China investors seeking refuge in foreign markets

Updated: 2015-08-29 05:00

By WU YIYAO in Shanghai(China Daily USA)

|

|||||||||

Chinese investors are looking to reallocate assets to overseas markets in a bid to retain their value amid stock market fluctuations and sharp devaluations of the renminbi, according to a report released by Forbes China on August 24.

Market insiders also said that US-dollar denominated equities and bonds are among the most popular investment items as the currency has appreciated against China’s renminbi, alongside gold and properties, in global gateway cities.

The Forbes report, which polled 1,149 Chinese investors with net assets of up to 1 million US dollars, indicated a change in investors’ tolerance levels for risks and yield preferences, with more people now favouring low-risk products. About 88.4 percent of respondents said they are seeking products with low to medium risk levels as compared to only 11.6 percent who stated they would target high risk investments.

Shanghai-based Wang Shunying is one such investor. The 31-year-old had earlier this month sold all her stocks in the A-share market to minimise her losses. She also sought the advice of three consultants who specialize in overseas market investments.

“I may come back to the Chinese stock market when it has stabilized, but right now have I just learned a lesson — do not put all your eggs in the same basket. It is really important to diversify risks by investing in various kinds of products and in different markets,” said Wang.

About 46.5 percent of the Chinese investors surveyed said they are investing in markets outside China to diversify their risks. It was a different story just two years ago, when the majority of local investors were looking at annual yields of up to 20 percent from investments such as trash bonds, said Lin Caiyi, chief economist at Guotai Junan Securities in Shanghai.

“The higher the yield, the higher the risk. Investors have learned this notion and their interests have been shifting towards more stable and safer items, which may help offset inflation. Given the current consumer price index and the yuan’s devaluation against the US dollar, annual yield of some 5 percent is already a quite reasonable return,” said Lin.

The report stated that the property market is experiencing change too, as more people are now looking to invest in commercial projects — such as buying a share in a hotel, shopping mall or a pensioner’s home — instead of just focusing on residential developments. Initially, Chinese investors were apprehensive about looking for overseas investments opportunities due to a lack of knowledge and limited access to international markets but the situation is now changing, according to research by Manulife-Teda Fund Management Co Ltd.

“Wider exposure to global markets have boosted the appetite for global investments in Chinese investors who are well travelled,” added Yuan Yue, president of Horizon China, a leading survey and research company.

He Mei, Chief Executive Officer at Overseas & Consultancy Co Ltd, which provides advice to investors seeking opportunities in the global market, echoed this sentiment, saying that overseas markets no longer seem intimidating to a growing number of Chinese investors who have become global citizens.

“This trend will certainly change investors’ preferences — they now have a much wider range of choices, not only in terms of categories but also in geographical span. An investor who made his first property purchase in US as part of preparations for his son’s overseas education may later decide to purchase some euro-denominated stocks. Once he takes the first step, he will soon walk far beyond,” Yuan added.

Bolt 'somersaults' after cameraman takes him down

Bolt 'somersaults' after cameraman takes him down

A peek into daily drill of ceremonial artillery unit

A peek into daily drill of ceremonial artillery unit

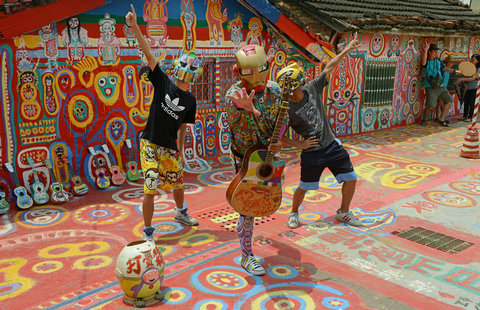

93-year-old's murals save Taiwan's 'Rainbow Village'

93-year-old's murals save Taiwan's 'Rainbow Village'

Top 8 novel career choices in China

Top 8 novel career choices in China

Hairdos steal the limelight at the Beijing World Championships

Hairdos steal the limelight at the Beijing World Championships

Chorus of the PLA gears up for Sept 3 parade

Chorus of the PLA gears up for Sept 3 parade

Iconic Jewish cafe 'White Horse Coffee' reopens for business

Iconic Jewish cafe 'White Horse Coffee' reopens for business

Beijing int'l book fair opens new page

Beijing int'l book fair opens new page

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Surviving panda cub at National Zoo is male

China eases rules for foreigners to buy property

Ministry denies troops sent to reinforce DPRK border

Stem cell donor offers ray of hope for US boy with leukemia

All creatures great and small help keep V-Day parade safe

China not the only reason global stock markets are in a tailspin

Market woes expected to delay Fed hike

Gunman had history of workplace issues

US Weekly

|

|