Central bank sets midpoint of yuan at weakest level in six years

Updated: 2016-10-10 11:26

By Wang Yanfei(chinadaily.com.cn)

|

||||||||

|

|

A clerk counts yuan bank notes and US dollar bills at a bank of the Industrial and Commercial Bank of China in Huaibei, East China's Anhui province, Nov 28, 2012. [Photo/IC] |

Midpoint of yuan set by China's central bank on Monday stood at 6.7008, the weakest level since September 2010, but economists see no further sharp depreciation of the currency after the nation's weeklong holiday.

The People's Bank of China, the central bank, sets midpoint of the currency, which is the level that the yuan can be traded within a two percent band below and above the midpoint.

Xie Yaxuan, chief economist at China Merchants Securities Co, attributed the level that fell below the psychological line 6.7 to a possible interest rate hike by the Federal Reserve by year-end, and to impact brought by sharp fluctuation of pound sterling and other major currencies against US dollar during the holiday.

"The disturbance brought by the depreciation to the financial market and economy remains limited," he said.

Xie believes that with international competitiveness of China's trade ,the exchange rate does not have fundamentals for a sharp depreciation.

The yuan joined the Special Drawing Rights basket, the International Monetary Fund's reserve currency basket, on the first day this month, raising some concerns over the likelihood for a sharp depreciation of yuan and capital flight soon after the SDR inclusion.

Li Chao, chief economist with Beijing-based Huatai Securities Co. said that the influence of inclusion of SDR upon China's exchange rate reform and foreign reserves is rather minimal.

Earlier data from the central bank shows that China's foreign exchange reserve shrank for the third consecutive month in September.

The reserve, the world's largest, stood at $3.17 trillion in September, down by $18.79 billion from August.

- World's longest sightseeing escalator awaits you in China

- More than 20 buried under collapsed buildings in Wenzhou

- Li arrives in Macao to boost ties with Portuguese-speaking countries

- Scenic spots ranked for their holiday services

- Illness raises risk of vanishing

- Jack Ma and Spielberg work together to tell Chinese stories

- Russia-US relations change fundamentally

- Trump assails Bill Clinton, vows to jail Hillary Clinton if he wins

- US Navy ship targeted in failed attack from Yemen

- Panel tackles Fox News skit on Chinatown

- Chinese tourists forced to sleep at airport for 5 days

- Saudi-led coalition denies striking funeral in Yemen's capital

The world in photos: Sept 26 - Oct 9

The world in photos: Sept 26 - Oct 9

Classic cars glitter at Berlin motor show

Classic cars glitter at Berlin motor show

Autumn colors in China

Autumn colors in China

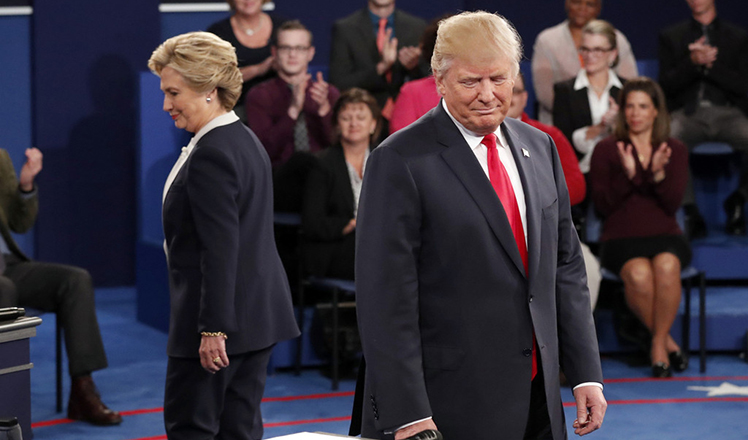

US second presidential debate begins

US second presidential debate begins

Egrets Seen in East China's Jiangsu

Egrets Seen in East China's Jiangsu

Highlights of Barcelona Games World Fair

Highlights of Barcelona Games World Fair

Coats, jackets are out as cold wave sweeps in

Coats, jackets are out as cold wave sweeps in

6 things you may not know about Double Ninth Festival

6 things you may not know about Double Ninth Festival

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

US Weekly

|

|