China warns of property-related financial risks

Updated: 2016-10-24 07:59

(Xinhua)

|

||||||||

|

|

People look at a housing project near the Dianchi Lake in Kunmin, Southwest China's Yunnan province, on Oct 21, 2016. [Photo/VCG] |

China's banking watchdog has ordered strict control of financial risks related to real estate as bank loans to the sector surged.

Regulations over property loans must be rigorously implemented, and financial business related to real estate agents and developers should be conducted in a prudent manner, according to a statement on the website of the China Banking Regulatory Commission (CBRC).

Irregular inflow of loans or wealth management funds into the property sector must be banned, said the statement.

By the end of September, financial institutions in China had lent 25.33 trillion yuan ($3.74 trillion) to the property sector, up 25.2 percent year on year, central bank data show.

While the property sector has been a significant growth driver for the Chinese economy so far, policymakers have tried to prevent an asset bubble following drastic price rises in some first- and second-tier cities.

As a result of government curb policies, including purchase limits and tightened mortgage restrictions, the month-on-month price index for new homes in 15 first- and second-tier cities retreated in the first half of October from September, according to the National Bureau of Statistics.

The CBRC also urged efforts to avert risks related to local government debts and industrial sectors with excessive capacity.

Ten photos from around China: Oct 14-20

Ten photos from around China: Oct 14-20

Veterans mark 80th anniv. of end of Red Army's Long March

Veterans mark 80th anniv. of end of Red Army's Long March

Road with 24 bends zigzags in Southwest China

Road with 24 bends zigzags in Southwest China

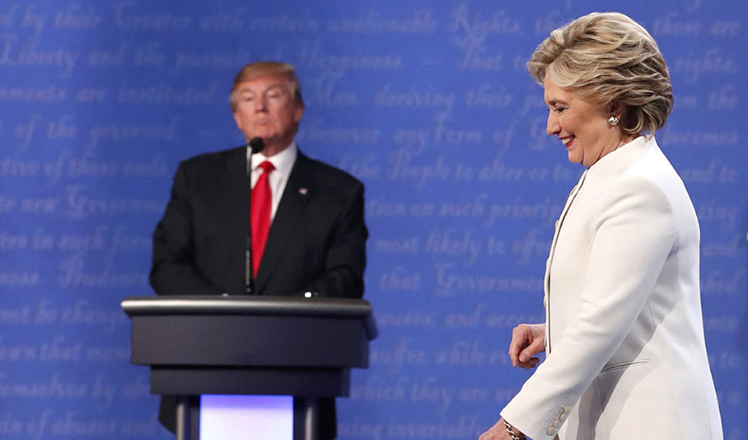

Trump refuses to say he will accept election results

Trump refuses to say he will accept election results

Top guns: Airshow China in past two decades

Top guns: Airshow China in past two decades

Street photographer captures hustle-bustle of Beijing

Street photographer captures hustle-bustle of Beijing

Five-time Olympic champion diver Chen Ruolin retires

Five-time Olympic champion diver Chen Ruolin retires

Glimpse into lifestyle of astronauts in space

Glimpse into lifestyle of astronauts in space

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

'Zero Hunger Run' held in Rome

Trump outlines anti-terror plan, proposing extreme vetting for immigrants

Phelps puts spotlight on cupping

US launches airstrikes against IS targets in Libya's Sirte

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

US Weekly

|

|