Wealthy Chinese turn to high-profile art purchases as investments

Updated: 2016-04-27 14:12

(chinadaily.com.cn)

|

||||||||

Wealthy Chinese are splashing big on foreign art pieces in recent years, marking a trend in art collecting becoming a major portion of their global assets.

During the just concluded Art Basel Hong Kong, many wealthy Chinese from the mainland nabbed contemporary pieces from all over the world with prices ranging from tens of thousands to millions of US dollars. This is a great cause of excitement for art galleries and artists, and David Zwirner Gallery from USA is already looking to locate a branch in Hong Kong, according to 21st Century Business Herald.

In recent years, Chinese moguls like Wang Jianlin, Wang Zhongjun and Liu Yiqian are splashing money in purchasing European art masters' works, including those by Pablo Picasso and Amedeo Modigliani, which has aroused the art world's attention.

The 21st Century Business Herald says that the scene makes people think of the time in the mid-80s when wealthy Japanese were pursuing masterpieces of the Impressionists. At that time, Japan's economy reached its peak with its cars and machines exported worldwide. The Japanese yen appreciated all of a sudden and lots of Japanese people went abroad and traveled overseas. Wealthy people and enterprises also splashed out abroad to purchase art pieces.

Today's China is quite like Japan at that time. But the problem is, after that, Japan's economy had been in recession due to the bursting of the asset bubble, and the art market broke too. Will China experience a similar situation, or avoid the decline?

Well, China is different from Japan in three main aspects. First, China has a much larger population which means a huge domestic market. Second, China has more a diversified and multi-leveled industrial system. Third, China has many resources and a powerful government which may save the dangerous situation caused by an asset bubble if it happens.

- EU pledges 20 mln euros to nuclear safety fund

- DPRK seems set to launch Musudan ballistic missile

- Austria far right freezes out coalition in presidency race

- Chernobyl's 30th anniversary: Living under radiation

- S. Korea denounces DPRK's missile test

- Saudi-led coalition says kills more than 800 al-Qaida militants in Yemen

Human-like robots say 'hi' to President Xi

Human-like robots say 'hi' to President Xi

Animals turn savvy earners from entertainers

Animals turn savvy earners from entertainers

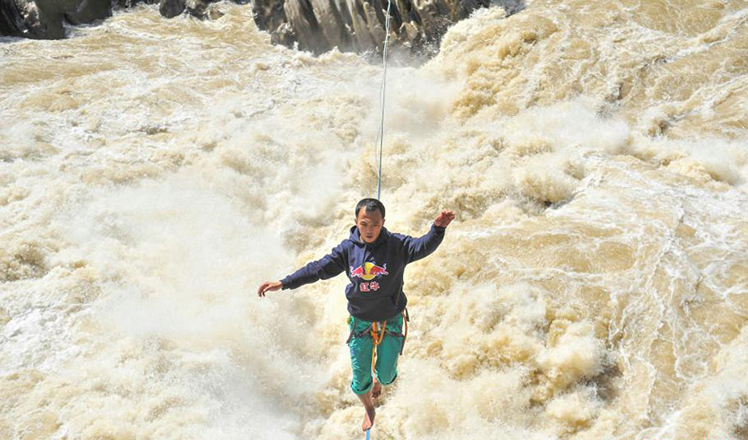

Slackline walker conquers Tiger Jumping Gorge

Slackline walker conquers Tiger Jumping Gorge

Top 6 domestic new-energy vehicles at Beijing auto show

Top 6 domestic new-energy vehicles at Beijing auto show

30th anniversary of the Chernobyl nuclear disaster marked

30th anniversary of the Chernobyl nuclear disaster marked

Shanghai unveils Disney-themed plane and station

Shanghai unveils Disney-themed plane and station

Hebei's poverty-stricken village gets new look after Xi's visit

Hebei's poverty-stricken village gets new look after Xi's visit

Cooks get creative with spring food exhibition in central China

Cooks get creative with spring food exhibition in central China

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Liang avoids jail in shooting death

China's finance minister addresses ratings downgrade

Duke alumni visit Chinese Embassy

Marriott unlikely to top Anbang offer for Starwood: Observers

Chinese biopharma debuts on Nasdaq

What ends Jeb Bush's White House hopes

Investigation for Nicolas's campaign

Will US-ASEAN meeting be good for region?

US Weekly

|

|