China Life invests in Starwood hotels

Updated: 2016-10-20 08:34

(China Daily)

|

||||||||

|

|

Pedestrians walk past the W Hotel Hollywood, owned by Star-wood Hotels& Resorts Worldwide Inc, in Hollywood, California. [Photo/Bloomberg] |

Starwood Capital Group sold a stake valued at about $2 billion in US hotels to China Life Insurance Co, extending a streak of Chinese investment in overseas lodging properties and travel-related businesses.

China Life, the country's largest life-insurance company, will be the lead investor in the properties, with sovereign-wealth funds and others also owning a piece of the 280 select-service hotels in 40 US states, Starwood said in a statement on Tuesday.

The whole portfolio is valued at more than $3 billion, according to Starwood. The Greenwich, Connecticut-based firm, which last year sold New York's luxury Baccarat hotel to another Chinese insurer, will continue to be the asset manager.

"With this select-service hotel portfolio, China Life has an efficient vehicle for investing in the United States economy," Barry Sternlicht, chairman and chief executive officer of Starwood Capital, said in the statement.

"We look forward to working with China Life on additional opportunities across a wide range of real estate asset classes in the years to come."

Chinese investors have been buying hotel and travel businesses around the world as outbound tourism surges and China's economy and wealth expand.

Anbang Insurance Group Co last month acquired 15 luxury US hotels, including New York's JW Marriott Essex House and the Westin St Francis in San Francisco, as part of a $6.5 billion purchase from Blackstone Group LP.

Anbang helped usher in a wave of Chinese investment in US hotels with its February 2015 purchase of New York's Waldorf Astoria for $1.95 billion, the highest price paid for a US hotel.

The Beijing-based company started a bidding war for Starwood Hotels & Resorts Worldwide Inc in March.

BLOOMBERG

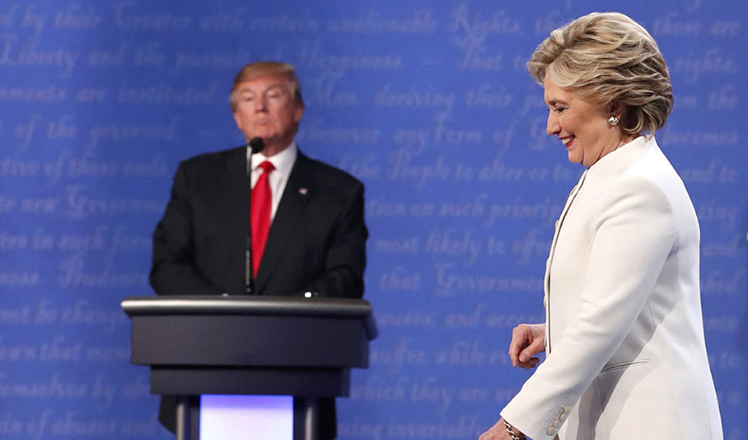

Trump refuses to say he will accept election results

Trump refuses to say he will accept election results

Top guns: Airshow China in past two decades

Top guns: Airshow China in past two decades

Street photographer captures hustle-bustle of Beijing

Street photographer captures hustle-bustle of Beijing

Five-time Olympic champion diver Chen Ruolin retires

Five-time Olympic champion diver Chen Ruolin retires

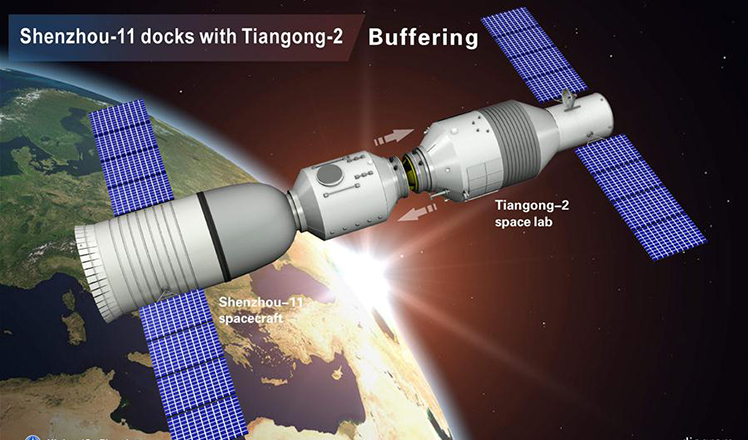

Glimpse into lifestyle of astronauts in space

Glimpse into lifestyle of astronauts in space

Shenzhou XI spacecraft docks with Tiangong-2 space lab

Shenzhou XI spacecraft docks with Tiangong-2 space lab

Typhoon Sarika makes landfall in South China

Typhoon Sarika makes landfall in South China

Handmade coarse cloth gets new shine

Handmade coarse cloth gets new shine

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

'Zero Hunger Run' held in Rome

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

US Weekly

|

|