Solar industry seeks light at end of tunnel

Updated: 2013-01-14 05:49

By Du Juan (China Daily)

|

||||||||

|

Workers checking the quality of solar panels at a PV solar factory in Jiangsu province. For the Chinese solar industry, the path to its largest overseas market - Europe - is increasingly narrowing because the European Union has started anti-dumping and anti-subsidy investigations on made-in-China solar products. Provided to China Daily |

Trade disputes causing damage to all and bringing about big changes

The solar trade disputes between China and Europe triggered increasing attention globally in 2012 and will continue to bring deep changes to the industry.

"The trade conflicts in the photovoltaic solar industry between China and Europe should end as soon as possible because it is bad for everyone," said Reinhold Buttgereit, secretary-general of the European Photovoltaic Industry Association.

He made the comment to China Daily during the 2012 Intersolar China Conference in December, one month after Europe initiated an anti-subsidy investigation on solar panels imported from China, in addition to the anti-dumping probe it launched in early September.

He said the association had suggested the European Union should accelerate the investigations into China's PV solar products.

"I hope this conflict won't take too long to come to an end because we will have to cooperate again eventually, no matter who wins," said Buttgereit.

Because Europe is China's largest overseas market for PV solar panels, accounting for more than 70 percent of the country's exports, the anti-dumping and anti-subsidy investigations started by the EU could hurt the Chinese solar industry more severely than a US probe launched in October.

About one year after the United States' arm of the Germany-based company SolarWorld AG complained that Chinese producers were dumping solar products at below the cost of production in the US and receiving "illegal" government subsidies, the US decided in November to impose punitive tariffs on Chinese PV solar products, with the highest one at about 250 percent, over the next five years.

Around 20 percent of China's PV solar panels were exported to the US market before the ruling was announced.

The tariffs will raise costs for Chinese solar panel manufacturers, leading to a decline in orders from the US.

Chinese companies hoped to rely on other overseas markets when they had to relinquish business in the US so the EU's probe came as bad news and has aroused serious concerns within China's solar industry.

"This is the third time that I have been in China," said Buttgereit. "I can feel that people from Chinese companies and my Chinese colleagues are more nervous than the last two times when I visited China under the current intense situation."

China launched an investigation on Nov 1 into polysilicon imports from the EU and on Nov 5 China lodged a complaint with the World Trade Organization regarding local content requirements in some EU countries.

Some Chinese experts said the moves were mere posturing.

"The trade war is bad for everyone no matter whether it's foreign countries or China," said Li Junfeng, deputy director at the Energy Research Institute under the National Development and Reform Commission.

He said the trade war acts against the principles of the solar industry, which aims to reduce the cost of renewable energy for sustainable development in the long term.

The Coalition for Affordable Solar Energy, an organization of American solar companies representing about 98 percent of the US solar industry jobs, believes free trade and industry competition are critical to making solar electricity affordable for everyone.

After the US announced the ruling on imported Chinese solar products, the coalition said it was concerned about the growing global trade war, which will hurt American solar industry jobs, growth and customers.

"On behalf of the 97 percent to 98 percent of the US solar industry that fought against SolarWorld, we are all looking forward to ending this distraction and returning to our everyday focus of creating jobs and lowering renewable energy costs," said Jigar Shah, president of CASE.

China imports large quantities of polysilicon and equipment for PV solar production from the US every year, which means it will hurt US manufacturers if Chinese companies suffer from the punitive tariffs and experience a reduction in equipment demand, said Gao Hongling, secretary-general of the China Photovoltaic Industry Alliance.

The way out

The Chinese government has made efforts to help the solar industry by expanding the domestic application of solar power plants and encouraging the distribution of solar power generation.

Starting in November, China's largest utility company State Grid began to provide a free service that allows PV solar power producers to connect to the national grid, a move considered "very encouraging" by industry experts.

"The biggest obstacle for China's new energy industry is the on-grid problem. The new policy will solve it to a certain extent," said Meng Xian'gan, deputy director of the China Renewable Energy Society.

