Chinese companies 'need to reduce leverage'

Updated: 2016-09-09 08:06

By Jiang Xueqing(China Daily)

|

||||||||

A recent JPMorgan report recommended that Chinese firms raise external equity and improve operational efficiency to rebalance their long-term capital structures.

The report, released on Wednesday, found that Chinese firms are some 50 percent more leveraged than their global counterparts. These companies have only a third or less of their debt in the form of bonds, compared with firms in the other global markets that have 80 to 90 percent of their debt in bonds. A greater reliance on loans may be restrictive in terms of market capacity, tenor and covenants, although loans are often associated with lower interest rates.

Moreover, Chinese firms have a lot more short-term debt than their global peers. The weighted average debt maturity is 1.9 years for firms listed in Shanghai and Shenzhen versus about nine years for large US firms.

"Short-term debt compared with the long-term is more likely to be exposed to refinancing risk and similar liquidity issues. If you believe that the western approach at the moment is appropriate, then you would definitely want to equitize to a greater extent in a number of industries. That means the debt-to-equity swap may be one option, or the only one, they have available," said Marc Zenner, global co-head of JPMorgan's Corporate Finance Advisory.

To bring their balance sheets in line with global peers, Chinese firms might need to raise more than 5 trillion yuan ($751 billion)-about 17 percent of their market capitalization-in equity to deleverage, and issue more than 5 trillion yuan of bonds to reduce their reliance on loans, as well as to extend debt maturities, the report said.

Another noteworthy point is the Chinese firms currently have lower return-on-equity, a measure of profitability, than their global peers. In China, ROEs have fallen by roughly one third in the past four years, compared with more modest declines of about 15 percent in the US and Germany.

The report advised Chinese firms to enhance operational efficiency to achieve lower leverage and to generate sufficient cash flow so that more long-term growth can be financed through internal equity.

- British parliament to debate second Brexit referendum petition

- Chinese women find their way through the glass ceiling

- Rousseff leaves presidential residence in salutation

- Thousands of Chinese rally in Paris to call for 'security for all'

- Xi tells Park China opposes deployment of THAAD in ROK

- Singapore confirms 27 new cases of Zika infection

Unforgettable moments of Premier Li at ASEAN meeting

Unforgettable moments of Premier Li at ASEAN meeting

Six policy signals China sent at G20 Summit

Six policy signals China sent at G20 Summit

'First Lady table ware' a hit in Hangzhou

'First Lady table ware' a hit in Hangzhou

Paralympics opens in Rio

Paralympics opens in Rio

Street-straddling bus continues tests

Street-straddling bus continues tests

British man falls for ancient Jiangxi village, buys property

British man falls for ancient Jiangxi village, buys property

Post-90s property beauty's daily life

Post-90s property beauty's daily life

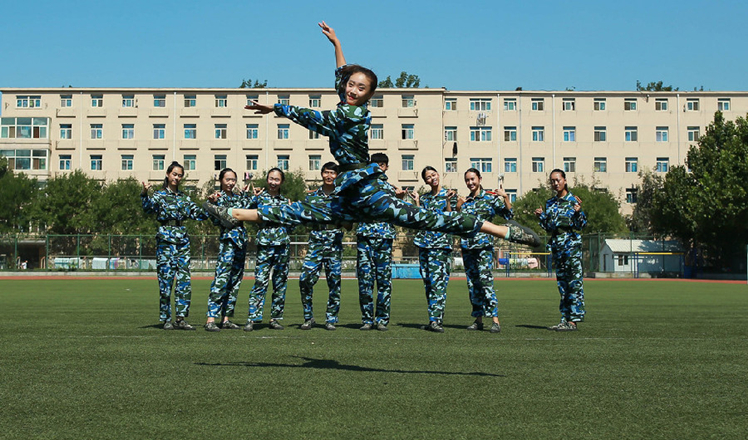

Freshmen show dance skills during military training

Freshmen show dance skills during military training

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|