Urbanization is backbone of the booming economy

Updated: 2013-01-17 08:13

By Huang Ying (China Daily)

|

||||||||

Urban rail development, and medical and other services are likely to lead the Chinese economy in 2013, which is almost certain to be a year of greater growth than 2012 was.

They reflect the stronger-than-ever momentum in the drive for urbanization, and the government's intention to use it as the economy's main powerhouse in the coming decades.

So are the companies in these industries - so long as they deliver quality goods and services and stay away from corruption and regulatory offenses.

Urbanization has been a main factor driving the Chinese stock market, as read by the Shanghai Composite Index, to rise more than 18 percent from early December to Wednesday.

In a number of government conferences, Vice-Premier Li Keqiang said he pins high hopes on the potential of urbanization in China.

Many economists argue that urbanization will be the theme of China's change in its business and social horizon over the next decade and beyond, instead of the export-oriented industry, which no longer suffices to generate new growth due to the sluggish global market demand in the post-recession era.

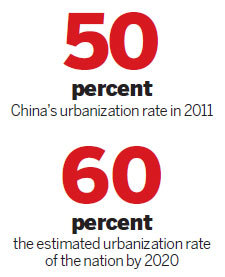

In 2011, the urbanization rate, the proportion of the people living in cities, just passed 50 percent. By 2020, the government aims to have this figure at 60 percent.

In comparison, developed economies in Europe and the United States have an urbanization rate of about 80 percent.

According to a research report by BOC International (China) Ltd, the railway industry will see many new opportunities in the development of high-speed and intercity train services.

Analysts predict the demand for railway construction will occur in the eastern part of the country before it does in the western and central regions.

Demand for transportation facilities will first emerge in first-tier cities, as they have stronger economies and are capable of launching large-scale infrastructure projects, according to CEBM Group Ltd, an independent investment advisory firm.

Urban mass transit and airport construction will have good opportunities for development even with the backdrop of an overall economic slowdown, because the government wants to relieve traffic congestion and provide better transportation services to citizens, according to Guosen Securities Co Ltd.

Liu Heming, a senior official of the Ministry of Housing and Urban-Rural Development, told chinanews.com in the middle of October that 34 cities have mapped out transportation networks stretching up to 4,300 kilometers, involving a total investment of 2 trillion yuan ($320 billion).

In the next 20 to 30 years, rapid urbanization development is expected to continue and the urban mass transit sector will experience its fastest-ever period of growth, Liu was quoted as saying.

Chen Hao, a senior executive at venture capital company Legend Capital, said in an interview with Zero2IPO Research Center that for venture capital and private equities in China, the investment opportunities next year and for an extended period will come from urbanization, and there are three sectors worth paying attention to - modern services, healthcare industries and consumer goods.

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Venezuelan court rules out manual votes counting

Venezuelan court rules out manual votes counting

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Boston bombing suspect reported cornered on boat

7.0-magnitude quake hits Sichuan

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|