Dynasty warns of losses ahead

Updated: 2013-02-07 07:36

By Shi Jing in Shanghai (China Daily)

|

||||||||

Dynasty Fine Wines Group Ltd, one of China's largest winemakers, has warned investors that it expects to make a loss in 2012 - its first since listing in Hong Kong in 2005.

The company, which saw profits plunge 97 percent in 2011 to HK$4.26 million ($549,000), said in a statement to the Hong Kong Stock Exchange that it had again suffered a sales drop last year as a result of a reorganization of its sales and distribution model, which it had initially disclosed in its interim report.

Dynasty's turnover fell 10 percent to HK$1.4 billion, year-on-year, in 2011. Last year, the company reported that its interim profits declined to HK$4.69 million.

In its statement, the group's chairman, Bai Zhisheng, said that the pace of its reorganization was slower than expected, especially in Zhejiang and Shanghai.

Bai added that weaker demand for domestic wine products, the economic slowdown and imported wines were taking their toll on sales.

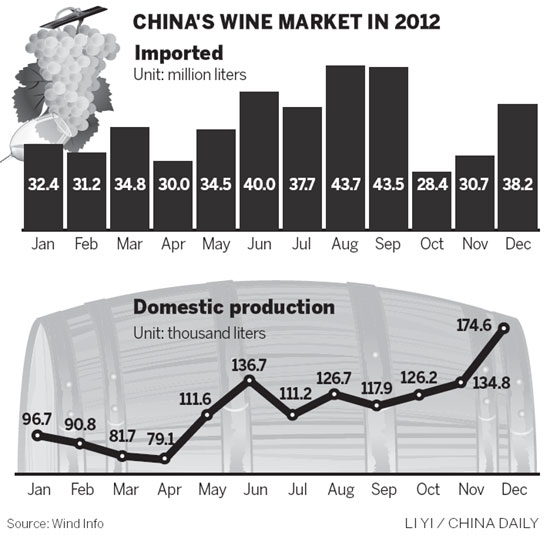

A report published by China Galaxy Securities showed 425,700 kiloliters of wine was imported to China in 2012, an 8.9 percent rise in volume. Domestic wine sales grew just 3.87 percent during the year, it said.

The weak demand for domestic wines also comes at a hard time for Chinese baijiu brands, including Moutai and Wuliangye, which have been forced to lower their prices ahead of Spring Festival, usually the peak season for local liquor sales.

Demand for baijiu has fallen significantly in recent weeks after the announcement that central authorities plan to crack down on extravagance in Party organs, government departments, public-funded institutions and State-owned companies.

"The Chinese drinks market is very tough at the moment," said Maximilian Spitzy, the general manager of Ezee Beverages in Shanghai, the sole importer of various foreign wine brands.

"But the big domestic companies are strong and are spending a lot of money to promote themselves."

Other Chinese red wine producers have also been having a tough 2012.

The 120-year-old Chang Yu Pioneer Wine Co Ltd, based in Yantai in Shandong province, suffered a 10 percent drop in its share price in August after rumors spread that its wines had been contaminated by pesticides.

Wang Jiaqi, business development director of Shanghai Wine Exchange, said: "That pesticide rumor seriously harmed the industry and demand for red wine has been less-than-robust ever since.

"Chinese wine producers have been investing a lot on marketing - but it's time to attach more importance to quality control and the selection of raw materials and techniques, instead of just offering favorable prices," she said.

"But it's nice to have seen a mushrooming in the number of wineries in China last year, as consumers continue to look for more quality."

shijing@chinadaily.com.cn

(China Daily 02/07/2013 page16)

In Photos: 7.0-magnitude quake hits Sichuan

In Photos: 7.0-magnitude quake hits Sichuan

Li Na on Time cover, makes influential 100 list

Li Na on Time cover, makes influential 100 list

FBI releases photos of 2 Boston bombings suspects

FBI releases photos of 2 Boston bombings suspects

World's wackiest hairstyles

World's wackiest hairstyles

Sandstorms strike Northwest China

Sandstorms strike Northwest China

Never-seen photos of Madonna on display

Never-seen photos of Madonna on display

H7N9 outbreak linked to waterfowl migration

H7N9 outbreak linked to waterfowl migration

Dozens feared dead in Texas plant blast

Dozens feared dead in Texas plant blast

Most Viewed

Editor's Picks

|

|

|

|

|

|

Today's Top News

Live report: 7.0-magnitude quake hits Sichuan, heavy casualties feared

Boston suspect cornered on boat

Cross-talk artist helps to spread the word

'Green' awareness levels drop in Beijing

Palace Museum spruces up

First couple on Time's list of most influential

H7N9 flu transmission studied

Trading channels 'need to broaden'

US Weekly

|

|