Anbang hunts for new deals while digesting old ones

Updated: 2016-09-08 07:25

(China Daily)

|

||||||||

|

|

An employee helps a guest with his bags at the Waldorf Astoria, Anbang's New York hotel. [Photo provided to China Daily] |

Anbang Insurance Group Co will focus on integrating its overseas purchases such as South Korea's Tongyang Life Insurance Co as it continues to seek acquisitions, Vice-Chairman Yao Dafeng said in an interview on Tuesday.

The acquisitions will mostly cover insurers and banks, Yao said.

"We want to build up the existing synergies a bit first, and consider new deals when appropriate opportunities emerge," Yao said. "You can't just keep buying everyday. You need to also digest and absorb."

Anbang, founded in 2004, has been at the forefront of a record wave of overseas acquisitions by Chinese companies as the world's second-largest economy cools. The insurer, which has amassed assets across the US, Europe and Asia, is now preparing an initial public offering in Hong Kong of its life insurance operations.

The proposed IPO is part of efforts by Anbang to better integrate itself into the global community as an "open and transparent" player, said Yao.

Anbang folded four of the companies it acquired into the life unit last year. They include Tongyang Life, Dutch insurer Vivat, Belgium lender Nagelmackers and insurer Fidea NV, according to the unit's 2015 annual report. Net income at the consolidated division more than doubled from the previous year to 19.6 billion yuan ($2.9 billion), while assets surged more than sevenfold to 921.6 billion yuan, according to the report.

"Those consolidated numbers are just the technical aspect, and a very small part" of benefits such acquisitions have brought Anbang, Yao said. "From the strategic and market competition point of view, our global deployment is taking shape."

Some of the acquired companies are already benefiting as Anbang has started started integrating them. Tongyang Life posted its best results since its establishment in 1989 in the first half of this year, with premiums income jumping 91 percent mainly thanks to a new pension insurance product designed with Anbang's help, Yao said.

Vivat reported a tenfold profit jump for the same period, after management strategies "exported" from Anbang helped reduce costs and improve efficiency, he added.

Bloomberg

- British parliament to debate second Brexit referendum petition

- Chinese women find their way through the glass ceiling

- Rousseff leaves presidential residence in salutation

- Thousands of Chinese rally in Paris to call for 'security for all'

- Xi tells Park China opposes deployment of THAAD in ROK

- Singapore confirms 27 new cases of Zika infection

Street-straddling bus continues tests

Street-straddling bus continues tests

British man falls for ancient Jiangxi village, buys property

British man falls for ancient Jiangxi village, buys property

Post-90s property beauty's daily life

Post-90s property beauty's daily life

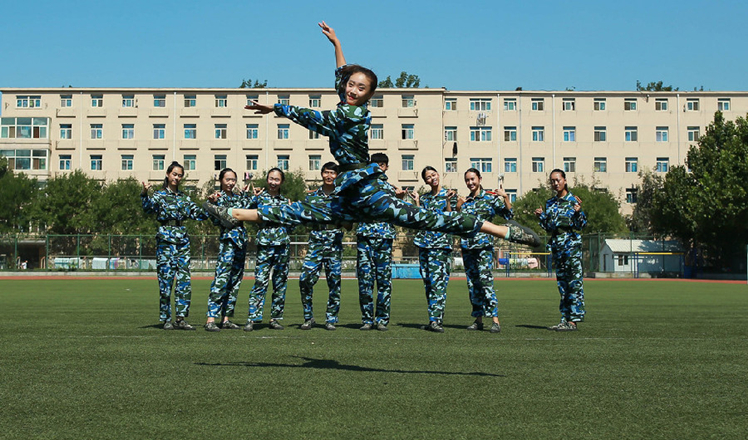

Freshmen show dance skills during military training

Freshmen show dance skills during military training

Premier to announce new initiatives while in Laos

Premier to announce new initiatives while in Laos

First Ladies shopping in Hangzhou

First Ladies shopping in Hangzhou

Flower children greet world leaders in Hangzhou

Flower children greet world leaders in Hangzhou

World's largest transparent-domed bar under construction

World's largest transparent-domed bar under construction

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|