Rising bad loans shift banks' focus to risks and debt securitization

Updated: 2016-07-25 08:04

By Jiang Xueqing(China Daily)

|

||||||||

Chinese banks are enhancing their comprehensive risk management and exploring securitization as a way to dispose of nonperforming loans from their balance sheets.

The move follows a rise in bad loans at commercial banks.

Recent statistics from the China Banking Regulatory Commission show that the NPL ratio of commercial banks rose to 1.81 percent as of June 30, up 6 basis points on-quarter and 31 basis points on-year.

Also by the end of June, Chinese financial institutions maintained a relatively high level of loan loss coverage ratio at the industry average of 161.3 percent. Their bad debt provisions increased 16.1 percent on-year to 3.47 trillion yuan ($518 billion).

Yu Xuejun, chairman of the CBRC's supervisory board for key State-owned financial institutions, said bank loans overdue for at least 90 days are on the rise, intensifying pressure on risk control, loan loss provisions and profitability of the banking sector.

"Our banking industry is facing the most severe operating pressure since the reform and listing of State-owned banks in 2004. The situation won't improve in the short term, so banks should be prepared for a tough, long-term battle," said Yu at the China Banking Development Forum in Beijing earlier this month.

He highlighted the importance of comprehensive risk management and urged banks to remain cautious because any asset bubble-burst could trigger a series of problems.

Shao Ping, president of Ping An Bank Co Ltd, a mid-sized commercial lender, agreed. "To withstand the hard times, banks should hold fast to prudential norms and improve risk management, and build a competitive advantage through differentiated financial products."

Banks are taking various measures like debt restructuring, NPL securitization and debt-to-equity swaps to dispose of bad assets.

In an effort to reduce existing credit risks, China re-launched a pilot program on NPL securitization this year, after having halted it in 2009. Now, 50 billion yuan has been set as the initial quota for six banks to participate in the program.

Bank of China Ltd and China Merchants Bank Co Ltd issued their first-ever NPL-backed securities in May. While the former sold corporate NPL-backed securities worth 301 million yuan, the latter sold credit card NPL-backed securities worth 233 million yuan.

On June 28, China Merchants Bank issued five-year securities worth 470 million yuan that were backed by small and medium-sized companies' NPLs. Of them, the senior tranche was worth 360 million yuan and the equity tranche 110 million yuan.

The senior tranche was subscribed 1.86 times at an interest rate of 3.98 percent, and the equity tranche was sold at a 2 percent premium.

"When non-performing loans start to rebound, it's better for banks to deal with NPLs as soon as possible, irrespective of whether we are speaking from the angle of bank valuation or the efficiency of economic resource allocation," said Sophie Jiang, head of equity research on Hong Kong and Chinese mainland banks at Nomura Securities, during a conference call in May.

"Although Chinese banks will see rising NPLs and increasing pressure on their profits, bank valuations may start to rebound, as the efficiency of capital turnover has bottomed out and is expected to rise. Valuation multiples of fundamentally stable banks will improve, thus leading to a price hike in banking sector stocks," she said.

- Fashion of Queen Elizabeth on exhibition in London

- Hollande urges Britain to begin EU exit talks 'as soon as possible'

- Trump vows law and order if elected

- Chinese cuisine stuns Thai princess

- Security Council holds first secret poll on next UN chief selection

- Turkey's Erdogan declares state of emergency after coup bid

Things you may not know about Major Heat

Things you may not know about Major Heat

Unveiling the secrets of Elizabeth II’s wardrobe

Unveiling the secrets of Elizabeth II’s wardrobe

Go global: Wanda's top 10 foreign acquisitions

Go global: Wanda's top 10 foreign acquisitions

Hot pepper and ice tub challenge held in E China

Hot pepper and ice tub challenge held in E China

Ten photos from around China: July 15 – 21

Ten photos from around China: July 15 – 21

Heavy rain, floods across China

Heavy rain, floods across China

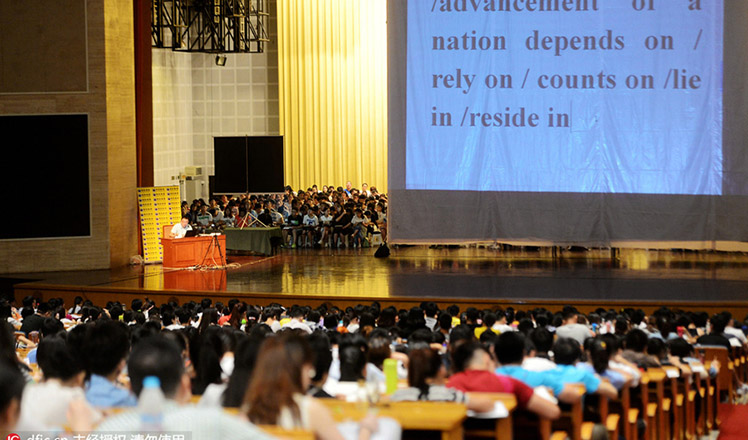

Super-sized class has 3,500 students for postgraduate exam

Super-sized class has 3,500 students for postgraduate exam

Luoyang university gets cartoon manhole covers

Luoyang university gets cartoon manhole covers

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

Liang avoids jail in shooting death

US Weekly

|

|