Five key regions set lower trade growth aims

Updated: 2013-02-05 11:36

By Li Jiabao in Beijingand Zhang Yuwei in New York (China Daily)

|

||||||||

|

A textile mill, whose products are mainly for export, in Huaibei, Anhui province. Many of the country's provinces have set lower foreign trade targets for this year due to sluggish global demand and the unfavorable trade environment. Xie Zhengyi / For China Daily |

Announced or expected cuts in 2013 trade targets by key Chinese provinces suggest more challenges ahead for Chinese exports and imports after lackluster growth last year.

Experts have said urgent steps are needed for China to improve.

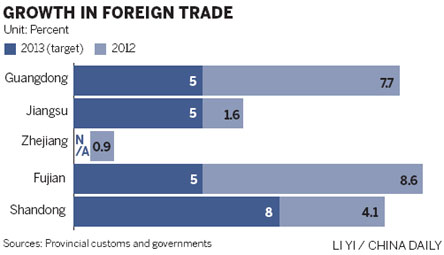

Five provinces - Guangdong, Jiangsu, Fujian, Shandong and Zhejiang - together accounted for 58 percent of Chinese foreign trade in 2012.

All recently cut their expectations for trade growth this year.

Guangdong, which represents a quarter of China's foreign trade, set a growth target of 5 percent. The province's trade volume increased 7.7 percent in 2012 from 2011, surpassing a 7.5 percent forecast.

"We must speed up the strategic transformation of foreign trade in 2013 ... and balance imports and exports while fostering new trade growth engines, as well as upgrading the processing trade," said Guangdong Governor Zhu Xiaodan.

The eastern province of Jiangsu lowered its target to 5 percent this year from 8 percent in 2012 after a 1.6 year-on-year increase.

Fujian has set a target of 5 percent for this year, while Shandong expects its foreign trade to grow by 8 percent.

Zhejiang is expected to set a lower target than last year's 10 percent.

Some experts remain positive about prospects for world trade overall, citing economic recovery in Europe as a way to rebalance volume.

Chen Zhiwu, a finance professor at the Yale School of Management, said the impact on Chinese exports may be "neutral and earlier expectations should stay intact", given expected growth from Europe this year.

"There may be a slight lowering of expectations, but not by much because the US economy will have better growth than last year. Given the euro's strengthening in recent months, China may actually experience better export growth to the eurozone this year than expected earlier," Chen said.

"As financing has become cheaper and more available to European governments and corporations, the eurozone economies may start their recovery a little faster than expected. Any gain in confidence for the EU economies will be good news for China."

Wei Jianguo, vice-chairman of the China Center for International Economic Exchanges, said, however, that China's foreign-trade outlook in 2013 will be "more challenging" than the previous year. He cited Europe as a major reason.

"We must also watch out for the European Union, a key player in China's exports.

"The EU's debt woes will last for a long time and the biggest concern now is its unemployment and looming fiscal trouble in Italy. Sluggish demand in the EU will further drive down turnover at the Canton Fair (a biannual trade-promotion event that is a barometer of China's exports) after a 9.3 percent drop at the autumn event," said Wei, a former vice-minister of commerce.

He added that global economic prospects will remain uncertain over the next three to five years.

China's foreign trade rose 6.2 percent in 2012, missing its 10 percent target and contrasting sharply with the 22.5 percent surge in 2011.

Exports grew 7.9 percent in 2012, the slowest pace in more than a decade except for 2009, in the wake of the outbreak of the global financial crisis.

Yao Jingyuan, a researcher at the counselors' office of the State Council, blamed weak exports in 2012 for China's slow economic growth, which was 7.8 percent year-on-year, the slowest pace since 1999.

China's high-tech exports grew robustly in 2012, which suggests that the current structure of the export-growth model isn't sustainable, he said.

"Amid rising costs at home and fierce competition from neighboring countries with lower costs, we are now at an urgent moment to transform exports and take the downward pressure in export growth as the motivation for restructuring," Yao said.

Chen Zhihan, general manager of Fujian Jiamei Group, a leading maker of ceramic art objects, said: "It's not very difficult for us to get orders this year, but it's hard to beat rising costs. The exchange rate fluctuation in 2012 eroded about 10 percent of our profit while our labor advantage has disappeared and raw materials are cheaper in some overseas markets."

Li Demin, general manager of Dongning Huaxin Group in Heilongjiang province, said: "We expect our trade value to rise to $250 million or $300 million this year from $200 million in 2012, mainly driven by our transformation from mechanical and electrical exports to Russia to agricultural investment, which in return boosts machine exports."

The CCIEE's Wei said: "Training of migrant workers, or semi-skilled workers - the main source of labor at Chinese exporters - must be enhanced for the country to retain its position as the world's factory and its leading exporter."

Wei suggested that more efforts should be given to trade in services in order to improve the trade-growth model.

"About 3 trillion yuan ($481.9 billion) in service trade will be shifted to China from overseas markets in the next three to five years."

Contact the writers at lijiabao@chinadaily.com.cn and yuweizhang@chinadailyusa.com

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|