Global growth main agenda of G20 ministers' meeting this weekend

Updated: 2016-07-22 10:37

By Wang Yanfei(chinadaily.com.cm)

|

||||||||

Measures to boost global growth amid rising uncertainties will be the focus when G20 ministers meet this week in Chengdu, Sichuan province.

Policy response to Brexit is expected to be one of key issues to be discussed during the meeting, as the referendum result would add long-term uncertainties to the faltering global economy, according to Lian Ping, chief economist with Bank of Communications.

G20 Finance Ministers and Central Bank Governors Meetings, which are scheduled to be held in Chengdu, Sichuan province on Saturday and Sunday are the first minister-level financial meeting held after the British referendum.

Central bankers and financial ministers are expected to reiterate the importance of providing sufficient liquidity to avoid market volatility, to support globalization of trade and investment, and to refrain from competitive devaluation, according to a report by China International Capital Corp (CICC) released earlier this week.

The CICC report followed earlier argument made by Gerry Rice, director of Communications Department with International Monetary Fund, who stressed the importance of decisive policies at a news conference last week, and that there should be something we would expect the G-20 to be seized off in regard of potentially negative impact on growth for the global economy.

G20 ministers have reached the agreement to enhance coordination of policy making and to inform one another of policy decisions that could lead to currency devaluation during the G20 meeting held in Shanghai in February.

As for whether China would devalue the currency, the report said that China would not trigger the currency war to squash global demand that remains to be weak, despite short term depreciation pressure exists.

Policy makers would stress the importance of structural reform, to use multiple tools to strengthen growth and to enhance financial sector reform, the report said.

- Turkey's Erdogan declares state of emergency after coup bid

- US sues to seize $1 bln in assets tied to Malaysian state fund

- Most Americans oppose Trump's immigration proposals: Gallup

- Mali extends state of emergency amid violence

- Grace, style and power: Theresa May's cabinet members

- Stenin Photo Contest announces winners of online voting

Heavy rain, floods across China

Heavy rain, floods across China

Super-sized class has 3,500 students for postgraduate exam

Super-sized class has 3,500 students for postgraduate exam

Luoyang university gets cartoon manhole covers

Luoyang university gets cartoon manhole covers

Top 10 largest consumer goods companies worldwide

Top 10 largest consumer goods companies worldwide

Taiwan bus fire: Tour turns into sad tragedy

Taiwan bus fire: Tour turns into sad tragedy

Athletes ready to shine anew in Rio Olympics

Athletes ready to shine anew in Rio Olympics

Jet ski or water parasailing, which will you choose?

Jet ski or water parasailing, which will you choose?

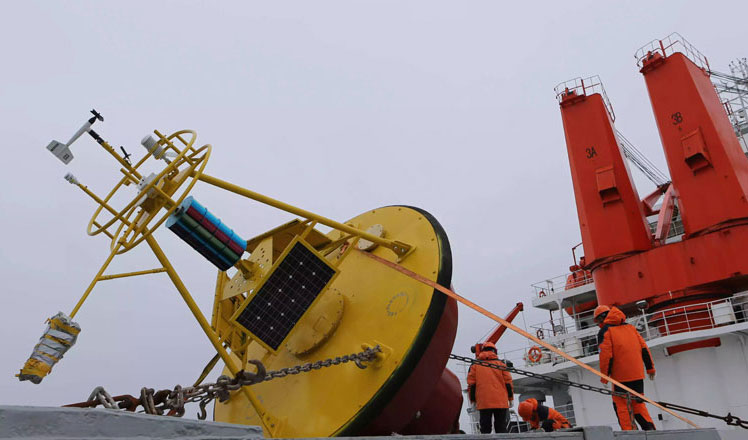

Icebreaker Xuelong arrives at North Pacific Ocean

Icebreaker Xuelong arrives at North Pacific Ocean

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Ministry slams US-Korean THAAD deployment

Two police officers shot at protest in Dallas

Abe's blame game reveals his policies failing to get results

Ending wildlife trafficking must be policy priority in Asia

Effects of supply-side reform take time to be seen

Chinese State Councilor Yang Jiechi to meet Kerry

Chinese stocks surge on back of MSCI rumors

Liang avoids jail in shooting death

US Weekly

|

|