PBOC policies may stave off depreciation

Updated: 2016-07-21 07:22

By Jiang Xueqing(China Daily)

|

||||||||

|

|

Liu Ligang, managing director and chief economist for China at Citigroup Inc. [Photo provided to China Daily] |

To get rid of one-way expectations that the yuan will depreciate, China must liberalize its capital market to allow foreign participation and attract renewed capital inflows, said Liu Ligang, managing director and chief economist for China at Citigroup Inc.

"If China opens its capital market to foreign investors effectively, the country will soon draw substantial capital inflows, which will change depreciation expectations on the renminbi," he said in Beijing on Wednesday.

The People's Bank of China, the central bank, is considering including the government bond market in some global government bond indexes. If it were to be included in Citi's World Government Bond Index with an initial share of up to 5 percent, the associated capital inflow could be as large as $100 billion to $150 billion, according to a recent Citi report.

The potential for future investment could be even bigger, as global pension assets under management are at about $26 trillion.

Zhu Haibin, chief China economist at JPMorgan Chase & Co, said in a research note: "In China's case, capital outflow has been a major policy concern in recent years. Brexit (the United Kingdom's decision to leave the European Union) could strengthen the asymmetric strategy in capital account openness in China, i.e. continue to make further progress to encourage capital inflows, but be cautious in moves on capital outflows."

Perhaps because of Brexit, the yuan has become weaker against the US dollar recently, but that does not mean the Chinese currency is overvalued.

After all, the country recorded a huge trade surplus of $240 billion during the first half of 2016 and $600 billion last year, Liu said.

Although the yuan does not suffer from trade competitiveness, the currency depreciation pressure was mainly driven by an increasingly large capital account deficit, he said.

China has started to see large capital account deficits recently. However, a large portion of the deficit was due to errors and omissions.

- Endangered elephants relocated by crane in Africa

- THAAD news met by DPRK missile launches

- DPRK top leader guides ballistic rocket test-firing

- Turkey's failed coup to further consolidate Erdogan's power

- Boris Johnson says UK not abandoning leading role in Europe

- Armed man attacked passengers on a train in Germany

Heavy rain, floods across China

Heavy rain, floods across China

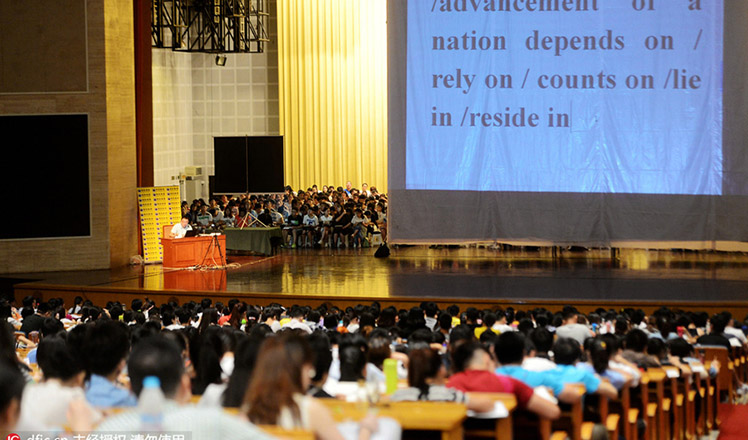

Super-sized class has 3,500 students for postgraduate exam

Super-sized class has 3,500 students for postgraduate exam

Luoyang university gets cartoon manhole covers

Luoyang university gets cartoon manhole covers

Top 10 largest consumer goods companies worldwide

Top 10 largest consumer goods companies worldwide

Taiwan bus fire: Tour turns into sad tragedy

Taiwan bus fire: Tour turns into sad tragedy

Athletes ready to shine anew in Rio Olympics

Athletes ready to shine anew in Rio Olympics

Jet ski or water parasailing, which will you choose?

Jet ski or water parasailing, which will you choose?

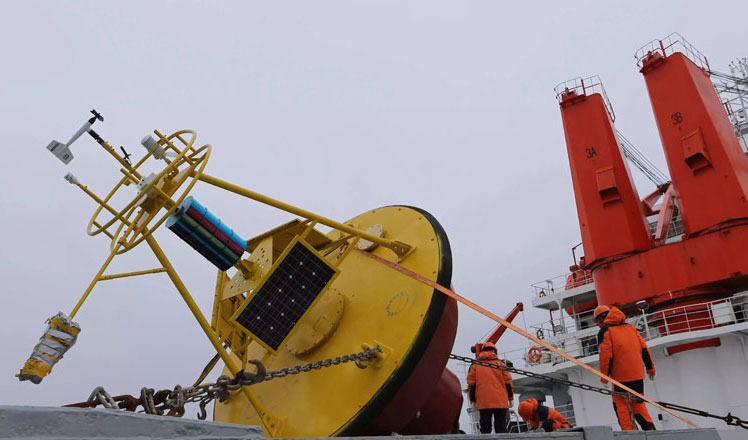

Icebreaker Xuelong arrives at North Pacific Ocean

Icebreaker Xuelong arrives at North Pacific Ocean

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

Liang avoids jail in shooting death

US Weekly

|

|