PBOC role in reform lauded

Updated: 2015-12-02 11:47

By Hua Shengdun in Washington(China Daily USA)

|

||||||||

Financial reforms backed by the People's Bank of China helped the renminbi gain entry to the International Monetary Fund's Special Drawing Rights currency basket, according to Zhu Ming, IMF deputy managing director.

"The executive board of the IMF spoke highly of the efforts PBOC made to reform the Chinese financial system," Zhu said at a roundtable discussion with the media on Tuesday at the IMF in Washington. "RMB joining SDR is not only a milestone of the Chinese economy going global, but (shows) the success of financial reforms which have been going on for one year."

The reforms started a year before the review year, when China requested that the IMF evaluate the eligibility of RMB, or yuan, to be in the reserve currency basket, Zhu said.

Whether the currency is widely used in international transactions and the volume of exports of the country issuing the currency determine if it can go into the SDR basket,according to IMF Work Progresses on 2015 SDR Basket Review in August.

Every five years, the IMF reviews SDR currencies and opens up a window for inclusion of additional currencies. 2015 is a review year,according to a report released from IMF.

Zhu said China is the third-largest exporting country in the world, which meets the export criteria.

But the IMF board was divided on whether RMB is a "freely usable" currency.

"In 2010, China failed to make it into the SDR because it was not widely used," Zhu said. "Therefore, PBOC focused on how to make RMB a 'freely usable' currency in international transactions."

There were four major changes in the financial reforms, according to Zhu.

First, the PBOC made Chinese financial markets more accessible to foreign central banks. In July, it scrapped a requirement of central banks and other sovereign-linked players to win approval to invest in China's on-shore bond markets.

Also, in free trade zones like Shanghai, PBOC uses quantity discounts and other preferential policies for foreign investors by connecting Shanghai with Hong Kong to make financial services in China more convenient.

Then, the floating exchange rate enabled the global financial market price of RMB to reflect the real value of the currency in international transactions.

Zhu said the floating exchange rate is one of the most significant steps for Chinese financial reform. The PBOC also gradually loosened control of loan and deposit interest rates.

China also has promised to increase transparency of its financial system by applying stricter tools to analyze financial data.

Pan Jialiang in Washington contributed to this story.

- New York orchestra a hot ticket in China

- Key consensus reached on cybercrimes

- White House rejects Pentagon plan to close Guantanamo prison

- Myanmar president meets Aung San Suu Kyi for post-election dialogue

- BRICS media leaders to secure louder voice

- Bilateral trade growth due to continue, minister says

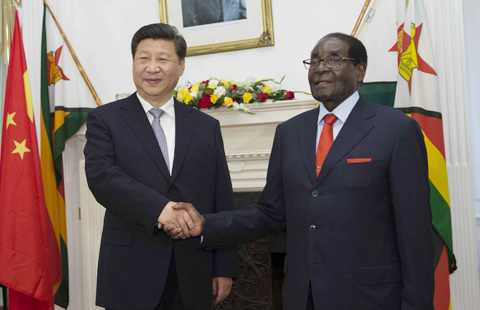

China, Zimbabwe agree to boost cooperation

China, Zimbabwe agree to boost cooperation

First lady visits Africa's 'new window' on China

First lady visits Africa's 'new window' on China

BRICS media leaders to secure louder global voice

BRICS media leaders to secure louder global voice

Western science in the eyes of Chinese emperors

Western science in the eyes of Chinese emperors

Top 10 smartphone vendors with highest shipments in Q3 2015

Top 10 smartphone vendors with highest shipments in Q3 2015

A deepening friendship

A deepening friendship

Xi, Obama pledge to manage differences in constructive manner

Xi, Obama pledge to manage differences in constructive manner

BRICS media leaders gather in Beijing for cooperation

BRICS media leaders gather in Beijing for cooperation

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Chinese bargain hunters are changing the retail game

Chinese president arrives in Turkey for G20 summit

Islamic State claims responsibility for Paris attacks

Obama, Netanyahu at White House seek to mend US-Israel ties

China, not Canada, is top US trade partner

Tu first Chinese to win Nobel Prize in Medicine

Huntsman says Sino-US relationship needs common goals

Xi pledges $2 billion to help developing countries

US Weekly

|

|