According to the new policy, the State Grid branches at city level will have the rights to approve distributed solar power plant projects with installed capacities of less than 10,000 kilowatts each to be connected to the grid. Distributed solar power plants are self-supporting small scale units that have the ability to sell excess capacity to the grid.

Meng said the new plan shows the government's determination to support the domestic solar industry. It was echoed by the State Council's official statement of supporting distributed power generation on Dec 19.

Distributed solar power generation plays a major role compared with the integrated power generation in developed countries including most European countries, the US and Japan, according to Wang Sicheng, a senior researcher at the Energy Research Institute.

He said the cost of electricity transmission in western China, for example, is high because of the long distances involved. Distributed power plants therefore have advantages by saving costs.

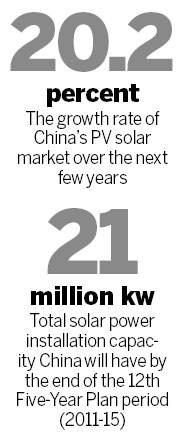

China's PV solar market will develop at an annual growth rate of about 20.2 percent over the next few years, Wang predicted. Meanwhile, the share of distributed solar power generation among the overall solar market will grow from 30.3 percent in 2011 to 45.24 percent in 2015.

"The current overcapacity problem in the global PV solar market is temporary, lasting just a few years," he said. "The demand in the market will grow by a large extent after about five years."

The Chinese government is not the only one supporting the PV industry across the world.

The US government provides tax breaks for homes or businesses supporting the domestic solar PV market, according to a report from GlobalData, an international business intelligence organization that focuses on energy, resources and healthcare sectors.

It said between 2009 and 2011 the US Treasury provided 3,731 grants for solar power projects, amounting to a total of $1.56 billion, for the installation of solar power projects equivalent to 1,290.64 megawatts.

The US government has also increased spending on PV in federal buildings and the defense sector, investing in PV equipment for military power supplies and the government sector, the report said.

Currently, the solar PV module market in North America is dominated by the US, which accounted for more than 85.3 percent of regional additions in 2011.

Chinese company Trina Solar Ltd is working on expanding the Canadian market by investing in the area and cooperating with local partners.

Many foreign experts believe Chinese companies will survive the crisis.

"It's easier for Chinese companies to beat the competition," said Buttgereit. "In the EU it is impossible to get loans from banks because of the bad economy there."

He said the debt crisis and weak economy is a much tougher issue in Europe than PV industry problems and some companies will not survive - a natural outcome of market economics.

He believes that China will become the biggest PV solar player in one or two years.

In the Chinese government's 12th Five-Year Plan (2011-15) on the energy industry, it states the country will reach a total solar power installation capacity of more than 21 million kilowatts by the end of the plan period.

Opportunities

As PV solar companies struggle to survive, some thin-film solar power producers have been making moves to speed up their development.

Thin-film solar cells, which have a 20 percent market share globally, are a less efficient photovoltaic technology than the widely used silicon panels which are the products that aroused the US and European probes into anti-dumping and anti-subsidies involving Chinese products.

First Solar Inc, a US-listed clean energy developer that specializes in thin-film technology, said in early December that it will cooperate with Chinese company Zhenfa New Energy Science and Technology Co to supply two megawatt thin-film solar modules for Zhenfa's solar projects.

The solar projects owned by Zhenfa have been approved and are located in Xinjiang Uygur autonomous region.

Just a week before the US company's announcement, Chinese private power generator Hanergy Holding Group Ltd announced it had become the world's largest maker of thin-film solar modules, replacing First Solar, with an annual capacity of up to 3 gigawatts.

Hanergy has invested around 27 billion yuan ($4.3 billion) in its thin-film research and development and production bases so far, according to the company.

Although both the domestic and foreign companies are eyeing China's thin-film solar market, experts say its future is uncertain.

"The market share of thin-film solar cells has been falling over the past few years globally because the price of polysilicon has dropped dramatically," said Meng from the China Renewable Energy Society. "Compared with the polysilicon-made PV solar panels, the thin-film solar cell's energy efficiency and lifetime both have much room to improve."

dujuan@chinadaily.com.cn

(China Daily 01/14/2013 page13)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|