CSRC speeds up tougher backdoor listing regulations

Updated: 2016-08-06 07:41

By Cai Xiao(China Daily)

|

||||||||

|

|

Investors look at computer screens showing stock information at a brokerage in Shanghai, August 13, 2015.[Photo/Agencies] |

China's securities regulator said on Friday that it is speeding up the development of revised regulations on the major asset restructuring of listed companies, which will curb speculative backdoor listings.

Zhang Xiaojun, a spokesman of the China Securities Regulatory Commission, said that the commission is studying suggestions from the public and will promulgate the regulations later.

The CSRC sought public comments on the draft of revised regulations on the major asset restructuring of listed companies from June 17 to July 17, and is now working to finalize the rules.

The draft of the revised regulations sets out five main indexes to judge whether an acquisition is in fact a major asset restructuring.

Previously, the regulator only looked at whether the assets of the unlisted acquiring company were greater than those of the listed one.

In China, the requirements of a backdoor listing are as strict as those of an initial public offering. But, many unlisted companies sought to go public by pretending that the deal was unusual or by understating their own assets. Many deals are suspected of being a way of achieving a backdoor listing.

"The revised regulations will make such deals much more difficult to make, and the speculative activities on shell companies will be fewer," said Cao Qijia, an analyst at Zero2IPO Group.

"China's securities regulator is tightening the regulations to curb speculative backdoor listings and maintaining market stability," said an investment banker at a Chinese securities firm who declined to be named.

Cao said backdoor listing is popular in China because it is a quicker way to go public than launching an initial public offering.

As of June 30, there was a backlog of 894 companies waiting to IPOs on the A-share market.

Backdoor listing is also a good way for companies listed in the US market to go back to the Chinese capital market.

Yang Feng, founding partner and chief executive officer of Shenzhen-based Blue Ocean Capital Group, said earlier that backdoor listing is still the best way for a company to list on the A-share market, especially for those whose market value is more than 10 billion yuan ($1.54 billion).

"It is much quicker. The cost of a shell company and dilution of its own equity could prove acceptable for a big company with a market value of 10 billion yuan.

- Chinese scientists claim possible breakthrough in HIV, hepatitis cure

- Connection lost: does technology make long distance dating harder?

- Chinese firm reports record-breaking optic fiber transmission

- Travel in space poised to spread its wings

- Tibet envisioned as hub of Himalayas

- Health certificate steps reduced for foreigners

- Nepal's newly elected PM takes oath

- Texas gun law worries incoming students

- China vows to deepen economic, trade cooperation with ASEAN

- Fire guts Emirates jet after hard landing; 1 firefighter dies

- Egypt's Nobel-laureate scientist dies of illness in US

- THAAD muscle flexing unmasks anxiety over declining hegemony

Ace swimmers make record-breaking splash in Rio

Ace swimmers make record-breaking splash in Rio

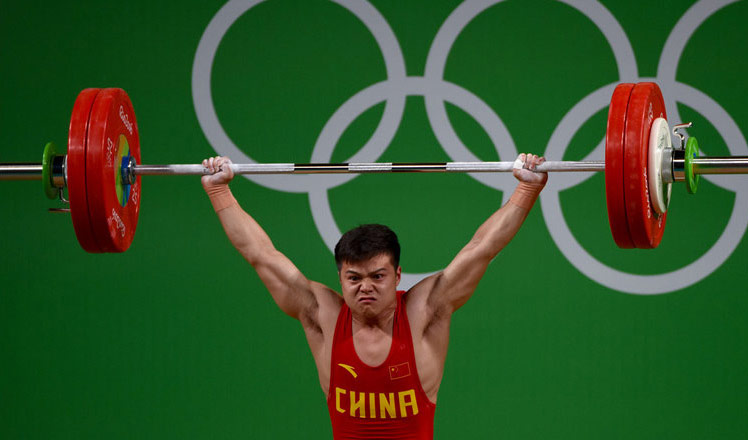

Chinese weightlifter Long smashes world record

Chinese weightlifter Long smashes world record

China wins first diving gold of Rio Games

China wins first diving gold of Rio Games

Fancy diving and mahjong at same time? No problem

Fancy diving and mahjong at same time? No problem

Qingdao delights taste buds with seafood delicacies

Qingdao delights taste buds with seafood delicacies

Big names train for Rio 2016

Big names train for Rio 2016

Photo exhibition narrates charm of old Beijing

Photo exhibition narrates charm of old Beijing

Traditional Tibetan handicrafts kept alive in SW China

Traditional Tibetan handicrafts kept alive in SW China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

US Weekly

|

|