destabilizing the world economy."

For Power at Investec, the real threat to global growth comes from Europe itself and not China as has been made clear by all the worrying data of the past fortnight that has created turmoil on global stock markets.

"We are now seeing Germany moving into negative growth and the whole problem with the eurozone countries. I think we are also going to see an end to the so-called German export miracle," he says.

"The Chinese are beginning to reverse engineer some of the capital goods they have been sold by the Germans such as magnetic trains. I think the US will begin to start to lose its competitive advantages, too within three to five years and we will move to a situation where there is more creativity coming from Asia."

For the moment, there is going to be increasing interest in the growth data coming out of China.

Evans-Pritchard at Capital Economics says it is often too easy to be bearish about China.

"I think a lot of people were too pessimistic after the very weak data we had in August. The latest growth figure therefore was not as bad as some people had expected," he says.

Kuijs at RBS believes the Chinese government is still very much weighing up all the options as to what growth level it wants the economy to achieve.

"I think they are still making up their mind as to how far to let this process go. I think there, however, still remains an element of ambition about achieving a certain minimum level of growth. I think that is why we are all still wondering what the growth target for next year and beyond will eventually be."

|

|

|

| Flash PMI for Oct brings cheer | Study: More US firms shift work back home |

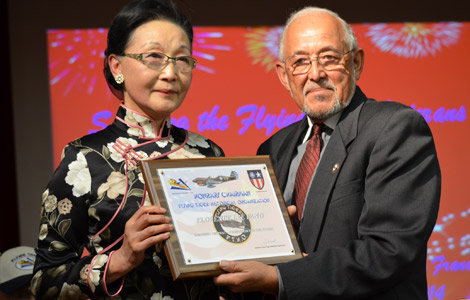

WWII's Flying Tiger veterans saluted

WWII's Flying Tiger veterans saluted

600-year-old Chinese book found in California

600-year-old Chinese book found in California

China's growing role in Mexico not a threat to US: expert

China's growing role in Mexico not a threat to US: expert

Beijingers see blue sky again after smoggy days

Beijingers see blue sky again after smoggy days

9th Rome Film Festival kicks off

9th Rome Film Festival kicks off

Highlights of China Fashion Week

Highlights of China Fashion Week

Remembrance of Flying Tigers & WWII Veterans

Remembrance of Flying Tigers & WWII Veterans

Lang Lang plays at the UN Day concert

Lang Lang plays at the UN Day concert

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

600-year-old Chinese book found in California

Asia, LatAm to lead air travel by 2034

China's growing role in Mexico not a threat to US

Improving air quality as 'priority'

The road goes on for teacher Levine

Redesigned SAT not brainwashed

Police step up efforts against smugglers

Stricter border check for terrorists

US Weekly

|

|