Firms chase overseas deals

Updated: 2013-01-08 07:56

By Du Juan (China Daily)

|

||||||||

|

A drilling platform developed by CNOOC Ltd, China's largest offshore oil producer. The Canadian government earlier approved the Chinese company's acquiring Canadian energy counterpart Nexen Inc. The volume of China's outbound M&As in the oil and gas industry reached $34.5 billion with 35 deals by Dec 13, 2012. Hu Qingming / For China Daily |

Global economic woes have boosted outbound mergers and acquisitions by Chinese companies to a new high in 2012, reports Du Juan.

China's outbound mergers and acquisitions reached a record high in 2012 as companies and investors continued to seek opportunities abroad, especially in the energy and resources sectors.

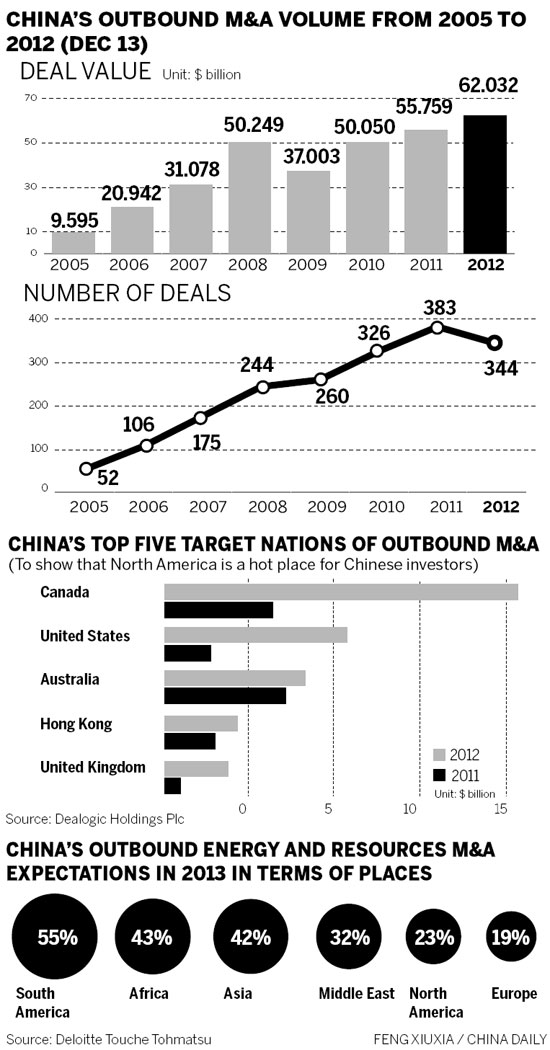

The country's total outbound M&A volume was $59.7 billion from January to Dec 13, up 23 percent from the previous year, and accounted for 7 percent of the global cross-border M&A volume in 2012, according to statistics from Dealogic Holdings PLC, an international financial-data provider.

In contrast, China-targeted M&A volume fell 7 percent year-on-year to $167.1 billion this year.

"The weak global economy has provided Chinese companies a good chance to purchase foreign assets in order to expand their overseas businesses," said Lin Boqiang, director of the Xiamen-based China Center for Energy Economic Research. "The timing is good for overseas acquisitions, especially in the high-capital energy industry."

The bulk of China's overseas investments continued to be within the energy and resources industries, reflecting its growing appetite for raw materials.

The volume of China's outbound M&As in the oil and gas industry reached $34.5 billion with 35 deals by Dec 13. That was 55.5 percent of the overall deal volume, up 20.6 points compared with the previous year, according to data from Dealogic.

After the oil and gas industry, finance, mining, leisure and utilities were the top five target sectors for Chinese companies.

They spent up to $20.7 billion in M&A deals in Canada, which made it the largest target nation of China's outbound M&As for the first time in 2012, boosted by CNOOC Ltd's $18.2 billion acquisition of Nexen Inc.

"It is a trend for Chinese oil companies to buy more overseas assets," said Liao Na, information director at energy consultancy ICIS C1 Energy.

"The CNOOC-Nexen deal will help China get into the North Sea area, which will lead to gradually increasing participation in the international oil-pricing market."

China's appetite for foreign energy and resources assets has remained strong over the period, accounting and consulting firm Deloitte Touche Tohmatsu said in a report.

In 2005, just 10 China outbound energy and resources deals were announced. In 2008, the number had grown to 34, and over the first nine months of 2012, 39 such transactions had come to market, it said.

China has spent $44.8 billion on purchasing Canada's assets since 2005, while $42.8 billion was spent buying Canadian energy and resources targets, Deloitte said.

In addition to the CNOOC-Nexen deal, Asia's biggest oil producer PetroChina Co Ltd, said it would purchase a 49.9 percent stake in Encana's Duvernay shale gas field in Canada last month. Sinopec Group had acquired a 49 percent stake in the United Kingdom subsidiary of the Canada-based Talisman Energy Inc for $1.5 billion.

The United States was listed as the second-biggest target nation of China's outbound M&As in 2012, with more than $10 billion in deal volume, nearly triple what it was in 2011.

Analysts said North America might become a new hot spot for Chinese energy investors.

"A key reason for the success of the CNOOC-Nexen deal is that the international energy scale has changed because the US is becoming increasingly independent in energy supply thanks to its unconventional natural-gas development," Lin said. "Thus, the US' dependence on Canadian energy resources is declining, which has created opportunities for closer China-Canada cooperation in the energy sector."

However, Liao said he believes that South Africa, Australia and the Middle East will continue to be major investment destinations for Chinese energy players.

The increasing participation of private capital is another trend of China's outbound M&As.

For the first nine months of 2012, 62.2 percent of the outbound M&A deals involved private companies, the first time that private companies' deals outnumbered those of State-owned enterprises, according to He Zhenwei, deputy secretary-general of the China Industrial Overseas Development & Planning Association.

"In the past four years, the number of the private companies' overseas M&As has kept increasing," He said.

Dalian Wanda Group Co Ltd last year completed its $2.6 billion acquisition of AMC Entertainment Holdings Inc, the world's second-largest theater chain, marking the first time Wanda has expanded its businesses overseas.

The deal is the largest outbound M&A of a Chinese private company on the record and was the third-largest deal in 2012.

To gain well-established brands and advanced technology in developed countries is the key strategy to become outstanding in the fierce domestic competition for Chinese companies, according to a report by US-based research firm Rhodium Group. The financial crisis and the Eurozone debt crisis have led to lower valuations of the foreign assets, which made the outbound M&A deals more attractive than domestic ones for Chinese buyers.

Moreover, the Chinese manufacturing companies can create a higher value by investing directly in foreign countries that are also their target markets.

(China Daily 01/08/2013 page17)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|