WeChat Pay launches No Cash Day, heats up payment war in China

Updated: 2016-08-08 14:31

By Zhu Lingqing(chinadaily.com.cn)

|

||||||||

|

|

A billboard displaying various kinds of supported mobile payments is pictured in a convenience store in Shanghai, on May 31, 2016. [Photo/VCG] |

Chinese third-party payment platform WeChat Pay's mobile payment campaign reached its climax today, dubbed "No Cash Day" by the platform since last year.

From August 1-7, every day's first payment by WeChat Pay's users to any offline store, with the sign of No Cash Day, could have gotten them a random monetary reward up to 888 yuan ($133).

On August 8, when users use WeChat Pay to make payments, they can spend the accumulated money rewarded to them over the previous seven days. In addition, they have the opportunity to get a direct discount on payments.

Meanwhile, WeChat Pay's rival Alipay, the third-party payment platform of Alibaba Group Holding Ltd, plans to spend 100 million yuan on rewarding its users.

From July 20 to October 31, Alipay's users can receive a direct discount of less than 999 yuan every time they use Alipay to make payments to offline stores. All Alipay users can check the real-time balance of the original 100 million yuan on the home page of Alipay.

Both of the offline mobile payments promotion campaigns by WeChat Pay and Alipay were launched last year. The number of offline stores cooperating with WeChat Pay in the "No Cash Day" campaign has increased from 80,000 last year to 700,000 this year.

China's third-party mobile payment market scale reached 5.97 trillion yuan in the first quarter (Q1) of 2016, having a year-on-year increase of 111 percent, according to a report by Chinese research firm Analysys.

Analysys still crowned Alipay as leading the mobile payment market, occupying 63.41 percent of the market share in Q1 this year, while Tencent Holdings Ltd's Tenpay ranked second with 23.03 percent of the market share.

As an in-app payment feature of Tencent's WeChat, a messaging and social networking app, WeChat Pay was launched by both WeChat and Tenpay in August, 2013. It contributed 84 percent of Tenpay's mobile payment market share in Q1 this year.

Although it was Alipay which first launched the mobile payment function in China in 2012, the generalization of no cash payments was originally boosted by WeChat Pay, according to a report by donews.com.

During the Spring Festival of 2013, WeChat Pay successfully used the Chinese tradition of sending red envelopes containing money as blessings to promote mobile payment to the masses.

The post-90 generation, and workplace freshmen aged between 23 to 29 years, are the main force driving mobile payment in China, according to a report by Ipsos Group Co, a Paris-based market research group.

Accustomed to living without cash, 12 percent of respondents who were university students, said they often went out with no cash, while 35 percent of young while-collar workers said they often went out with a maximum 100 yuan in cash.

Ipsos said China's third-party mobile payment market reached ten trillion yuan in 2015.

- Chinese scientists claim possible breakthrough in HIV, hepatitis cure

- Connection lost: does technology make long distance dating harder?

- Chinese firm reports record-breaking optic fiber transmission

- Travel in space poised to spread its wings

- Tibet envisioned as hub of Himalayas

- Health certificate steps reduced for foreigners

- Nepal's newly elected PM takes oath

- Texas gun law worries incoming students

- China vows to deepen economic, trade cooperation with ASEAN

- Fire guts Emirates jet after hard landing; 1 firefighter dies

- Egypt's Nobel-laureate scientist dies of illness in US

- THAAD muscle flexing unmasks anxiety over declining hegemony

Ace swimmers make record-breaking splash in Rio

Ace swimmers make record-breaking splash in Rio

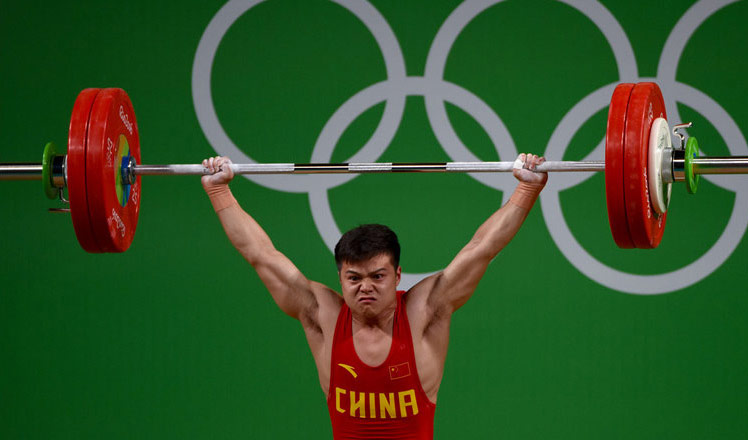

Chinese weightlifter Long smashes world record

Chinese weightlifter Long smashes world record

China wins first diving gold of Rio Games

China wins first diving gold of Rio Games

Fancy diving and mahjong at same time? No problem

Fancy diving and mahjong at same time? No problem

Qingdao delights taste buds with seafood delicacies

Qingdao delights taste buds with seafood delicacies

Big names train for Rio 2016

Big names train for Rio 2016

Photo exhibition narrates charm of old Beijing

Photo exhibition narrates charm of old Beijing

Traditional Tibetan handicrafts kept alive in SW China

Traditional Tibetan handicrafts kept alive in SW China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

US Weekly

|

|