Evergrande acquires stake in troubled Vanke

Updated: 2016-08-05 08:22

By HU YUANYUAN/JING SHUIYU(China Daily)

|

||||||||

|

|

Vanke's A shares started to rise on Thursday afternoon and surged 10 percent to 19.67 yuan ($2.96), their daily limit, within three hours, the highest price since July 21. [Photo/VCG] |

Chinese property developer Evergrande Group had bought a 4.68 percent stake in its rival China Vanke Co, further complicating the already intense battle for control of Vanke.

Vanke's A shares started to rise on Thursday afternoon and surged 10 percent to 19.67 yuan ($2.96), their daily limit, within three hours, the highest price since July 21.

The upward trend came after Guangzhou-based Evergrande bought more than 516 million Vanke A shares, worth over 910 million yuan, through a subsidiary, the company said in a regulatory filling on Thursday.

That makes Evergrande the fourth-largest shareholder in Vanke, after Baoneng Group, China Resources (Holdings) Co and Anbang Insurance Group.

The firm invested in Vanke because of its "strong" performance as the biggest property developer in China, the filling said.

The battle for control of Vanke will escalate when Evergrande got involved, analysts said.

A battle for control of Vanke has been raging since last year when Baoneng displaced China Resources as the property company's largest stakeholder.

"Evergrande's purchase of Vanke shares is unlikely to be a pure financial investment, given that there are so many uncertainties in Vanke at the moment," said Grant Ji, executive director of capital markets for northern China at CBRE Group, a US commercial real estate company.

Hui Ka Yan, chairman of Evergrande, intended to sit on the board of the company through allying with another shareholder or taking up a minimum of a 10 percent stake, people close to the company said.

Vanke will continue to prosper in the second half of the year, though sales in July declined, according to industry analysts.

Vanke's sales reached 27.44 billion yuan ($4.18 billion) in July, down 35.3 percent from the previous month, the company's statement showed on Wednesday.

The sales decline is mainly due to the flat season, but the battle for control may be another factor, said Huang Weibin, an investment manager at COFCO Futures Co Ltd.

"Vanke's sales will continue to grow in the second half of the year. Though the battle for control has yet to be resolved, I remain optimistic about the company given that it has a solid cash flow and there are many other investors, even its rival, that have confidence in it," Huang said.

- Chinese scientists claim possible breakthrough in HIV, hepatitis cure

- Connection lost: does technology make long distance dating harder?

- Chinese firm reports record-breaking optic fiber transmission

- Travel in space poised to spread its wings

- Tibet envisioned as hub of Himalayas

- Health certificate steps reduced for foreigners

- Nepal's newly elected PM takes oath

- Texas gun law worries incoming students

- China vows to deepen economic, trade cooperation with ASEAN

- Fire guts Emirates jet after hard landing; 1 firefighter dies

- Egypt's Nobel-laureate scientist dies of illness in US

- THAAD muscle flexing unmasks anxiety over declining hegemony

Ace swimmers make record-breaking splash in Rio

Ace swimmers make record-breaking splash in Rio

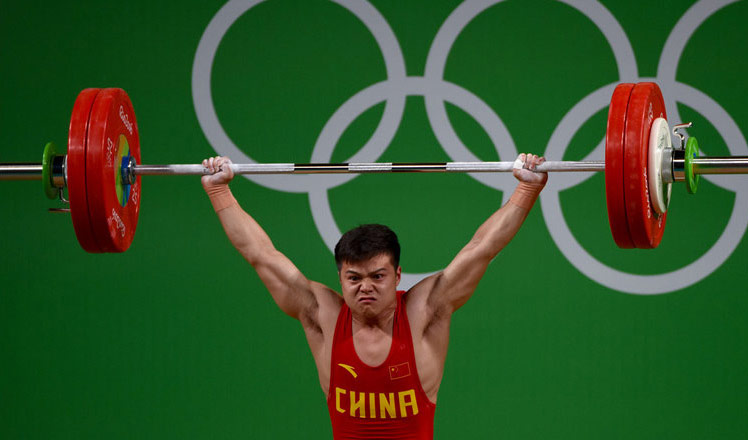

Chinese weightlifter Long smashes world record

Chinese weightlifter Long smashes world record

China wins first diving gold of Rio Games

China wins first diving gold of Rio Games

Fancy diving and mahjong at same time? No problem

Fancy diving and mahjong at same time? No problem

Qingdao delights taste buds with seafood delicacies

Qingdao delights taste buds with seafood delicacies

Big names train for Rio 2016

Big names train for Rio 2016

Photo exhibition narrates charm of old Beijing

Photo exhibition narrates charm of old Beijing

Traditional Tibetan handicrafts kept alive in SW China

Traditional Tibetan handicrafts kept alive in SW China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

US Weekly

|

|