Rate cut adding to global uncertainty

Updated: 2015-10-26 11:04

By Paul Welitzkin in New York(China Daily USA)

|

|||||||||

A slowing Chinese economy that required another interest rate cut, along with the possibility of additional stimulus in Europe and a US interest rate increase, could put the global economy on edge in 2016, according to observers.

The People's Bank of China (PBOC) on October 23 trimmed the interest rate and the reserve requirement for the nation's banks. It's the sixth time China's central bank has lowered rates since last November and the fourth cut to the reserve requirement this year. There is speculation that central bankers in Europe and Japan may add fresh stimulus to those economies next year, while the Federal Reserve Bank may be poised to increase borrowing costs in the US for the first time since 2006.

"If that scenario comes true, we can expect a stronger (US) dollar in 2016 and a widening US trade deficit. That will trigger some political backlash during the presidential campaign," said Gary Hufbauer, a senior fellow at the Peterson Institute for International Economics in Washington.

"If the Fed raises the interest rate, the dollar would appreciate, which would cause capital outflows from Europe and China. The euro and the RMB (yuan) could depreciate. This would cause trade instability and (potentially) damage the global economy," said Jianjun Miao, professor of economics at Boston University.

Dwight Perkins, a professor of political economy at Harvard University in Cambridge, Massachusetts, said if the US Federal Reserve does raise rates it will have some influence on increasing capital flows into the US and out of other countries.

"But because the change in US interest rates is likely to be very small - at least initially - the influence on the flow of capital will also be modest. Mainly there will be an adjustment in how companies hold their foreign exchange reserves and that is already happening with companies in China that are involved in foreign trade," he said.

"We've got half the world's central banks in easing mode," said Joe Rundle, the head of trading at ETX Capital in London according to Reuters. "And we'll probably see more easing from China to come."

The PBOC unveiled a quarter-point cut in benchmark interest rate to 4.35 percent and a half-percentage reduction in banks' reserve-requirement ratio to 17.5 percent.

The moves are intended to lessen corporate financing costs and pump additional liquidity into the economy. The easing came just days after China said its gross domestic product (GDP) increased by 6.9 percent in the third quarter from a year earlier. That result was just below the government's official target of 7 percent. All of this has some questioning just how much of a slowdown has occurred in China.

"Many people believed that the reported 6.9 percent growth rate was higher than expected. The actual growth rate could be lower than this number," noted Miao.

"China's economy is clearly slowing down and it is going to be increasingly difficult to achieve 6 to 7 percent growth and the PBOC lowering interest rates again will help maintain higher growth, but only to a very limited degree," said Perkins.

In a research note to clients, Patrick Chovanec, managing director of Silvercrest Asset Management Group, said markets will probably like the PBOC actions assuming that easier credit will help boost the Chinese economy. In the US, stocks jumped as the Dow Jones Industrial average gained nearly 158 points while the Nasdaq added almost 112.

"They're wrong on two counts," said Chovanec. "China's economic woes are mainly due to too much easy credit being channeled into over-investment, and without meaningful reform more credit will likely flow in the same direction and make things worse, not better."

The immediate beneficiary sectors will be the property market and heavily indebted companies, said Hufbauer.

Miao said the stock market will benefit the most from this policy, which will also help the Chinese financial system since it will inject more liquidity.

Amy He contributed to this story.

paulwelitzkin@chinadailyusa.com

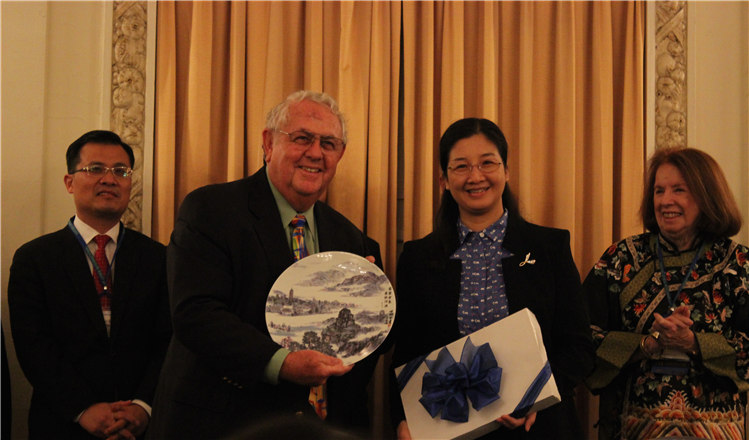

Sister cities mingle in Chicago

Sister cities mingle in Chicago

Girl with a sand painting dream

Girl with a sand painting dream

Decorating benefactors make a dorm a cozy home

Decorating benefactors make a dorm a cozy home

The world in photos: Oct 19 - 25

The world in photos: Oct 19 - 25

Hamilton takes third F1 title after US thriller

Hamilton takes third F1 title after US thriller

Qipaos sizzle on the runway as China Fashion Week kicks off

Qipaos sizzle on the runway as China Fashion Week kicks off

President Xi visits Man City football club

President Xi visits Man City football club

British PM Cameron treats President Xi to beer, fish and chips in English pub

British PM Cameron treats President Xi to beer, fish and chips in English pub

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

Xi pledges $2 billion to help developing countries

Young people from US look forward to Xi's state visit: Survey

US to accept more refugees than planned

Li calls on State-owned firms to tap more global markets

Apple's iOS App Store suffers first major attack

Japan enacts new security laws to overturn postwar pacifism

US Weekly

|

|