Investment expert banks on leading edge

Updated: 2016-05-20 11:37

(China Daily USA)

|

|||||||||

|

Hu Zhanghong said CCB International will aim to strengthen its asset management services and explore emerging opportunities related to the Belt and Road Initiative and internationalization of the renminbi. Edmond Tang / China Daily |

Emerging industries are a top priority as CCB International builds on its reputation as an investment services frontrunner, Chairman and Chief Executive Hu Zhanghong tells Sophie He.

CCB International is doing very well in Hong Kong and will actively look for business opportunities from emerging industries and companies on the Chinese mainland, said Hu Zhanghong, chairman and chief executive of the investment institution.

Hong Kong-headquartered CCB International is wholly owned by China Construction Bank Corp, and its services include sponsoring and underwriting, financial advisory services, corporate mergers and acquisitions (M&As), as well as restructuring, asset management, direct investment securities brokerage and investment consultancy, Hu told China Daily.

"Our core business has been performing very well in Hong Kong. (Take) our initial-public-offering (IPO) service, for instance. According to (financial analysts) Dealogic, CCB International in 2015 was the book runner for 18 IPOs and that makes us No 1 among the world's top investment institutions in Hong Kong."

CCB International's corporate mergers and acquisitions drive is also doing well, thanks to the "going overseas" strategy of Chinese enterprises, Hu pointed out.

CCB International has a competitive edge over its Chinese and foreign peers alike, as it is more familiar with the local market, Hu noted.

During the past decade, most of the companies that came to Hong Kong looking for services from investment banks have been from the Chinese mainland. CCB International understands Chinese mainland companies, and its ability to provide comprehensive financial services is envied by foreign investment banks, Hu claimed.

CCB International is among the few mainland investment managers that can boast international networks, which is quite an advantage, Hu said.

Hu said that the mainland economy is obviously undergoing restructuring, on a scale that has never been seen by the world before. During the structural optimization, many opportunities have presented themselves.

"We've seen many newly emerged industries and a lot of great companies. As an investment institution, we want to seize business opportunities, to invest in these companies and to be able to grow together with these companies."

He pointed out that healthcare, logistics, high-tech and high-end manufacturing are among the sectors that have stood out during the Chinese economic restructuring.

"From the structure of our organization to the allocation of our resources, CCB International is actively searching for business opportunities from these sectors. We believe there will be many national and even world-class enterprises emerging from these sectors," Hu said.

M&A expertise

He explained that in terms of seizing business opportunities, CCB International will undertake the role of financial consultant for these companies, helping them solve developmental problems.

"We have also set up various funds, we have direct investment in Hong Kong as well as asset management products to help these companies meet their capital demands," Hu said.

There are also great business opportunities related to the latest round of Chinese companies' overseas M&A, he noted, adding that here too CCB International undertakes the role of financial advisor.

"The latest round of M&A is quite different from what we've seen before. Mainland companies used to acquire resources when they participated in overseas M&A, but recently, aside from acquired resources, we've seen that Chinese companies are interested in bringing back advanced technologies," he explained.

"We've seen some consumer companies bring back new driving forces for themselves through acquisitions of foreign technologies. Some even acquired top-tier foreign companies in their field."

Hu said that during overseas M&A, CCB International usually advises Chinese companies to pay special attention to valuation of the assets or company they are acquiring.

It would also remind the companies to consider whether the technology they want to buy could be applied on the Chinese mainland.

- Russia to build first cruise liner in 60 years

- LinkedIn, Airbnb match refugees with jobs, disaster survivors with rooms

- Duterte 'willing to improve ties' with Beijing

- Canadian PM to introduce transgender rights bill

- Hillary Clinton says her husband not to serve in her cabinet

- New York cake show designs fool your eyes

China Daily, celebrating 35 years

China Daily, celebrating 35 years

Six things you may not know about Grain Buds

Six things you may not know about Grain Buds

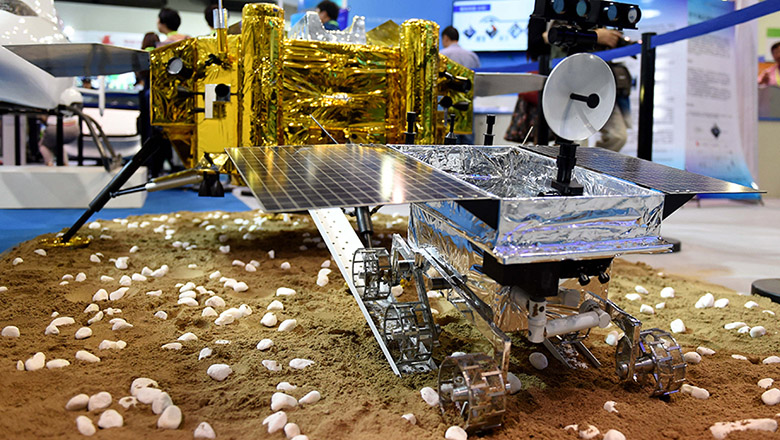

China Beijing International High-tech Expo

China Beijing International High-tech Expo

Highlights at Google I/O developers conference

Highlights at Google I/O developers conference

Nation celebrates International Museum Day

Nation celebrates International Museum Day

Body brushwork creates vivid animals

Body brushwork creates vivid animals

Can you still recognize these cities?

Can you still recognize these cities?

A private museum owner's devotion to cultural protection

A private museum owner's devotion to cultural protection

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|