Call for wise spending as SAR purse gets fatter

Updated: 2015-03-06 07:07

By Oswald Chan(China Daily USA)

|

||||||||

Review of tax laws

Various tax experts also urge that the Inland Revenue Ordinance be reviewed, in order to boost long-term economic competitiveness.

"Given the passage of time and the tremendous changes that have taken place in the manner in which businesses operate, including substantial rules governing how results of business transactions are reflected in financial accounts, we consider it appropriate to perform a further comprehensive review." EY's Hong Kong and Macao tax managing partner Tracy Ho Suk-fan argued.

Defining the sources of profits clearly is the first and foremost task. This is especially important as these days many cross-border financial and business transactions facilitated by advanced technology are increasingly blurring the lines in defining the "source of profits".

"If the Inland Revenue Department can lay down more clear guidelines on interpreting corporate profits, multinational companies can better gauge their tax burdens arising from business operations in Hong Kong. This should help in promoting Hong Kong's status as a regional corporate hub for multinationals," said PwC tax partner Agnes Wong Hill-yin.

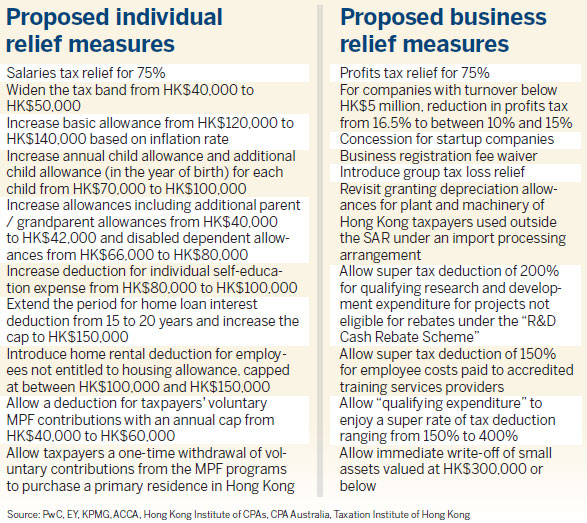

Group loss relief is the second aspect that a tax law review could focus on. ACCA recommends introducing group loss relief, where the losses of a group company can offset the taxable profits of holding companies within the group, hence reducing the company tax burden. In addition, the tax loss of a business could be allowed to be "carried back" to offset assessable profits in the preceding year.

Third, many Hong Kong enterprises currently cannot enjoy tax concessions if they operate machinery equipment or plants on the mainland, and that makes these local enterprises bear a higher effective tax rate.

"We suggest loosening Article 39E of the Inland Revenue Ordinance, so that Hong Kong enterprises with manufacturing machinery and plants can enjoy tax deductions on depreciation," PwC's Wong added.

KPMG highlighted that the government should also review the current principle of territoriality in tax collection; as the accounting firm believes it is hurting Hong Kong's competitiveness.

Under the principle of territoriality, corporate profit taxes will be assessed based on incomes derived from economic activities in Hong Kong. However, many countries adopt the principle of residency in tax collection where taxes are levied according to the company's resident status.

"Because the Hong Kong tax authority exempts from tax enterprises' incomes derived outside Hong Kong, tax authorities in other jurisdictions will not grant other tax concessions to these enterprises, which means these multinationals find it difficult to gauge their tax burdens arising from global business operations," KPMG tax principal Stanley Ho Ki-fai said.

Apart from tax law revision, the government is also being called upon to establish a strategic unit so that the competitiveness of the Hong Kong tax regime can be proactively fortified.

"Many Western countries have done a lot to enhance their tax regime transparency so that corporations can accurately estimate their tax costs. Asian nations have also introduced many tax concessionary policies to attract more investment. Hong Kong needs to be more responsive to major developments in international and regional tax and bolster its tax regime stability," said Chan at the Hong Kong Institute of CPAs.

Contact the writer at oswald@chinadailyhk.com

Living amid the mountains

Living amid the mountains

Plane skids off LaGuardia runway during snowstorm in NYC

Plane skids off LaGuardia runway during snowstorm in NYC

The Legend of Mulan told at Lincoln Center

The Legend of Mulan told at Lincoln Center

Six things you may not know about Awakening of Insects

Six things you may not know about Awakening of Insects

Top 10 favorite gift brands of rich Chinese men

Top 10 favorite gift brands of rich Chinese men

Buddha statue with mummified monk is museum draw

Buddha statue with mummified monk is museum draw

Across Canada March 4

Across Canada March 4

Seven things you may not know about Lantern Festival

Seven things you may not know about Lantern Festival

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Birthing centers mum after raid in California

4 Chinese students look to take 'risk'

China likely to maintain 7% growth for 20 years

China's top two train makers to merge

Finance Minister: no spending spree

US fails to grasp China's terror laws

Militaries' cooperation 'key' in ties

China, California address climate, energy issues

US Weekly

|

|